ETH Exchange Inflows Hit Monthly High, What Do Analysts Say?

Ethereum’s entries in centralized exchanges increased sharply in early July, which could inform investors hoping for a resumption of ETH.

You will find below chain signs suggesting that many whales could seek to sell, just like the ETH ETF entrances show signs of slowdown.

Ethereum goes to exchanges – What do the analysts say?

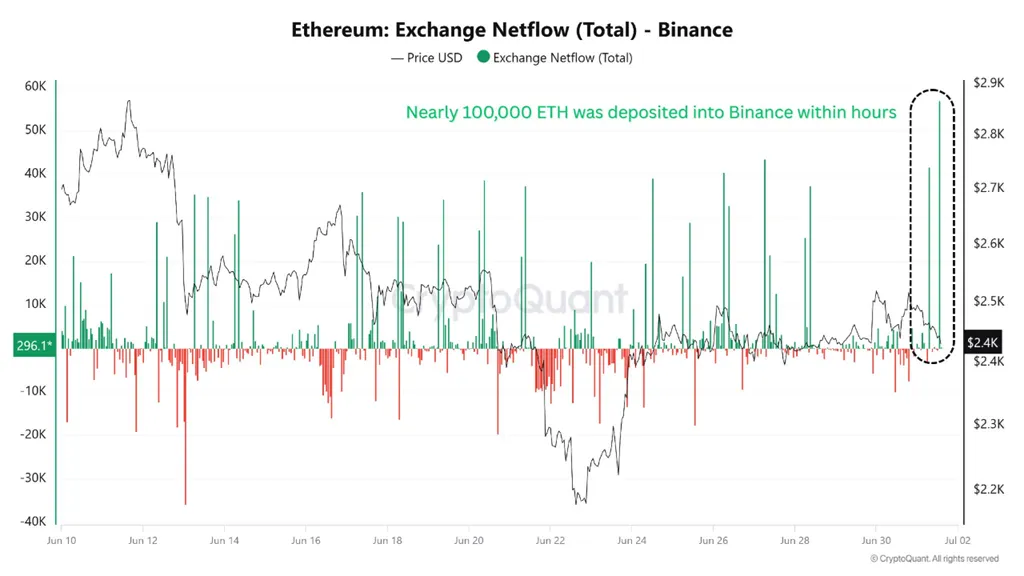

According to cryptocurrency data on July 1, 2025, nearly 100,000 ETH, worth around 250 million dollars, were deposited in Binance. This marks the influx of the highest day to exchange in the last month.

Compared to the behavior of recent prices, significant daily starters often lead to ETH price corrections or to maintain the price of prices in a tight side range.

In addition, a chain observer noted that over the past three weeks, a large entity has withdrawn 95,313 ETH from Jalititude using two wallet addresses. The entity then transferred 68,182 ETH (around $ 165 million) to centralized exchanges such as HTX, OKX and Bébit.

With an average ignition price of approximately $ 2,878 per ETH and the current price almost $ 2,431, this entity underwent a loss of around $ 42.6 million. This action suggests a Stop-Loss strategy or a portfolio restructuring, which adds to market sales pressure.

Meanwhile, Sosovalue’s data show that if the net entries in the ETH spot in the United States remain positive, they slow down.

More specifically, the net flow of these ETH ETF increased from more than $ 240 million on June 11 to just over $ 40 million on July 1. This reflects a slowdown in the purchasing momentum of the ETF.

All of these combined data points could weigh the ETH price during the first week of July. At the same time, quince statistics indicate that the quarter has always been the lowest quarter of ETH, with an average yield of only 0.59%.

“The long -term upward perspectives for Ethereum remain intact, depending on an improvement in wider macroeconomic conditions. However, Ethereum could face a slight short -term decline,” noted the cryptocurminating AMR Taha analyst.

Experts show consensus on the potential for long -term eth

Experts seem to be widely agreed on the long -term potential of ETH.

Mexc Research noted that Ethereum stages a strong recovery, thanks to the upgrades of validators who improve the effective implementation and lighter regulations of the Stable Reserve provided by the Act on Engineering.

“With the risk appetite which slowly returns to the market, as well as the stabilization of the geopolitical situation and the improvement of global liquidity, the ETH seems well positioned for new gains in the coming weeks. If the current dynamics persist and the macro-waonditions remain favorable, a movement around $ 3000 and potentially $ 3,300 seems more and more plausible. Mexc research told Beincrypto.

Meanwhile, Ryan Lee, Bitget chief analyst, also underlined basic factors such as clearer regulatory signals thanks to the engineering law and a high activity on the chain which could increase the price of the ETH.

“Ethereum wins a notable impulse, supported by its upgrading of the Validator spine, which has improved the effectiveness of implementation and contributed to a reduction in the ETH offer … In the short term, Ethereum can test the beach from $ 2800 to $ 3,000 in the middle of July,” said Ryan Lee to Beincrypto.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.