ETH Exchange Withdrawals Fall to Lowest in Months

Ethereum’s inability to establish a solid foot over $ 2,000 continues to alleviate the feeling of investors, which has made many traders maintain their liquid assets in the event of potential sale.

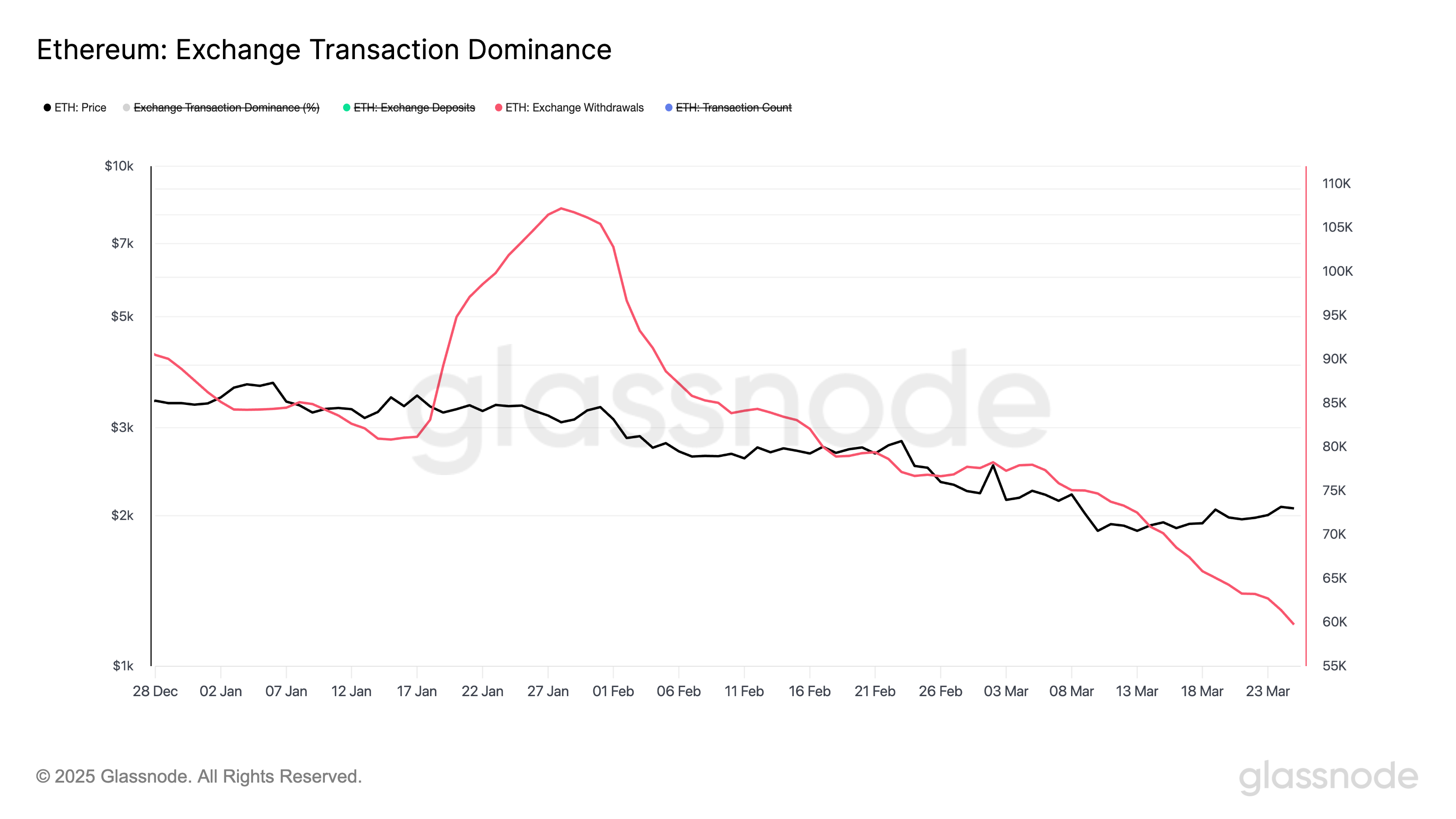

This cautious position is reflected in the withdrawals of the ETH exchanges, which plunged to a hollow of seven months.

ETH exchange activity signals pushing the lowering feeling

An assessment of the domination of Ethereum exchange transactions has been showing a significant drop in ETH withdrawals since the end of January. According to Glassnode, the transactions for withdrawing ETH exchange have totaled 59,755 coins on Tuesday, marking its account for a lowest day since August 31.

When the withdrawals of ETH exchanges drop, this means that fewer investors move their assets to private wallets or cold storage. This suggests that they do not plan to hold the room in the long term. Instead, they wish to keep their ethors on exchanges; A trend that signals a desire to sell.

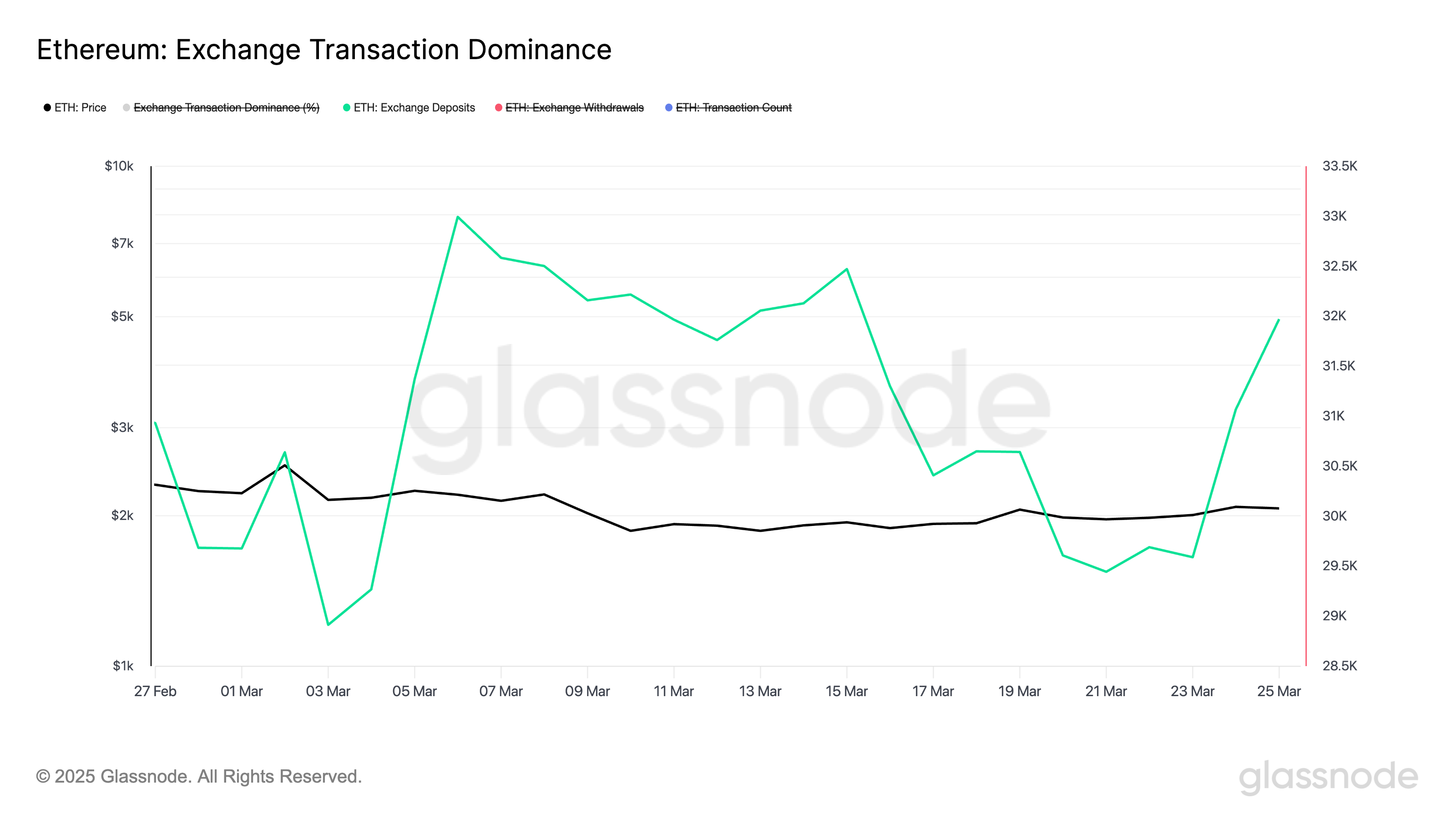

At the same time, eTH deposits have climbed, confirming the increase in sales pressure on the market. According to Glassnode, the number of ethnic parts sent to the scholarships has increased by 10% since early March.

When asset exchange deposits increases like this, more investors move their assets on trade, often in preparation for sale. As the lowering feeling is weakening, these pieces are sold for profit, exerting more pressure downwards on the price of ETH.

Will the upward trend in ethn are holding? The bulls face resistance at $ 2,148

At the time of the press, ETH is negotiated at $ 2,073, marking a gain of 3% during last week as part of the wider recovery of the market.

On the daily graphic, the Altcoin Leader follows a line of ascending trend, reporting sustained prices growth. If the bullish momentum intensifies and withdrawals of exchange increases while the deposits slowly, the ETH could maintain this trend and recover the level of $ 2,148.

However, if the exchange activity remains unchanged and the sale pressure increases, the risks of the ETH decompose below the upward trend line, up to $ 1,759.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.