Ether could ‘rip like 2021’ as SOL traders brace for 10% drop: Trade Secrets

Welcome to Trade Secrets – Bitcoin and price price of the main analysts, as well as the options of options, the analysis of feelings and the prediction markets to determine what they can tell us over the months and years to come.

XRP at $ 7.50 if “Momentum supports”; Ath by the end of August?

XRP is preparing for a huge increase of 160% by the end of 2025, predicted Shubh Varma, co-founder and CEO of Hyblock Capital.

Varma tells the magazine that XRP could reach $ 7.50 at the end of 2025 if the “Momentum supports”. His forecasts occur after XRP reached an up to date summit of $ 3.66 on July 18, but did not reach its official $ 3.84 summit from January 2018.

Over the next two weeks, Varma says that XRP could be negotiated in the range of $ 3.25 to $ 3.50, which is around 12% higher than its current price of $ 2.85 at the time of publication.

He says that the “cooling” of the token after the recent gathering, but strong purchases can set it up to get closer to its peaks from all time at the end of August.

Meanwhile, Crypto Analyst Cryptotes says that XRP must stay above the “Make-Or-Break” support range from $ 2.80 to $ 2.95 to maintain its bullish momentum.

Ether will “tear up like 2021” once he hits $ 4,200: Trader Crypto

Ether is expected to be discovery of prices if he exceeds $ 4,200, explains Merlijn The Trader.

“The break of $ 4,200 and ETH will tear as 2021,” said the Crypto Trader in a recent post X, highlighting the indicator of divergence of mobile average convergence (MacD), which previously led to significant price movements.

“Ethereum is organized for a monster movement,” he added.

In 2021, Ether climbed more than 230% between March and November, exceeding the summit of $ 4,878.

Ether briefly exceeded $ 4,000 in December 2024 during a post-electoral rally, but it has not been almost $ 4,200 since 2021.

More than a few traders believe that it is about to change. The Lord of Entry tells the magazine that Ether will break its summit of $ 4,878 at the end of October and exceed $ 5,000 before the year.

Crypto Trader Milkybull Crypto said in a post X: “Ethereum is defined for a macro break.”

“It will trigger a huge Altszn if it happens. A very critical moment for Ethereum. “

The relative force of ether against bitcoin continues to increase

Despite a dive during the weekend, Ether is negotiated at $ 3,697 at the time of publication and remains up 44% in the last 30 days, according to Nansen.

The relative force of asset against bitcoin continues to increase, up 30% in the last 30 days, according to the ETH / BTC ratio of tradingView.

The growing institutional interest in ether is a major catalyst for momentum. Standard Charterd said in a recent research report that the 10 largest cash value companies in corporate cryptocurrency have now purchased 1% of the total supply of ETH since early June.

During the same period, cash companies focused on Ether have doubled the pace of investments compared to their counterparts focused on bitcoin.

While Yellow Executive President Alexis Sirkia was hesitant to give a magazine a prediction of the Ether prices, he said that he remained super optimistic about Ethereum’s infrastructure.

“Ethereum becomes more scalable and friendly every day,” he told the magazine.

“The rest of the market can continue short -term trends. I prefer to focus on active ingredients that really build the future, ”he says.

Solana plunged 10% as an institutional ether interest in

Other large institutions that penetrate ether could seriously harm the short -term solana price, explains chief researcher Sean Dawson.

“The recent resurgence of ETH seems to exhaust both the attention and liquidity of the competitors, in particular Solana,” Dawson told the magazine.

Dawson stressed that if Solana’s price increased 10% last month, it also dropped 25% compared to ETH, from 0.06 ETH per soil to 0.045.

The trend coincides with the growing interest in the ETH of Tradfi, while cash societies such as Bitmin and The Ether Machine continue to stack their Eth bags.

Dawson points to Solana options for the expiration of August 29, which shows a concentration of sales options at around $ 145, suggesting that traders are preparing for a potential decrease of 10% in August.

The host and trader of “cryptocurrency”, Fefe Demeny, told the magazine that he expects a certain volatility this month, but still sees Solana climbing around 50% compared to her current price of $ 161.

“I plan a quick withdrawal in August. Under the current market conditions, it is very difficult to make specific price forecasts for the month, but if I had to, I would say that Solana could reach the range of $ 240 to $ 260, “explains Demeny.

Demeny expects Solana to surge her $ 293 summit in October, but he has a much darker taking for the way things end the year.

“In December, I expect to see the start of a major correction, perhaps a 30% to 50% draw,” he said.

Read

Features

Unlock cultural markets with blockchain: Web3 brands and decentralized rebirth

Features

Recover your money: the strange world of Crypto dispute

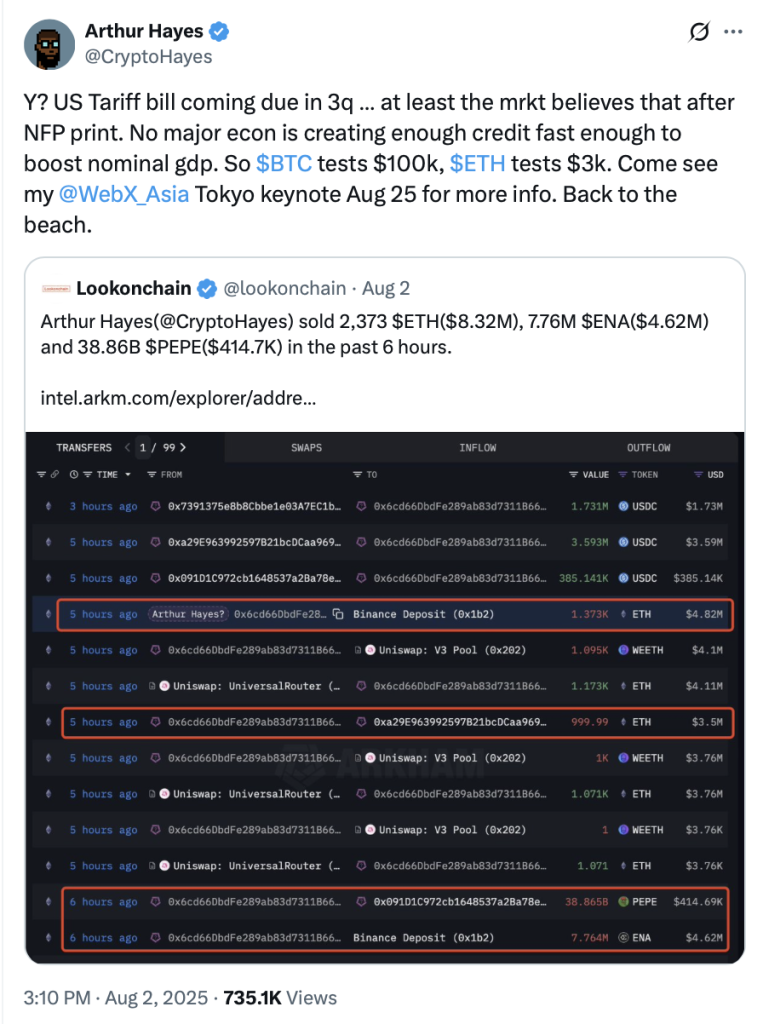

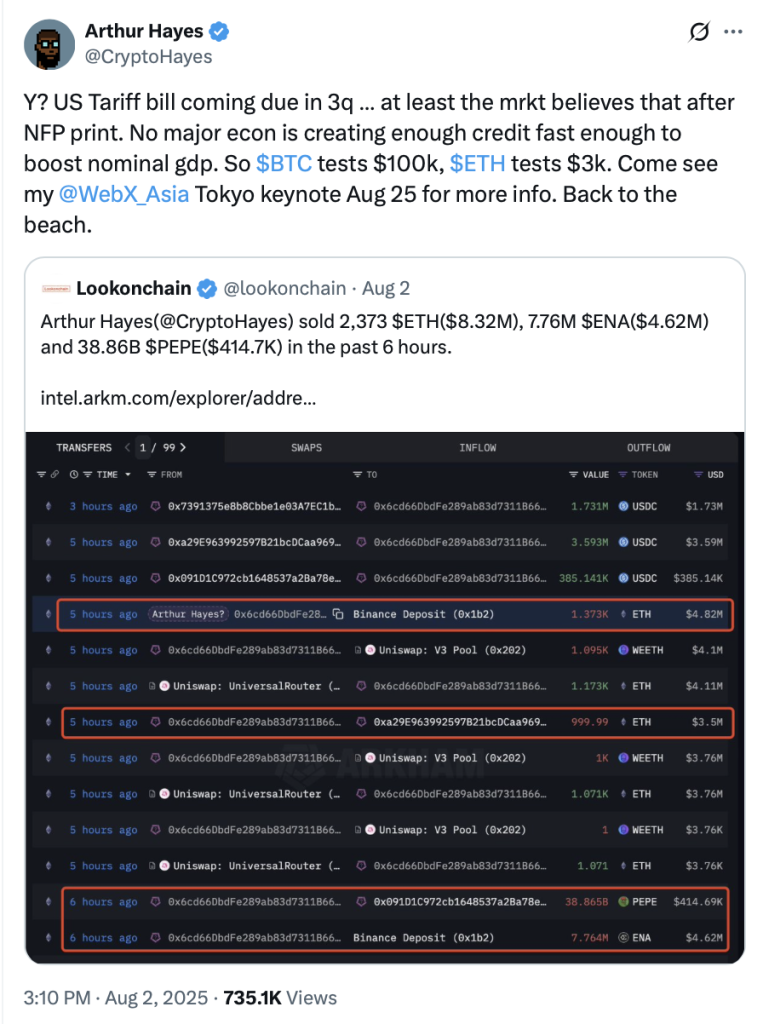

Arthur Hayes says Bitcoin could fall at $ 100,000

Bitcoin can once again fall to the psychological level of $ 100,000 as the impacts of the prices become clearer, according to the co-founder of Bitmex, Arthur Hayes.

“The American tariff bill on the date of 3q,” said Hayes on August 2, highlighting the non -agricultural disappointing pay report – only 73,000 jobs added compared to the estimate of the 100,000 – as a sign that the labor market weakens, strengthening fears of the market.

“No major eon creates enough credit quickly enough to stimulate nominal GDP,” said Hayes.

Xapo Bank’s investment manager Gadi, Chait, said that Bitcoin’s consolidation after the recent heights of all time does not surprise. “Once again, the inflationary fears have increased while prices and geopolitical uncertainty linger, frightening the cryptographic and traditional markets,” said Chait.

“In recent times, Bitcoin has proven its ability to summarize the turbulence inflicted by external factors, an encouraging sign of its growing maturity. Our conviction in Bitcoin’s long -term potential is always discouraged by short -term price fluctuations. ”

The comments of Hayes and Chait come as Bitcoin continues to retreat from its highest July 14 of $ 123,100, now 7% less than $ 114,349.

However, other analysts consider gout as a simple healthy correction in a greater rise.

Crypto Mags’ analyst said the recent drop in Bitcoin prices at $ 115,000 was a new thumbnail of the reverse head and shoulder neck before BTC continues its upward trend.

“It’s just a matter of time before the price of Bitcoin becomes vertical,” said Mags in a Thursday article on X.

Meanwhile, the Plessis Crypto Kyle trader told the magazine that Bitcoin has a much more upward and does not think Bitcoin will end with the usual four -year cycle this time.

Instead, he sees the late stages of the cycle playing well at the end of 2025, perhaps even at the beginning of 2026.

Read

Features

Cryptographic mass adoption will be there when … [fill in the blank]

Features

The success of the grid shows that the `invisible ” blockchain is the winning game

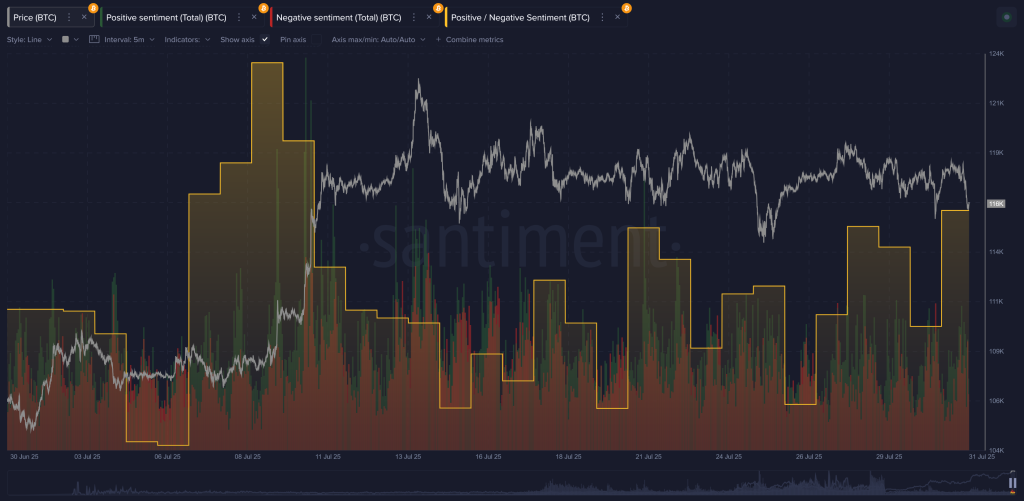

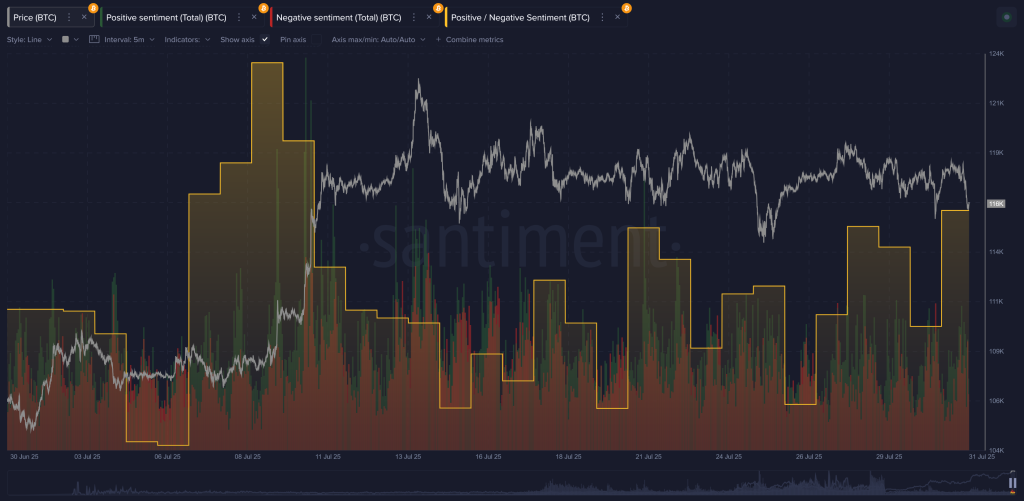

Crypto traders show “careful optimism”: santly

Crypto traders remain cautiously bruised while Bitcoin is negotiated further below the top of all time it has reached on July 14, according to the healthy feeling data platform.

“Overall, merchants mainly show cautious optimism after the $ 123,000 retraced all time two and a half weeks ago,” said Brian Q Teels Magazine.

The DIP was not a shock for Santiment analysts. Q noted that the chatter of social media had become a little too optimistic, often a warning sign that a reversal could be close.

Q shared the graphic below to show the Bitcoin scheme that backs up when the feeling of social media expects it to increase, and it often bounces when feeling is lower.

“The feeling regularly slipped at the end of July, and but not as high as we saw on June 10, there is certainly a meager towards the increase in social media,” explains Q.

Although q says that the feeling of social media indicates that there is a “light charging period” to come for Bitcoin, it will not be drastic:

“Those who expect a massive and sudden accident may not have an opportunity to buy as simple as they hoped.”

According to Q, portfolios holding between 10 and 10,000 BTCs – which control 68.4% of the total offer – have poured 21,114 BTC since July 15, after having stacked mid -March in mid -July.

“It is not a great decline. But historically, when they take a break on accumulation, prices tend to lose steam quickly, ”explains Q.

What derivative markets say about bitcoin and ether

The Onchain Derive Options Protocol Nick Forster told the magazine that the long -term traders become a little more lower.

Future traders assess 36% like Bitcoin fell below $ 100,000 before September 26, up 6% compared to last week.

As for Ether, future merchants estimated 22% of $ 2,500 before September 26, up 14% compared to last week.

Forster says that the data indicate that traders estimate the risk of a sudden and net reversal of the market.

“It is a clear sign that the market is expecting a difficult start in August while the tensions of commercial prices warm up,” explains Forster.

What the prediction markets say About bitcoin and ether

The prediction markets have become more optimistic in the last 30 days after the summits of all time in July Bitcoin launched a wider market rally.

Bitcoin reached new peaks of $ 123,100 on July 14 and 59% of you can break this level by September 30, according to the Crypto Polymarket prediction platform.

Since the chronicle of commercial secrets of July, the chances of polymarket of other major cryptocurrencies have reached new heights of all time at the end of the year have increased.

Solana is now 26% chance of exceeding its previous peak of $ 293 by the end of 2025, up 4% compared to its ratings last month, its price increased by 10% over the same period.

Ethereum has 48% chance of breaking its summit of $ 4,878 this year, up 26% compared to its dimensions last month, because its price increased by 40% over the same period.

Get down

The most engaging can be read in the blockchain. Delivered once a week.

Ciaran Lyons

Ciaran Lyons is an Australian journalist Crypto. He is also a standing actor and was presenter of radio and television on Triple J, SBS and the project.