Did Pump.fun Derail Altcoin Season? Analysts Weigh In

Cryptographic analysts are effervescence in the midst of individual and joint attempts to dissect the impact of the token launch platform based on Solana, Pump.fun, on the Altcoin market.

Analysts and traders are divided on the question of whether the platform alone has derailed the long-awaited Altcoin season by diverting liquidity far from traditional cryptographic assets.

Analysts plead against Pump.fun

Miles Deutscher underlined the tokens generator based in Solana as a major reason for the delayed Altcoin season. The famous Crypto analyst observes that the dynamics of the current market differs from previous cycles, where speculative capital has sold altcoins with solid liquidity.

“The launch of Pump Fun is directly correlated with the destruction of the Altcoin market against BTC. The reason why we have not seen any major “Alt season” through the majors is that the speculative capital which would have once flocked in the 200 best workers rather flooded in low chain caps, “said Deutscher.

Instead, retail investors have been attracted to illiquid meter -meter parts, many of which retraced 70 to 80% of their summits. This is aligned with a recent survey, which established that more than 60% of pump traders have lost money.

The change has led to significant losses for latecomers, exacerbating the lowering feeling on the market and reporting the season of the familiar Altcoin.

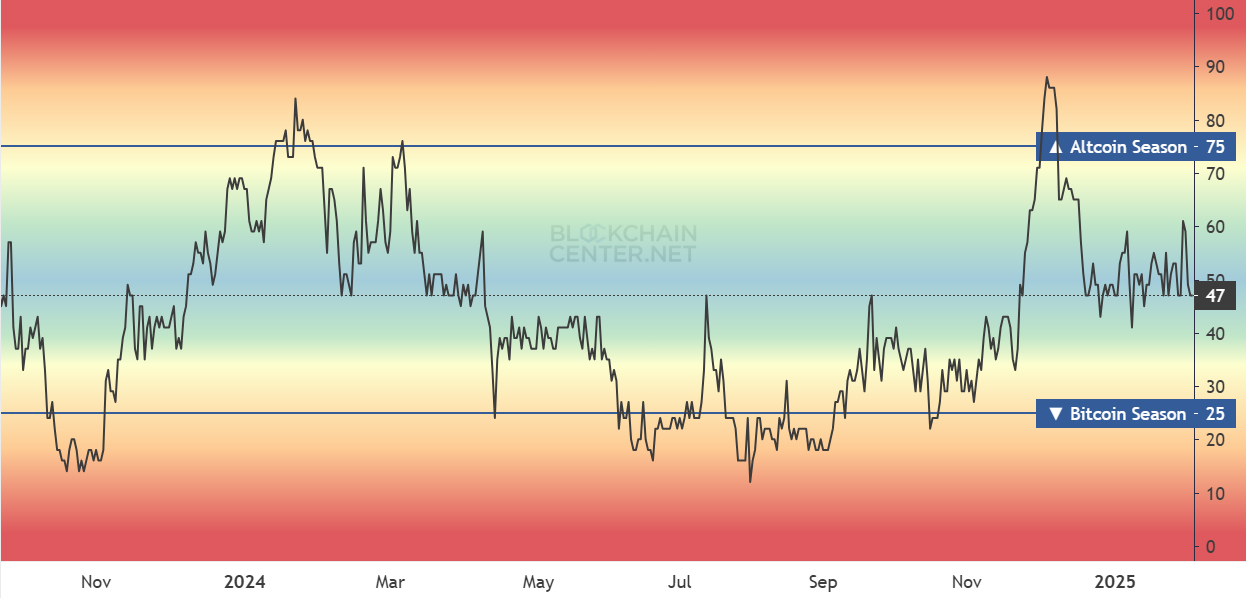

Historically, the seasons of Altcoin follow the overvoltages of Bitcoin prices while capital turns to projects with fundamental solids. Ideally, the Altcoin season was due a few months after the summit of $ 73,000 in Bitcoin in January 2024. This followed the approval of the BTC (negotiated stock market funds) in the United States.

Master of Crypto, a veteran trader, highlighted the amazing scale of the impact of the pump. He noted that since April 2024, more than 5.1 million tokens have been launched on the platform. This generated $ 471 million in income.

While traders are trying to take advantage by continuing the products of the platform, this has created a fragmented market in which no Altcoin can gain ground.

Pump.Fun as a black liquidity hole

Pump.fun was launched in April 2024, coinciding with the Altcoin season, which broke the expected models. According to analysts, his Money Mania has gradually dominated speculative interest, which has made traditional altcoins fight to attract liquidity.

“Pump Fun launched in April 2024 exactly when this Altcoin race deviates from past cycles,” said Elliotrades.

Pump.fun, which allows users to launch tokens instantly with a minimum of effort, has increased in popularity. The platform began 2025 with a record of $ 14 million in daily income. However, critics argue that this success was a black liquidity hole. The web researcher, Mercek, described the liquidity breakage platform designed by an initiate.

“Liquidity flight on the Altcoin market? Pump.fun knows how to do it. The mania of memes or the retail game are terms used just to avoid seeing the hard truth … The pleasure of pumping has never been a question of decentralization or pleasure … but a robbery of liquidity designed by initiates Said the merchant.

In their opinion, since its creation, Pump.fun has treated more than $ 4.16 billion in transactions. He also channeled the product in centralized exchanges (CEX), further draining the Altcoin ecosystem.

Counter-argument HAS Changing speculative capital

Not everyone is convinced that Pump.fun is to blame for the slow Altcoin market. The researcher from Blockchain Rasrm questioned the story. He maintains that the market capitalization of pump tokens.

“Total Pumpfun Coin MC is not high enough to have affected it, surely?” He posted.

Others have stressed that speculative capital does not always remain in the ecosystem. This means that not all winning exchanges rest on another job. He could leave the ecosystem entirely.

It seems to establish the amount of the pump ecosystem.

Whatever the cause of the delayed Altcoin season, Pump.fun has fundamentally changed the way capital moves to the cryptography market. The founders of Solana would not have hated the platform, according to a recent investigation, the long-term viability of Pump. Fun remains uncertain.

Meanwhile, Deutscher also combines the rise of Pump. The repression of the United States (Securities and Exchange Commission) of CEX and tokens offers forced market players to explore decentralized alternatives.

This regulatory playground has created an environment where tokens even and game style speculations thrive, transforming the crypto into a casino. Some consider this to be harmful to the long -term growth of industry. Meanwhile, others argue that it serves as a powerful integration tool for new users.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.