ETH Price Holds Above $4.5K as Institutional Demand Signals Strength

The price of the ETH has shown remarkable price action in recent weeks after reaching an ATH. Now, during writing, he is today above $ 4,500 while institutional demand is strengthening.

Onchain’s data becomes positive, because the specific metric “Fund Market Premium” (FMP) suggests that the curve returns in positive territory and that chain activity rises.

Consequently, the environment of the current market has brought an excitation renewal on the ETH market, because the important decision of today of the FOMC would establish the trajectory for the rest of the year.

However, opinions are tilted on the bullish side which could support a potential rally to the $ 6,800 area.

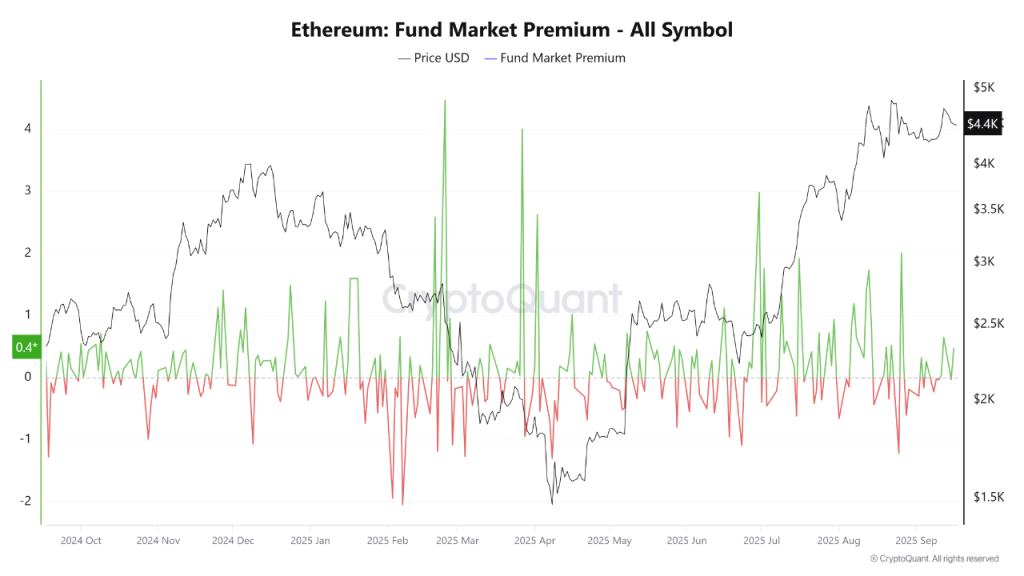

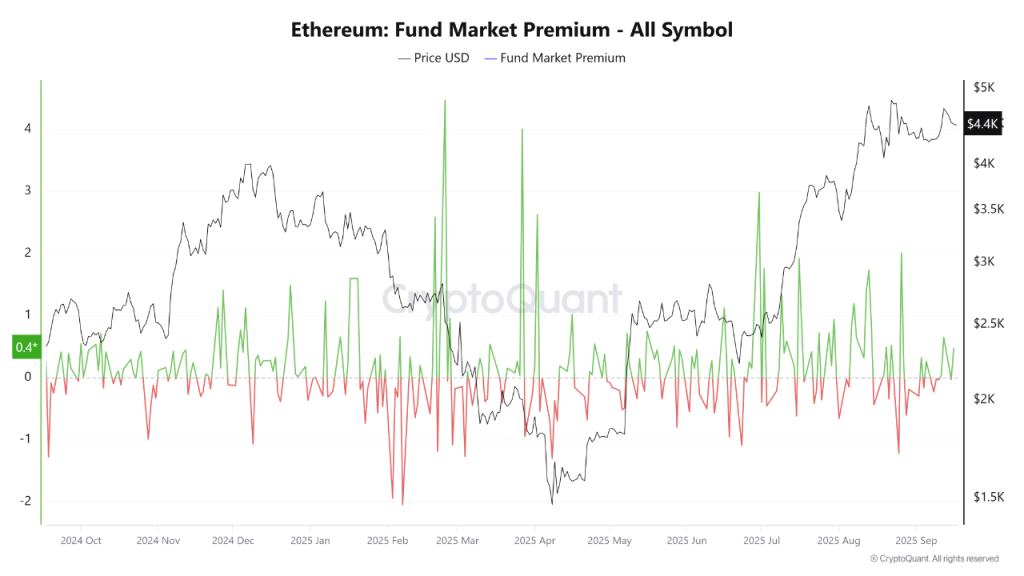

The positive fund market premium supports the momentum of ETH prices

The Fund market premium (FMP) on Cryptochant, which measures the price difference between term contracts and cash markets, has become positive again.

While when the premium is positive, it means that for an asset, the term contracts are negotiated with a bonus beyond its cash market. It even represents the additional demand for institutional investors which results in stronger and lasting rallies.

That said, this trend was played for the last time in November 2024 until January 2025, during which a great pump was seen. After long months of waiting, now, once again, from July 2025 to now, when ETH continued its ascent.

This suggests that institutional trust is coming back, buyers showing a desire to pay a bonus to guarantee positions in Ethereum Crypto.

Growing activity and FOMC results could lead

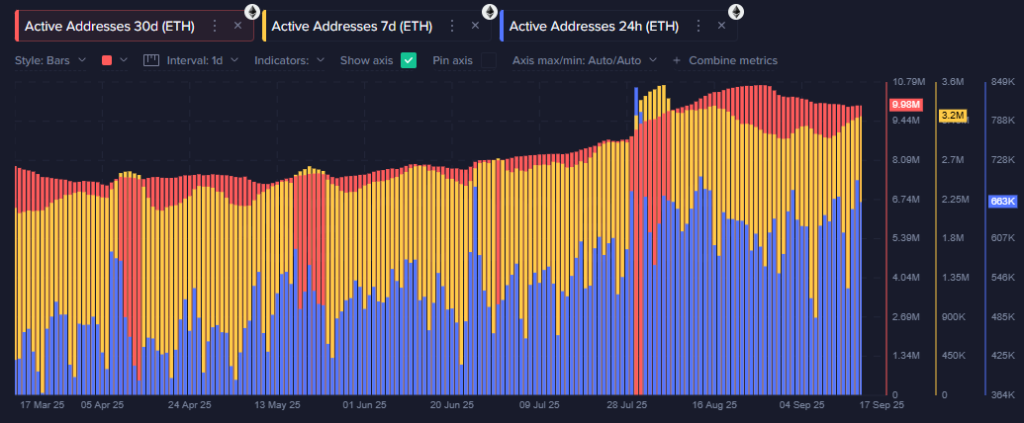

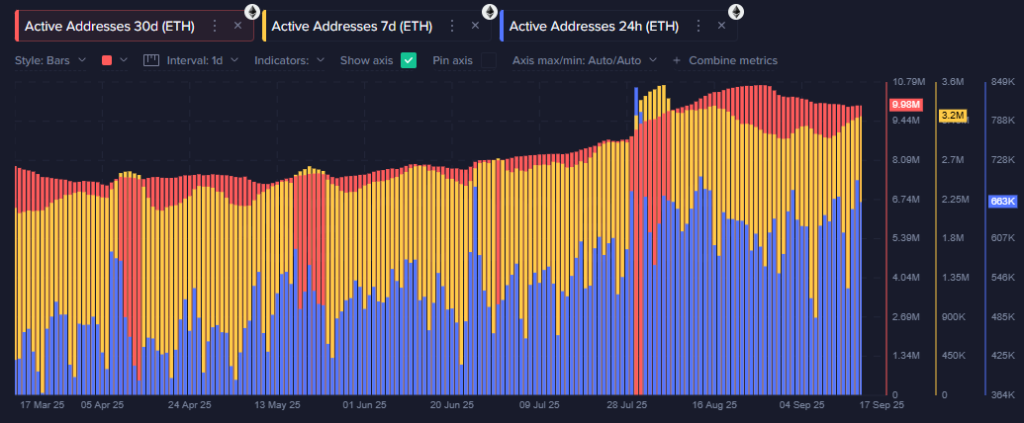

Another notable factor supporting the bullish position for the price of the ETH today is the increase in active addresses throughout the third quarter, based on data on the chain of santiment.

This growing user activity clearly reflects a broader participation on the Ethereum network.

In addition, Macro Event could further influence the momentum and set the tone for sessions and even months to come.

The planned meeting of today’s FOMC was supposed to be the most important meeting of the month, where a critical decision on interest rate reductions will take place.

If the rates are reduced, it would be very good news for assets like Bitcoin and Ethereum, which will probably receive more capital of capital, which will increase the purchase pressure which should bring the price of ETH to $ 6,800 in a few weeks.