ETH Holders Face Losses as Profits Plunge – Can $2,500 Hold?

Ethereum lost 18% of its value in last month. While its price continues to slip, the percentage of the ETH offer held for profit has fallen at its lowest level since October, reporting mounting challenges for Altcoin.

With the strengthening of sales pressure, ETH holders can record more short -term losses on their investments.

Ethereum holders have their losses

The two -figure decrease in ETH has pushed its price below the crucial support formed at $ 3,000. Altcoin is currently negotiated at $ 2,640 and remains under significant down pressure.

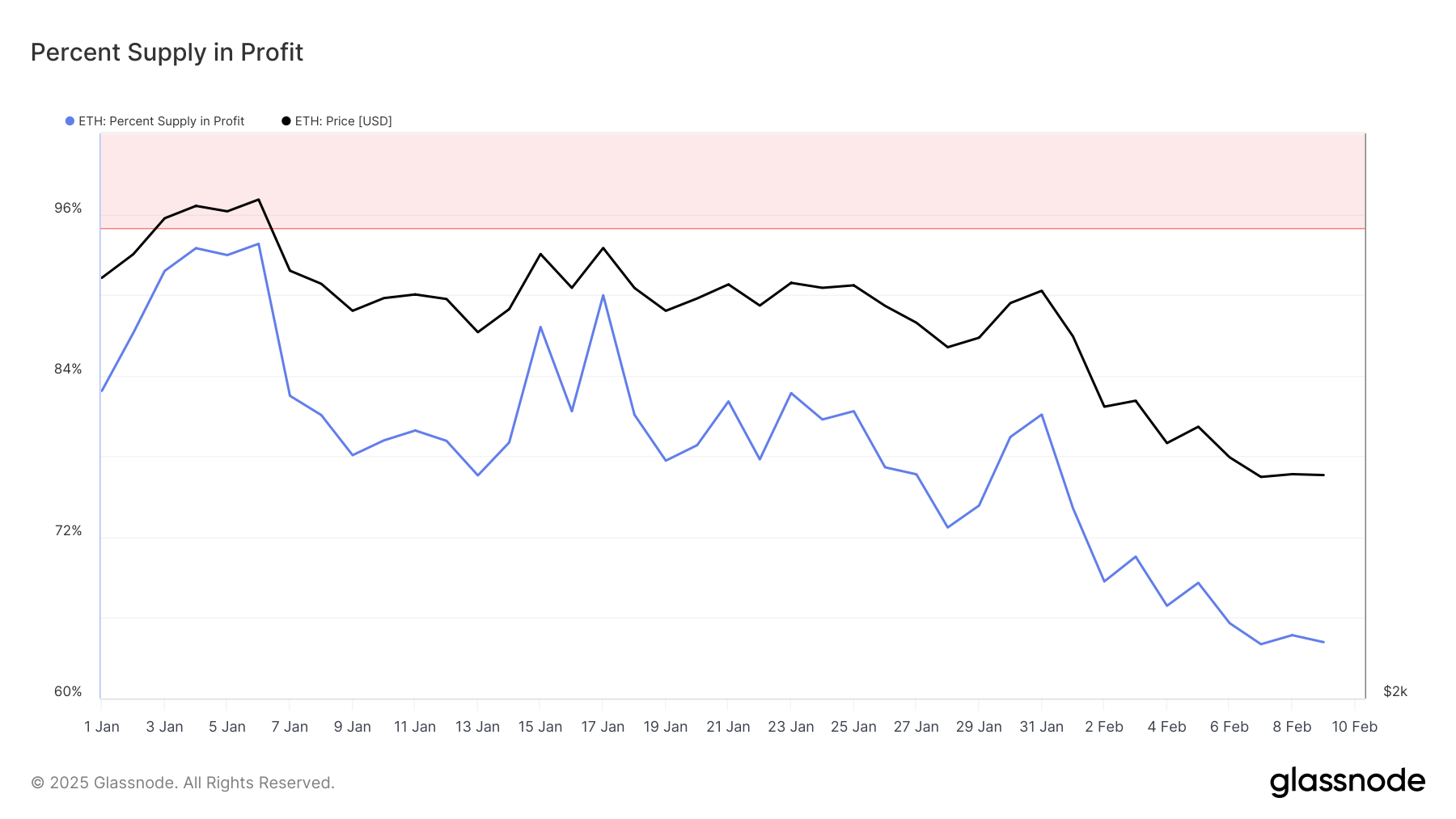

The recent drop in prices has pushed many Ethereum holders in the red. According to Glassnode, the percentage of the circulating offer of ETH to profit has dropped at its lowest point since October. To date, only 64.19% of the total supply of Ethereum is in profit. In other words, 48 million ETH ETH ETH remain in profit.

For the context, on January 1, 83% of the total offer in ETH circulation was in profit. When the percentage of the circulating offer of an asset downwards, a larger part of the holders is now confronted with losses, because the price of the asset market has fallen below its purchase price.

This drop often points out a reduction in investor confidence and may indicate potential risks for the price of assets.

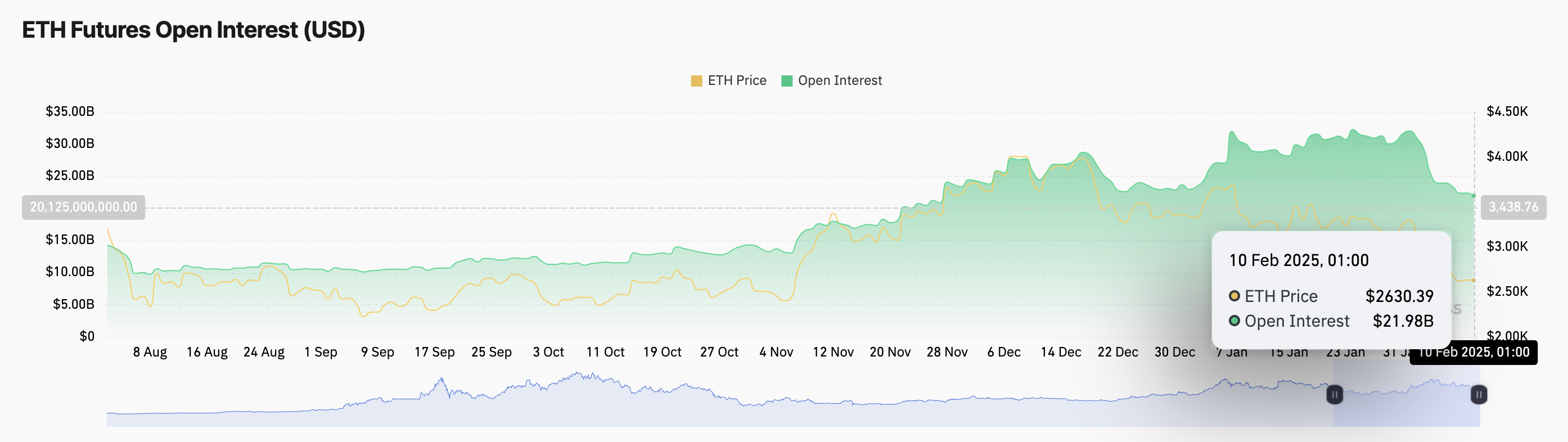

In particular, ETH’s open interest has also decreased, confirming the drop in investors’ confidence. To date, this represents $ 22 billion, fell by 31% since the beginning of February.

Open interests measure the total number of current contracts (long or short), such as term contracts or options that have not been set. When open interest drops like this, this indicates a decrease in market activity or investor participation, which can suggest reduced confidence or a change in market feeling.

ETH price prediction: lower $ 2,224 or $ 2,811 inversion?

On the daily graphic, ETH is negotiated at the lower line of its descending channel, which constitutes a support at $ 2,553. If sales take more momentum, Bulls may not be able to defend this level, which means that the price of the ETH extends its losses.

In this scenario, the price of the part could drop to $ 2,500 or less to $ 2,224.

However, a reversal of the current market trend will invalidate this downward projection. In this case, the price of ETH could resume its upward trend and climb $ 2,811.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.