Cronos (CRO) Price Surges on Trump Media Hype, But Liquidation Risks Mount

CRO has become the best winner on the market, increasing by almost 50% in the last 24 hours. The rally is fueled by a renewed force in the wider market of cryptography and the news of Trump Media Group (TMTG) acquires CRO tokens.

While the wave has drew up the attention, the chain signals indicate a market that can already be overheated, increasing the probability of a short -term decline.

Cro Rockets on 6.42 billion dollars Trump Media Buzz

CRO has jumped almost 50% in the past 24 hours, a large part of the rally linked to reports connecting the Trump media to a large -scale CRO acquisition.

Beincrypto reported that the previous news suggested that Trump Media was preparing to buy a value of $ 6.42 billion in CRO chips, which has fueled market speculation and stimulated an bull feeling.

However, new disclosure now indicates that the plan is more measured. Rather than an immediate acquisition of $ 6.42 billion, the company will start with approximately $ 200 million in cash and a token position equal to around 19% of CRO’s market capitalization.

Traders collapse in long, increasing the risks of liquidation

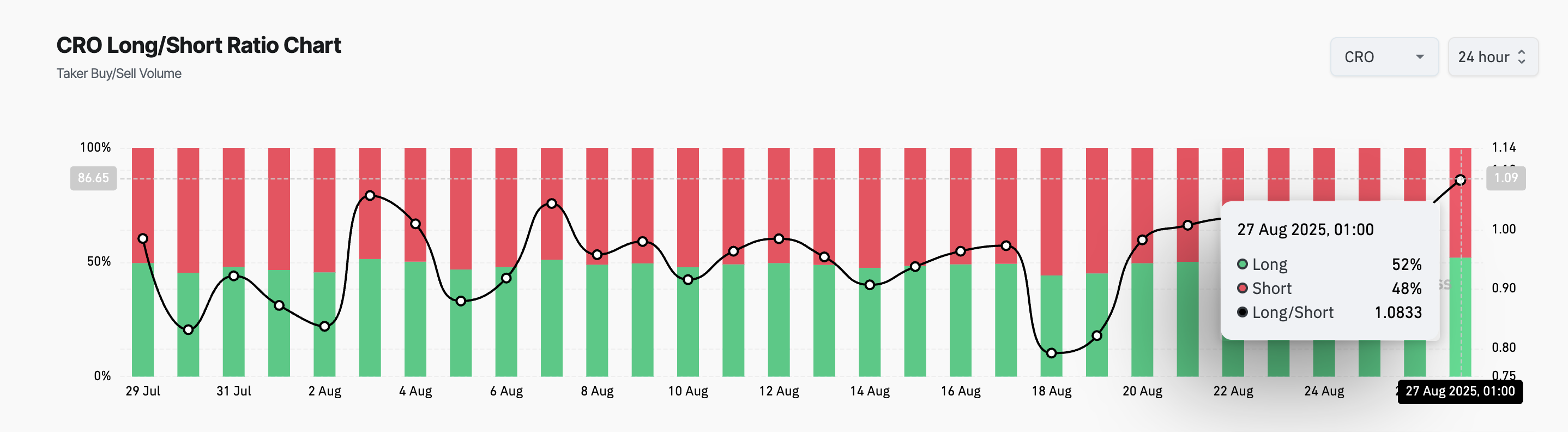

While CRO increased, his traders in the long term rushed into long positions, pushing the long / short ratio of the token at a higher 30 days. When writing these lines, it amounts to $ 1.08, per quince.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The long / short ratio measures the balance between merchants betting on price increases compared to those who plan decreases. A reading greater than 1 indicates that more traders take long positions, signaling a strong increased conviction, while the values lower than a high demand for shorts.

While CRO’s long / short ratio suggests confidence in its ascending momentum, it also exposes the market to greater risks of liquidation. If its price faces a reversal, the high concentration of longs could trigger many forced sales, aggravating market volatility.

CRO enters the Subouche area

The readings of the CRO’s relative resistance index (RSI) on the daily graph show that Altcoin has entered the exaggerated territory, a classic indicator that it may be due for a drop. At the time of the press, this indicator rises to 80.77.

The RSI indicator measures excessive market conditions and occurs as an asset. It varies between 0 and 100. The values greater than 70 suggest that the asset is overflowed and due for a drop in prices, while the values less than 30 indicate that the assets are occurring and can attend a rebound.

At 80.15, RSI of CRO suggests the probability of a short -term correction, with the exhaustion of buyers that worsen. Any reversal of the CRO’s current trend could trigger a drop at $ 0.195, its next major support floor.

On the other hand, if buyers continue to accumulate CRO, it could recover $ 0.23 and come together at $ 0.27, a last last seen in May 2022.

The Post Cronos (CRO) price increases on Trump’s media threshing, but the risks of Mount liquidation appeared first on Beincrypto.