Bitcoin’s Short-Term Challenges Loom Despite Trump’s Support

As the crypto community expects a strong 2025 following Donald Trump’s return to the Oval Office, new reports show that the Trump-led rally may face obstacles.

As 2025 begins, the crypto trading environment shows mixed trends following the December FOMC meeting and the holiday season.

Bitcoin Rally Risks Losing Momentum Despite Trump Support

According to 10x Research, the first quarter of 2025 may not see the same level of momentum as seen between late January and March 2024 or between late September and mid-December.

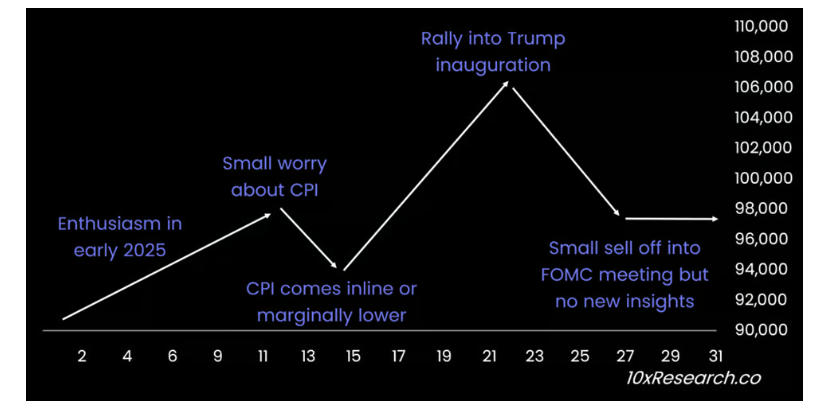

The release of Consumer Price Index (CPI) data on January 15 is a key event to watch. A pullback should be expected before the release of CPI data, and the market could rally again in the event of favorable results.

“A favorable inflation number could reignite optimism, fueling a rally leading up to Trump’s inauguration on January 20,” wrote 10x founder Mark Thielen.

However, the momentum generated by such a recovery could be short-lived. Thielen added that the market would likely pull back ahead of the Jan. 29 FOMC meeting. He predicts Bitcoin will be between $96,000 and $98,000 by the end of January.

Bitcoin reached new all-time highs in the fourth quarter of 2024 following the Fed’s 25 basis point interest rate cuts. The rate cuts in September were also very bullish for the crypto market.

Bitcoin dominance persists into 2025

Another factor to consider when considering BTC’s price trajectory in 2025 is Bitcoin’s dominance. According to the 10x report, from January 2024 to mid-November, Bitcoin’s market share increased from 50% to 60%, putting significant pressure on altcoins.

As Bitcoin’s dominance grew, many altcoins struggled to gain traction, making it difficult for investors to earn substantial returns outside of Bitcoin.

There was a brief period where Bitcoin’s dominance dropped to 53% in three weeks, sparking hopes of an altcoin season. However, this decline was short-lived and Bitcoin’s dominance quickly rebounded to almost 58%, settling around 55% by the end of 2024. This consolidation around the 55% level indicates that Bitcoin remains firmly in control of the walk.

For investors, this highlights the importance of closely monitoring Bitcoin’s dominance. At press time, Bitcoin dominance was around 57% while the price was trading at $99,225.

10xResearch’s Bitcoin projections come as James Butterfill, head of research at CoinShares, predicted last week that Bitcoin could see potential peaks to $150,000 and corrections to $80,000 in 2025.

Likewise, Bitwise Asset Management predicts that Bitcoin could reach $200,000 by the end of the year.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent reporting. This news article aims to provide accurate and current information. However, readers are advised to independently verify the facts and seek professional advice before making any decision based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.