Elon Musk’s Post Sparks PNUT Price Buzz, But On-Chain Data Tells a Different Story

Award L’Ecoréuil (PNUT) jumped out of 12% following a vague tweet by Elon Musk who set fire to the crypto.

While the tweet did not make any direct mention of the medal, the degens and the hunters of memes were quick to establish connections and to buy. But under media threshing, chain indicators tell a very different story. Inputs and Flips of funding rate at the Diverge of Chaikin, the real move of the PNUT price seems to have belonged to the first people, not to detail.

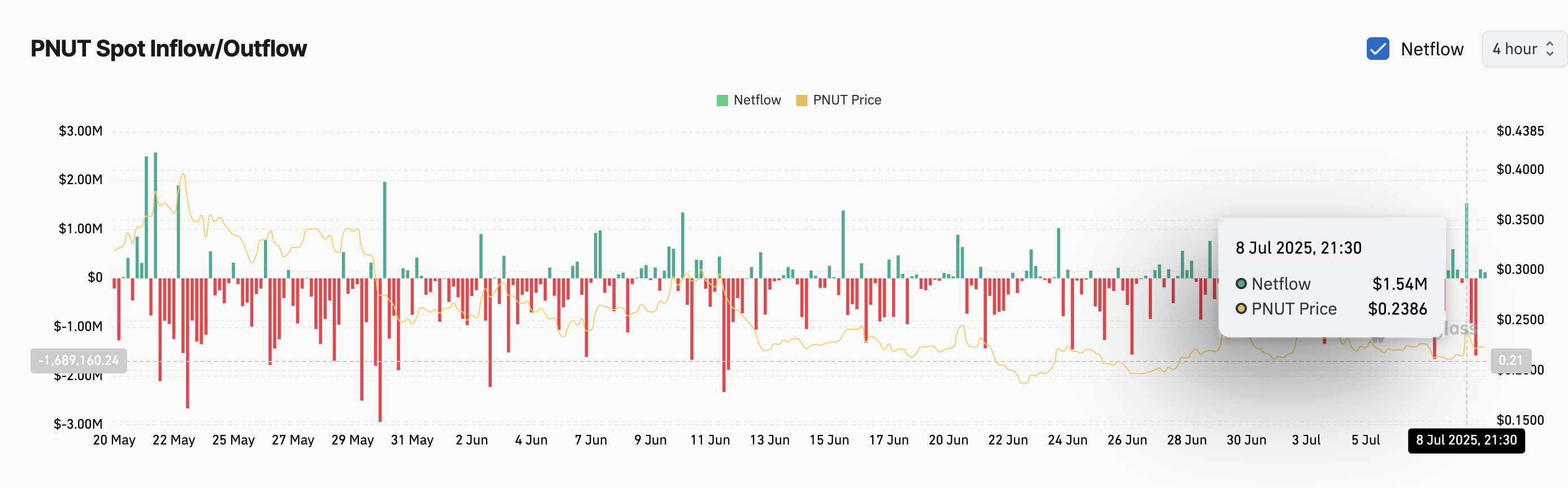

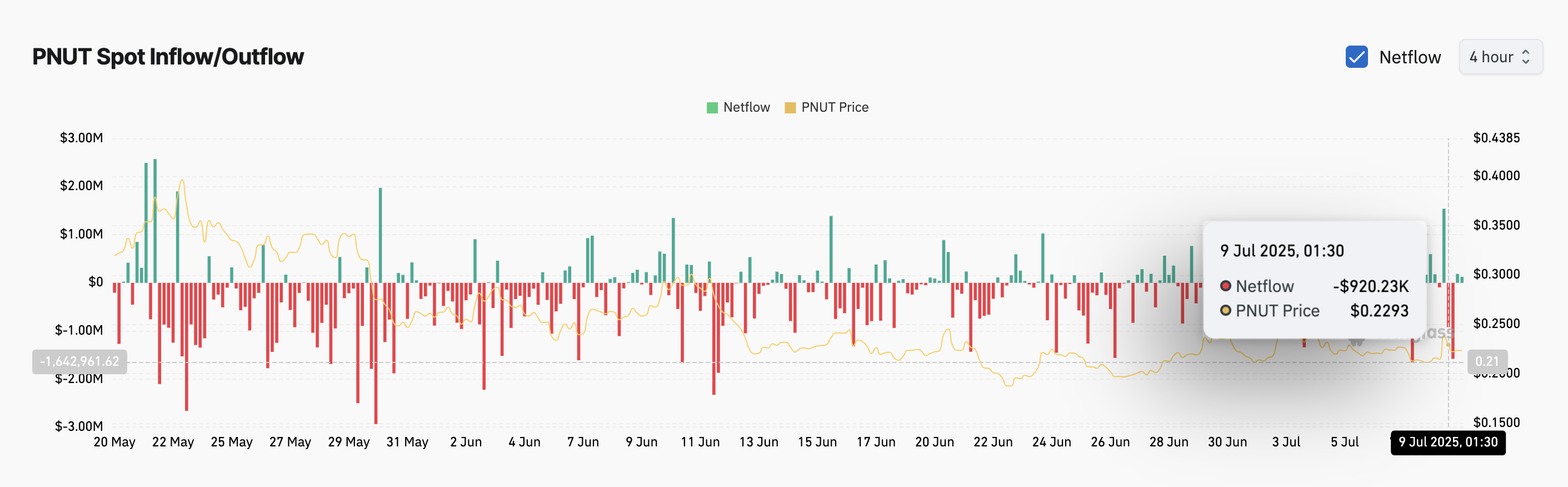

Netflows turned after the tweet, but the retail trade has sold the top

The first signs of movement came before Musk’s tweet, not after.

On July 8, the Netflows Exchange overturned positively, with 1.54 million dollars in PNUT passing to the scholarships, probably traders positioning themselves for a sale.

It was a few hours before the top of the price.

Four hours later, while PNUT reached $ 0.2398 (compared to $ 0.2136), outings increased again, with almost $ 920,000 in withdrawal tokens. The model is clear: the first players moved before the tweet, while the retail trade probably bought the top and came out late.

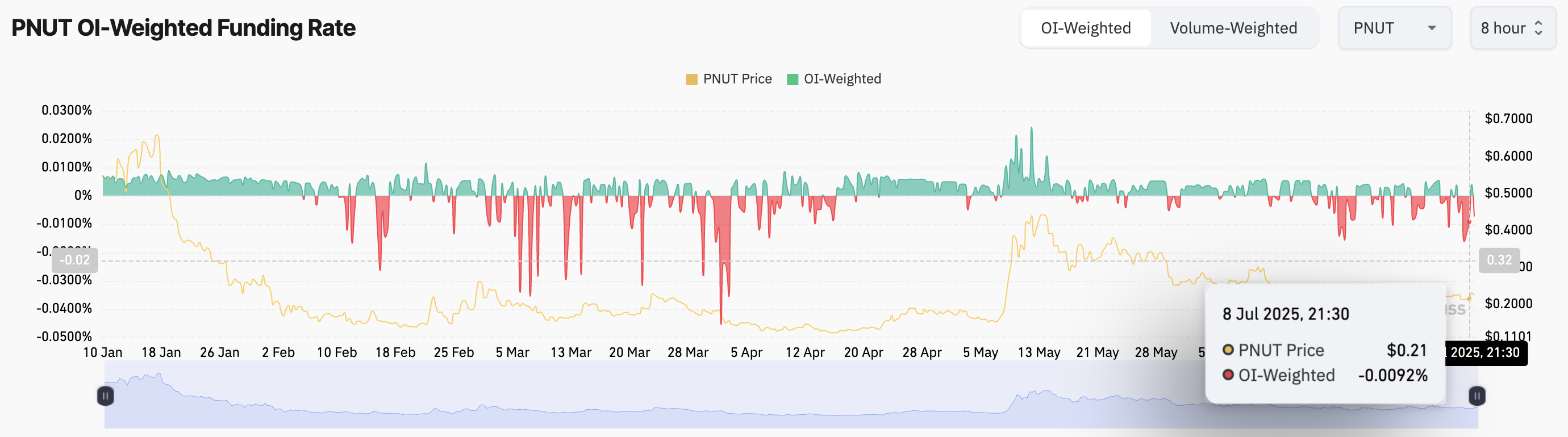

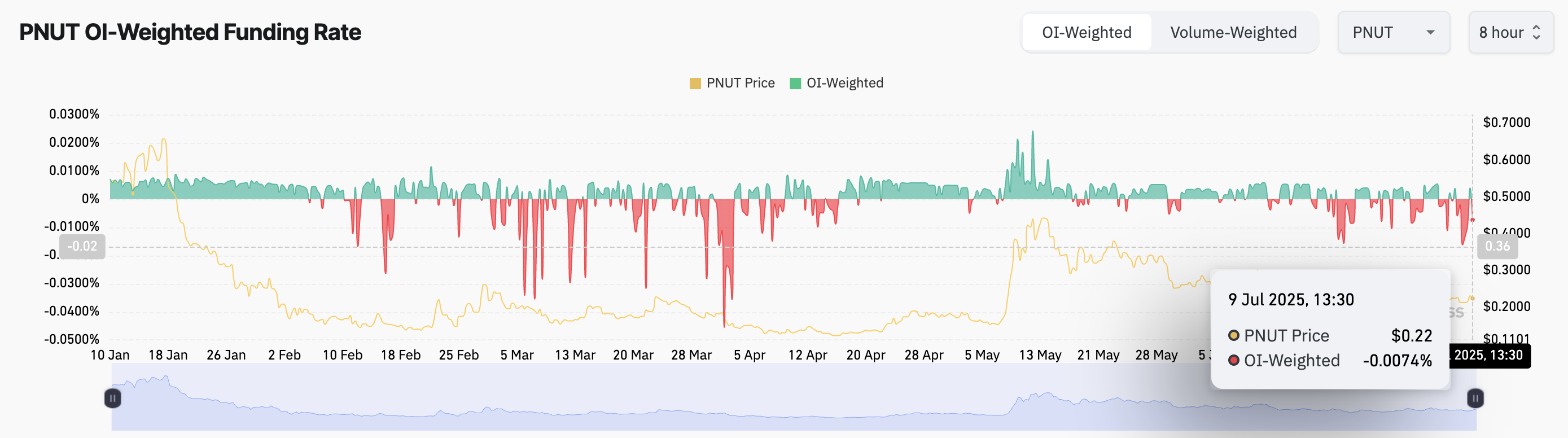

The funding rate has been changing to zero for the first time in weeks

For several days, the IPC financing rate has remained negative, showing that more traders were betting on the price to fall. But just after the Musk tweet on July 8, it changed. The rate approached zero, reaching -0.0074% on July 9.

This means that some traders have started to open long positions, expecting the price to increase. However, as the rate was still negative, this indicates that they are not yet confident. They test the trend, don’t jump completely. This change suggests a growing interest, but not a strong bullish signal.

Funding rates are paid costs between long and short traders. When the financing is negative, short traders are dominant. A positive rate means that long merchants control.

Pnut Price faces FIB resistance, with an invalidation in view

Fibonacci’s retrace from the previous low to high swing (July 3) shows that the PNUT price retests the FIB level from 0.382 to 0.2386 $, after the violation momentarily. This area, as well as $ 0.245 and $ 0.256, are critical resistance levels. Pnut Price is now back almost $ 0.22 and has trouble recovering the upward trend.

If PNUT Price manages to recover $ 0.245 proper, a movement to $ 0.256 is back on the table.

But a fall less than $ 0.216 (key key and 0.786 FIB) would break the upward structure, pushing all of the long time than the long -standing ascending trend line. This would return to the short -term lower bias.

Elon Musk’s post stretches the Buzz Pnut Price, but chain data tells that another story appeared first on Beincrypto.