Dogecoin On-Chain Activity Hits 6-Month High, Eyes On $0.30 Flip or Breakdown?

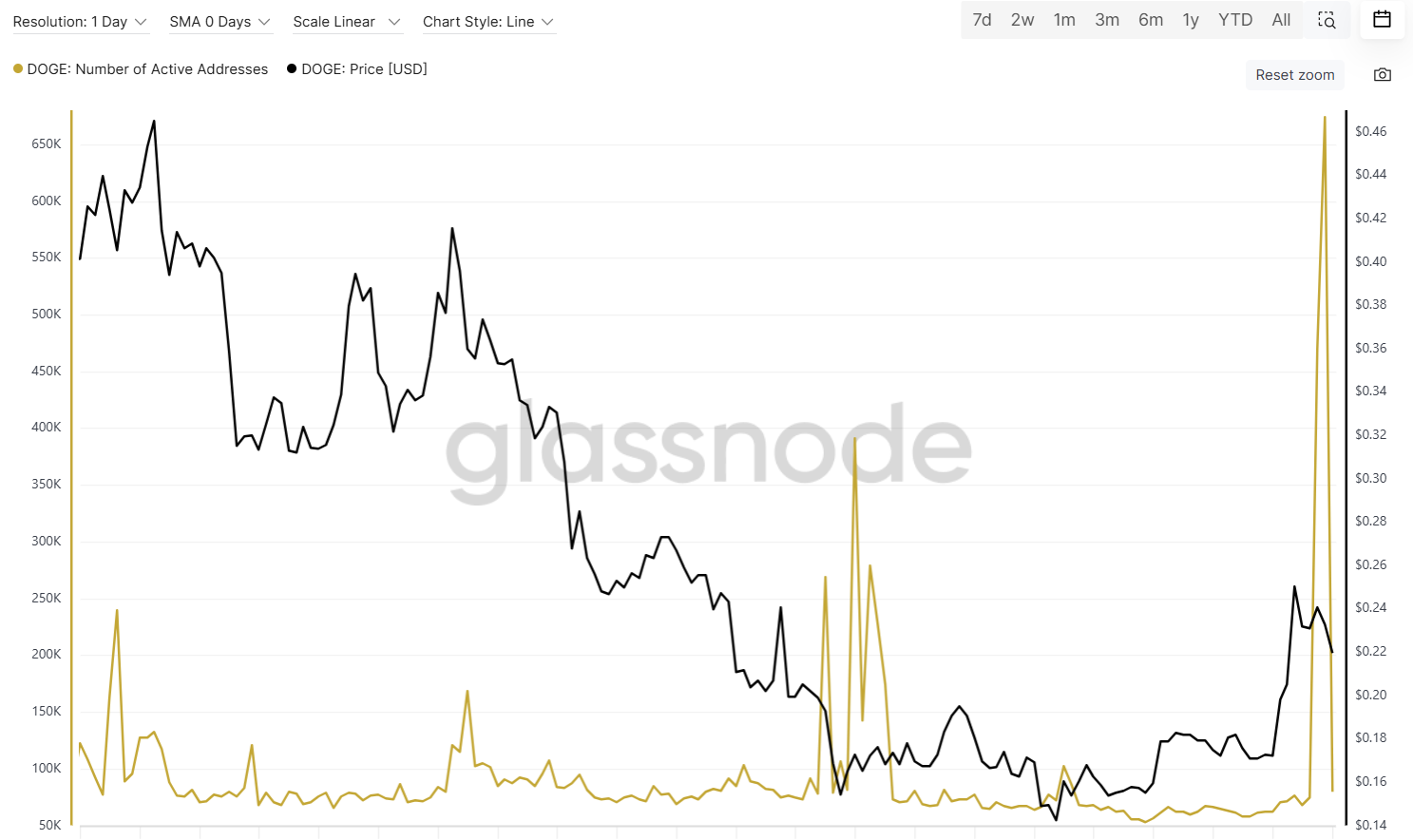

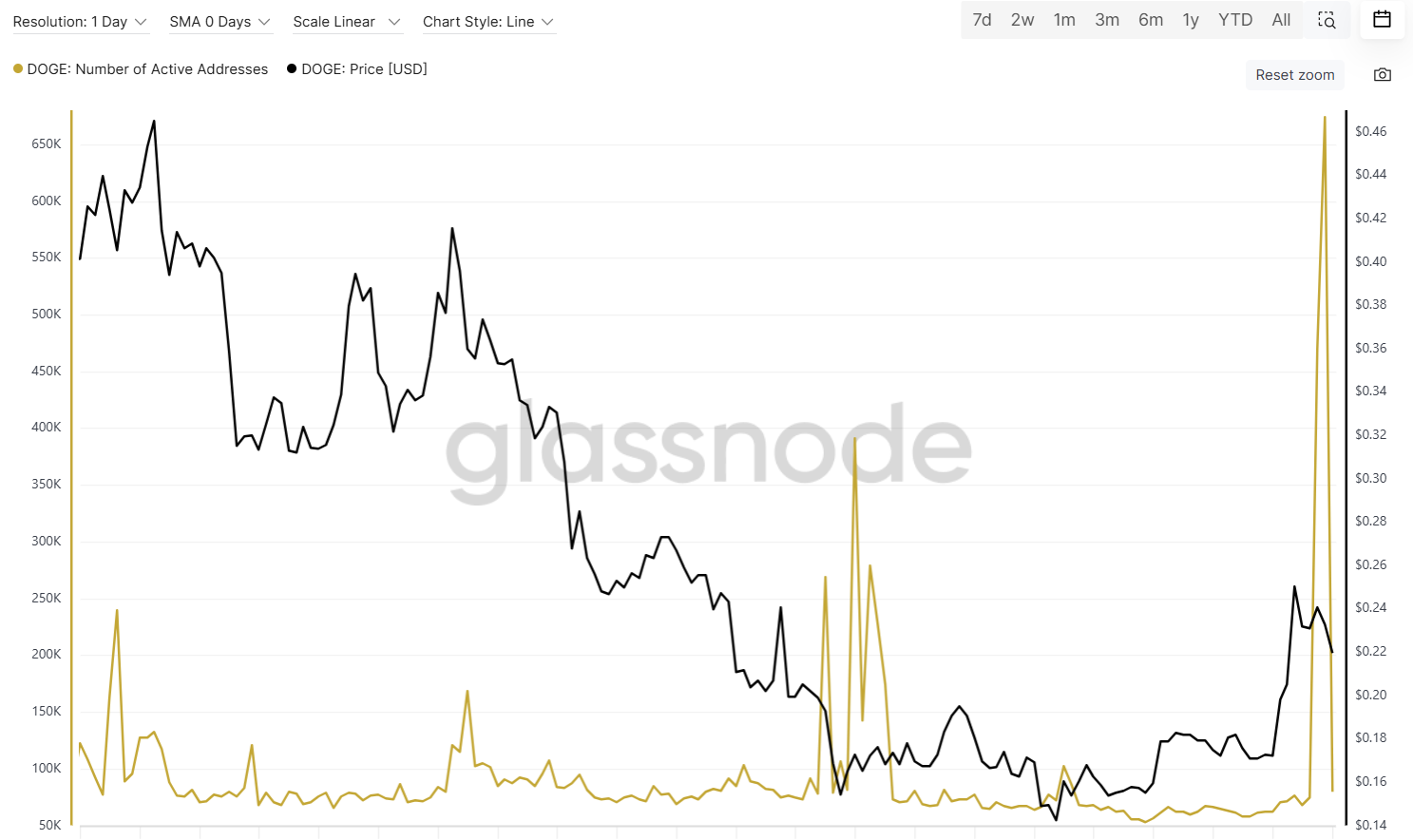

- The active addresses of Dogecoin increase to a summit of 6 months, reflecting the cutting -edge commitment of the retail and the renewed attention of the market.

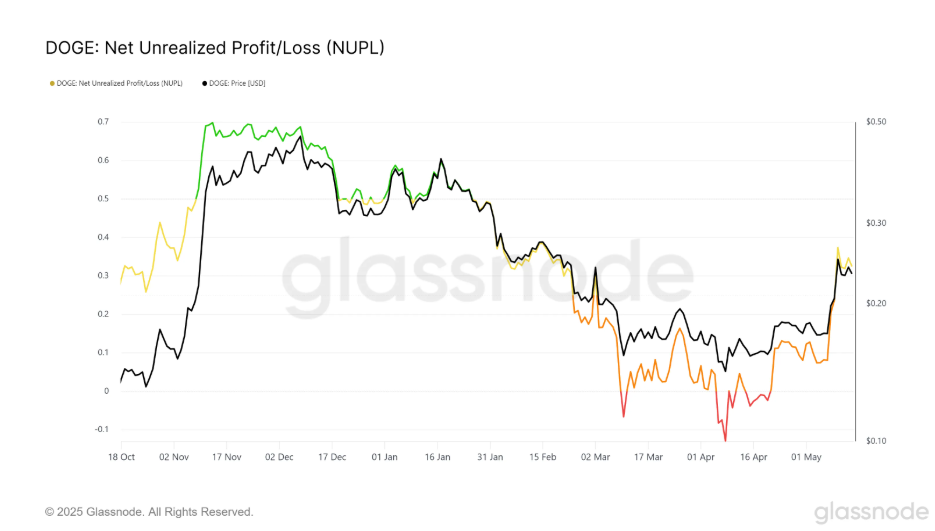

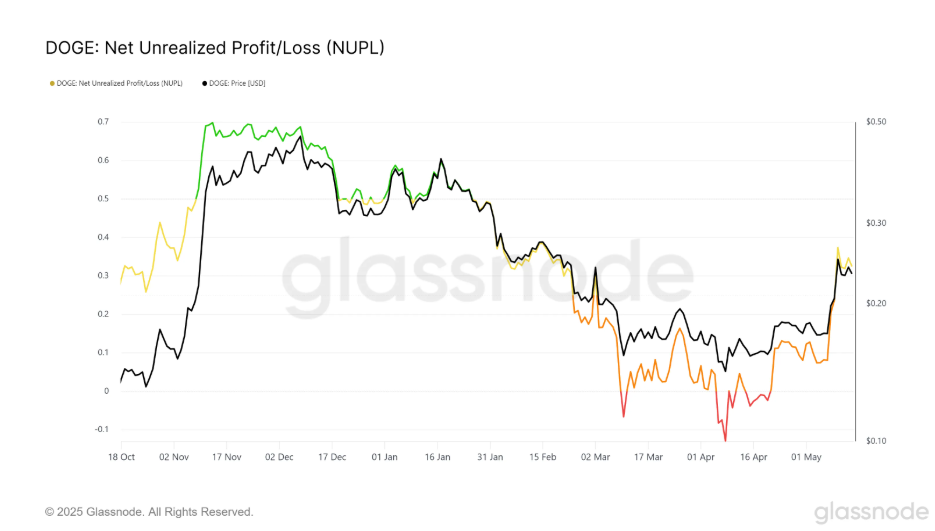

- The metrics on the chain show the cost of acquiring parts transferred and the profits made near the February levels, referring to a potential distribution.

- DOGE is negotiated at $ 0.226, with a key resistance at $ 0.30 and a support at $ 0.20; The non-return can trigger a reward of $ 0.145.

- Technical indicators (MacD Haussiers, RSI 62) suggest consolidation; Breakout above $ 0.30 can open an open room for $ 0.36 to $ 0.41 on the rise.

The activity and the technical structure of the Dogecoin chain indicate a critical moment – with an increasing participation of investors and bullish indicators referring to a potential break, but the fact of not recovering $ 0.30 could trigger a deeper correction towards long -term support.

Dogecoin (DOGE) has experienced a sharp increase in investor activity, with Active addresses crossing 650,000 – The highest since November 2024.

This wave reflects a strong retail interest, but the time of the tip near the local summit of $ 0.41 suggests that it may have been motivated by speculative purchases at an advanced stage.

The profits increase, optimism comes back

The net indicator not made of profits / losses (NUPL) has returned to the “optimism” zone, showing that the majority of Doches are now in profit.

Although this reflects increased confidence, high profits high can cause sales pressure if the resistance levels are not convincingly broken.

Volume volume utility

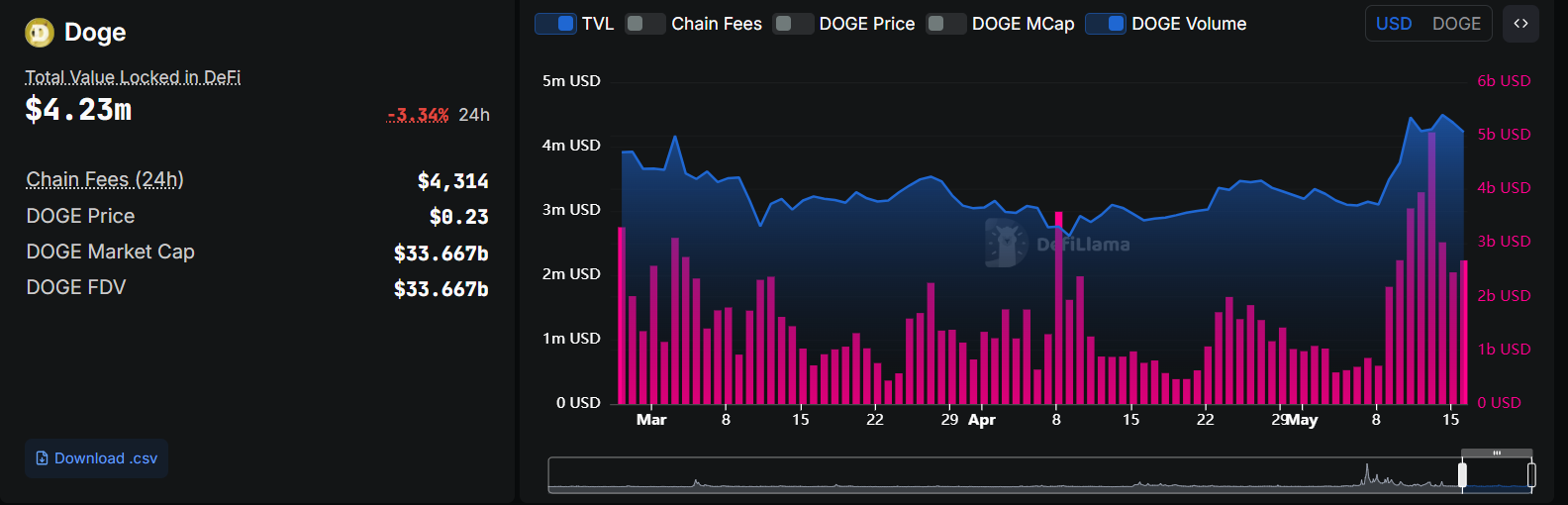

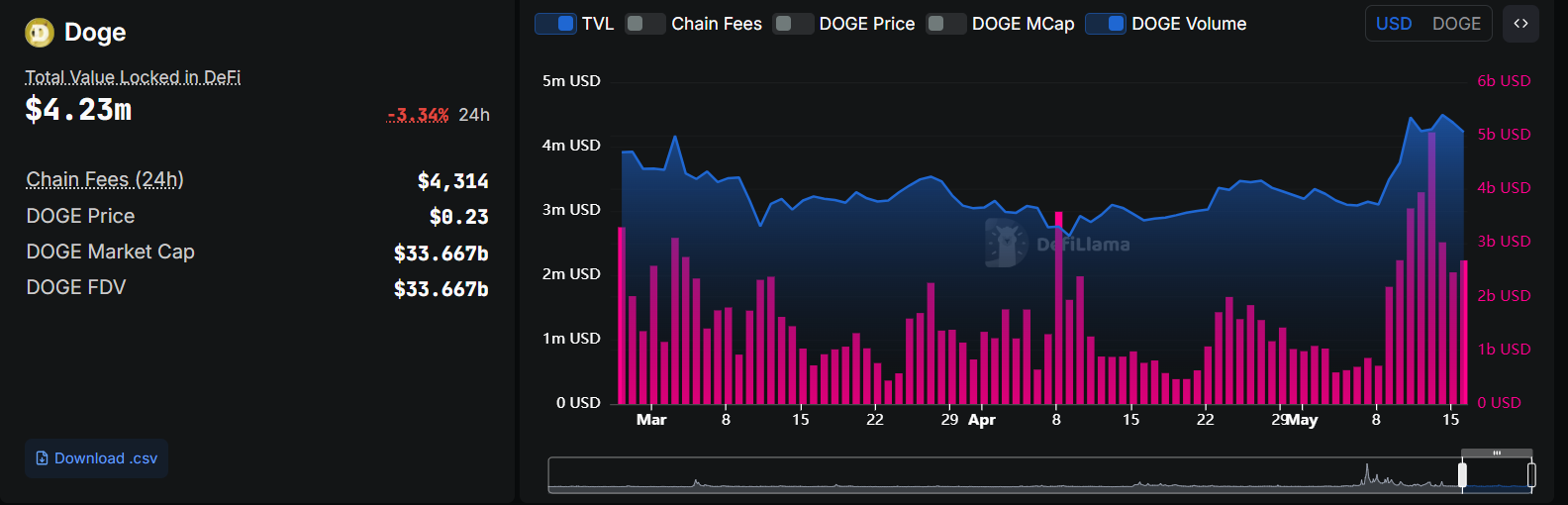

Despite the daily negotiation volume exceeding $ 5 billion during the recent price increase, the total Dogecoin Total DEFI value (TVL) remains less than $ 5 million. This highlights a significant gap between price action and network usefulness, which suggests that rally has been more motivated by the feeling and speculation than the real growth of use.

DOGE / USDT stops at a key support while the momentum is weakening

Dogecoin consolidates about $ 0.225 after faced a rejection at $ 0.245. Despite this decline, the wider trend remains intact, with a price higher than the EMA of 20, 50, 100 and 200 days. This cluster, especially around the $ 0.205 to $ 0.216 Zone, is a key support range. Holding above, it maintains the valid bullish structure.

The momentum shows, however, the first signs of weakness, the MacD line is oriented downwards and can turn around, while RSI fell to 62, indicating a neutral feeling after having previously reached levels of Surbelle.

If Doge fails to recover $ 0.245It can remain linked to the beach or revisit the levels of support close to $ 0.220. Ventilation below could open up dropping targets at $ 0.198, or even $ 0.145.

Conversely, a rupture greater than 0.245 with a strong volume could trigger a movement towards $ 0.268 or $ 0.30.

The Dogecoin price is above the key EMAs nearly $ 0.220, keeping the bullish structure intact. However, the weakening of the MacD and a cooling RSI suggest the decolining momentum.

DOGE remains in a tight range between $ 0.220 and $ 0.245, traders monitoring an escape or ventilation of this area.

DOGE faces the key decision zone between the media threshing and the structure

The activity on the Dogecoin chain shows a strong retail interest and an increase in profits, but the lack of fundamental utility and the decline in volume indicate a speculative rally. Technically, DOGE holds above the key EMAs, but the modification of the discoloration suggests an uncertainty.

An escape greater than 0.245 could confirm the upward continuation to $ 0.30, while a drop below 0.220 can trigger a deeper correction to $ 0.198 or $ 0.145. For the moment, DOGE remains linked to the range and traders should monitor a clear decision before engaging in the direction.