ETH Price Could Hit $3,000, But Retail Selling Puts the Brakes On

The price of Ethereum increased regularly in last week, up almost 10% while institutional actors continue to pay capital in the Altcoin Leader.

This growing momentum occurs in the midst of broader optimism on the cryptography market and a correlation of strengthening with Bitcoin, which is similar to a new summit of all time. Together, these trends suggest that Ethereum can be ready for a significant escape, but a familiar roadblock still hinders.

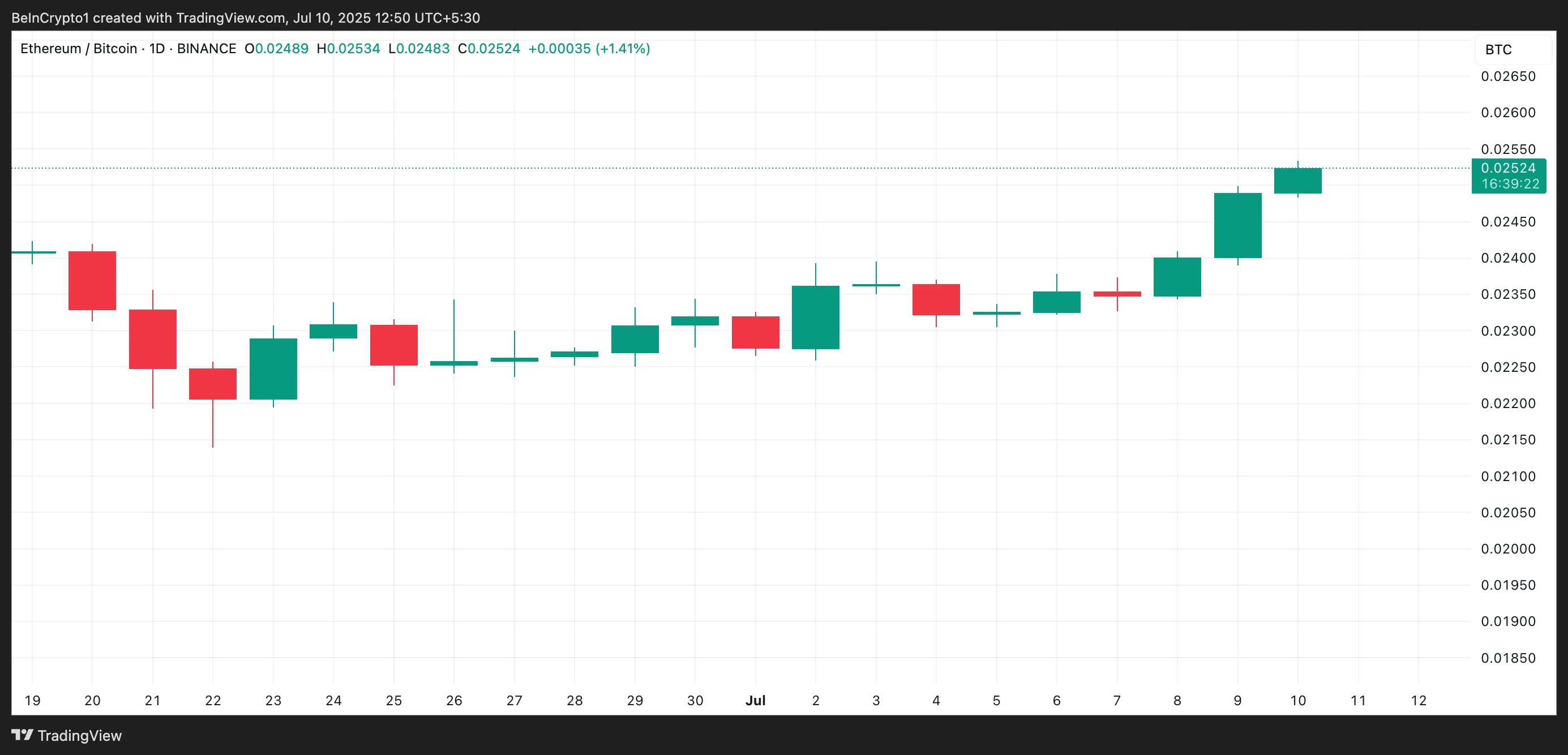

ETH / BTC correlation

The correlation of Ethereum with Bitcoin has climbed strongly since the end of June. The ETH / BTC correlation coefficient, which measures how much the ETH price movements follow those of BTC over a given period, is now at 0.02.

A value close to 1 indicates that the two assets move in the same direction, while a close value -1 means that they move in opposite directions.

The BTC approaching its top of all time, the price of ETH could follow the plunge and rally. In fact, historically, a raised correlation in the bull phases preceded joint rallies for the two assets.

ETH targets $ 3,000 while institutions are responsible

Ethereum’s institutional investors seem to lock positions because they benefit from the ETH / BTC climbing. The two active ingredients historically rallying in tandem during the bullish phases, this group is positioned for a probable escape greater than $ 3,000.

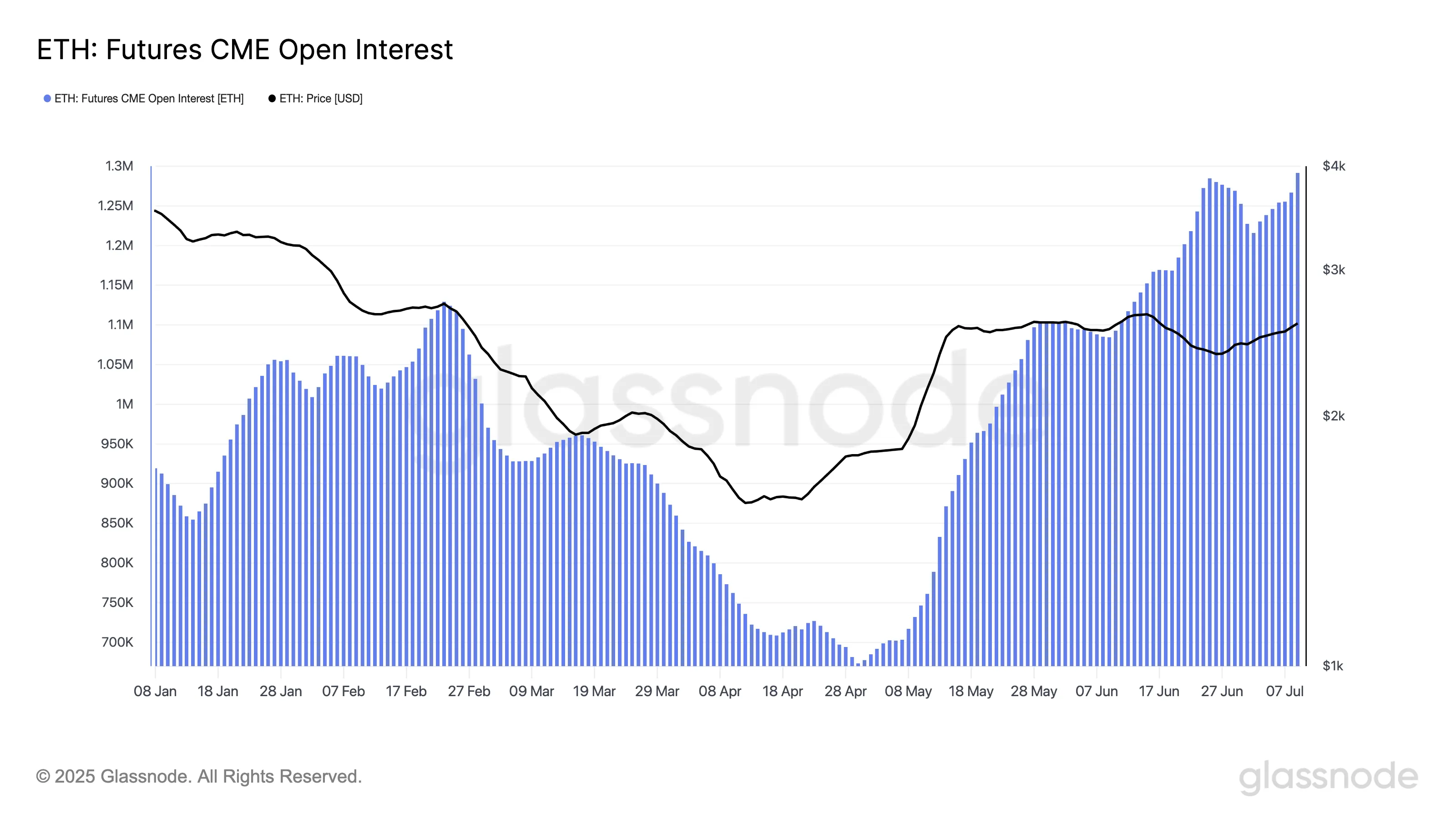

According to data on the Glassnod chain, an open interest in the term contracts on ETH on the Mercantile Chicago Exchange (CME), measured by the 7 -day single mobile average, reached a record summit of $ 3.34 billion.

This reflects the increase in institutional positioning while the main market players accumulate ETH in anticipation of the additional increase.

The open interest refers to the total number of current contracts in progress which have not been settled. When it increases like this, this indicates an increase in commercial activity and an increase in capital entering the market.

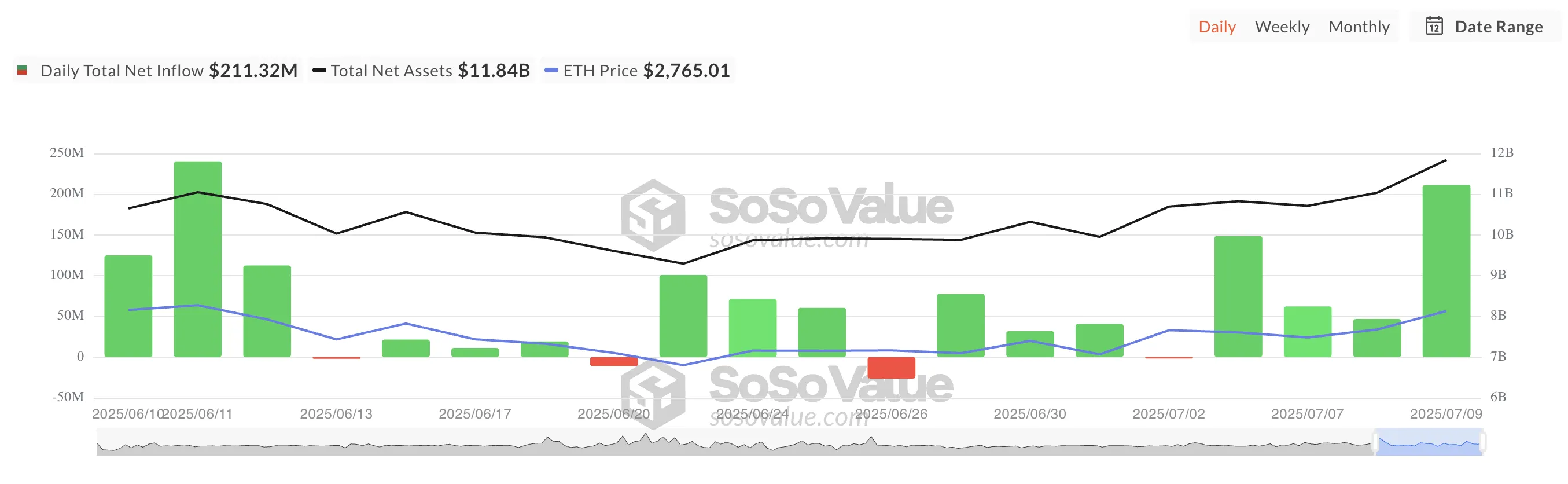

In addition, the coherent weekly entries in the ETH Spot highlight the strengthening of confidence in Altcoin among these key investors.

According to Sosovalue, the funds supported by ETH have recorded uninterrupted weekly entries since May 9. Last week, more than $ 219 million in capital flocked in the ETH Spot ETH despite the action for the largely laterally of the room.

This sustained investment confirms the growing confidence in the long -term value of the ETH, as sophisticated investors are positioned before a planned rupture of more than $ 3,000.

However, there is a catch.

Eth Bulls is below $ 3,000 while retail traders hit

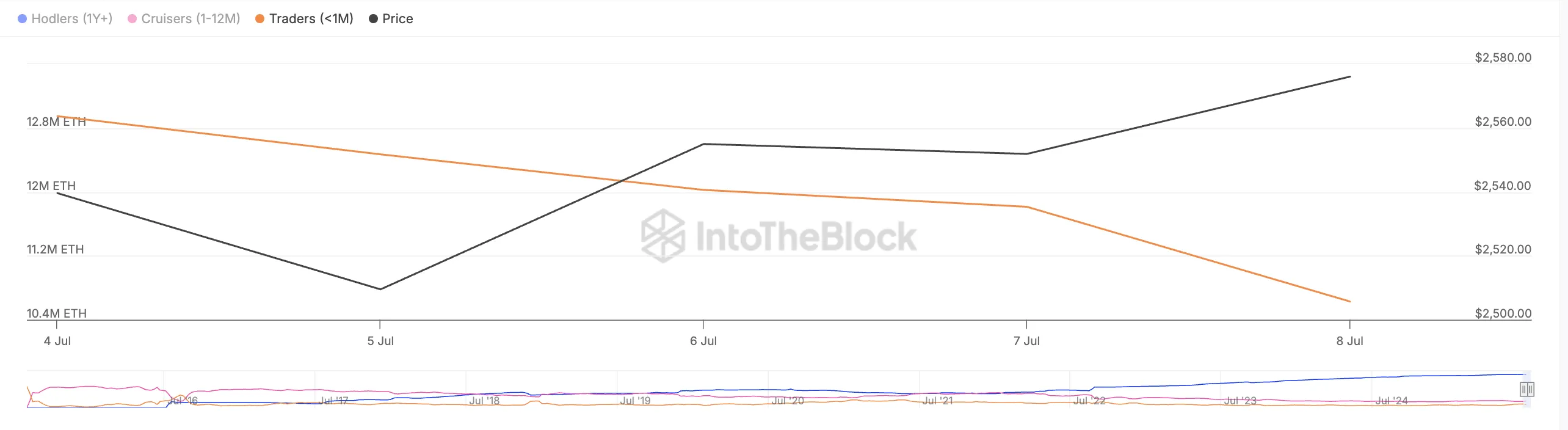

While the keychain pursues a rally greater than $ 3,000, the share of short-term ETH prices continues to be increased by “paper hands”. These retail merchants held the room for less than 30 days and sell in its recent strength.

Intotheblock data show that the balance of this group has dropped by 16% since July 4, slowing down the growth in the part in the middle of solid institutional support.

Retail merchants stimulate short -term price performance of an asset thanks to frequent purchases and sale focused on emotions. Unlike institutional investors who tend to hold fluctuations, retail participants are more reactive to news, feelings and short -term price movements.

When they start to sell, the pressure downwards increases, dropping out of rallies or triggering corrections.

Although the institutional interest in ETH is a good sign of long -term confidence, retail merchants are necessary to catalyze a rally greater than $ 3,000 in the short term. If they stay away and the request falls, the medal could lose part of its recent earnings and fall below $ 2,745.

However, a resurgence of the new request could increase the price of ETH greater than $ 2,851 and to $ 3,067.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.