Ethereum Burn Count Drops 95% – What Does It Mean for ETH?

In recent months, Ethereum has experienced a significant drop in user activity on its blockchain. This slowdown has reduced the network’s burning rate – a mechanism that helps reduce ETH’s supply over time.

With fewer burned token, the supply of ETH circulation has increased, putting inflationary pressure on the asset. Consequently, the medal has struggled to maintain a stable price higher at $ 2,000 in recent months.

A low burning rate is equivalent to more coins in circulation

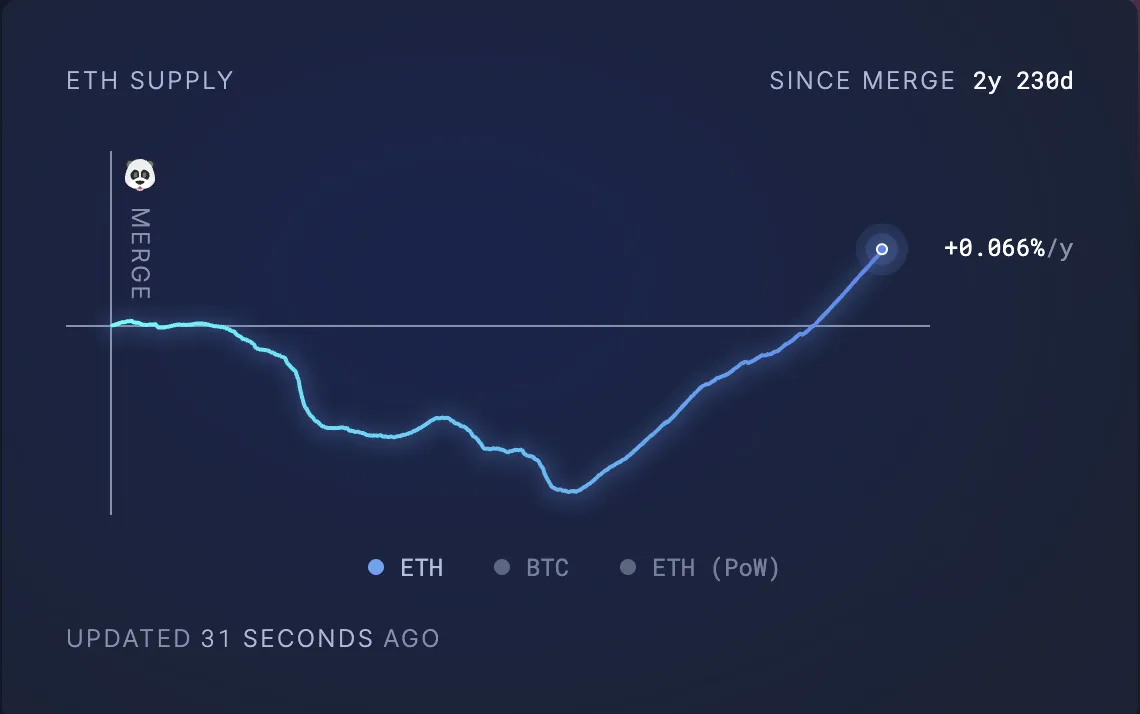

According to Ultrasoundmoney, 72,927 ETH, worth $ 134 million at current market prices, were added to ETH’s circulating offer in the last month.

At the time of the press, this is 120,730 19999, considerably above pre-fummer levels.

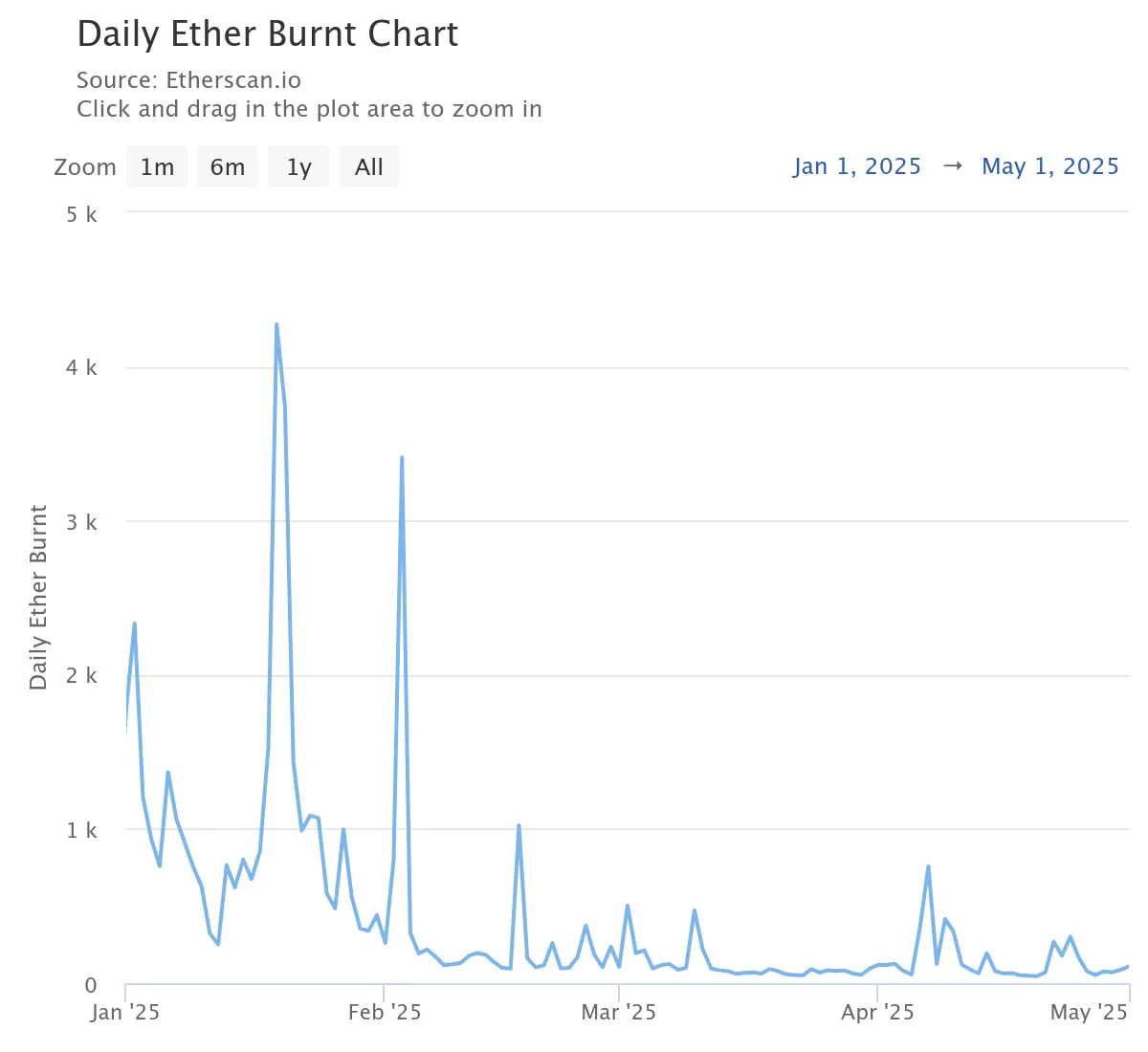

This increase in ETH’s supply is driven by a drop in user activity on the Ethereum network, reducing its burning rate. The Ethereum burning mechanism, introduced via EIP-1559, destroys part of the transaction costs to reduce the supply of ETH.

However, this mechanism is directly linked to the use of the network. Thus, when fewer transactions occur like this, less eTh is burned, which leads to doping of the ETH offer.

According to Etherscan, the daily amount of ETH Burnt fell 95% up to date. In fact, the network recently recorded its lowest amount of pieces burned in a single day on April 20.

Why do Ethereum users leave the blockchain?

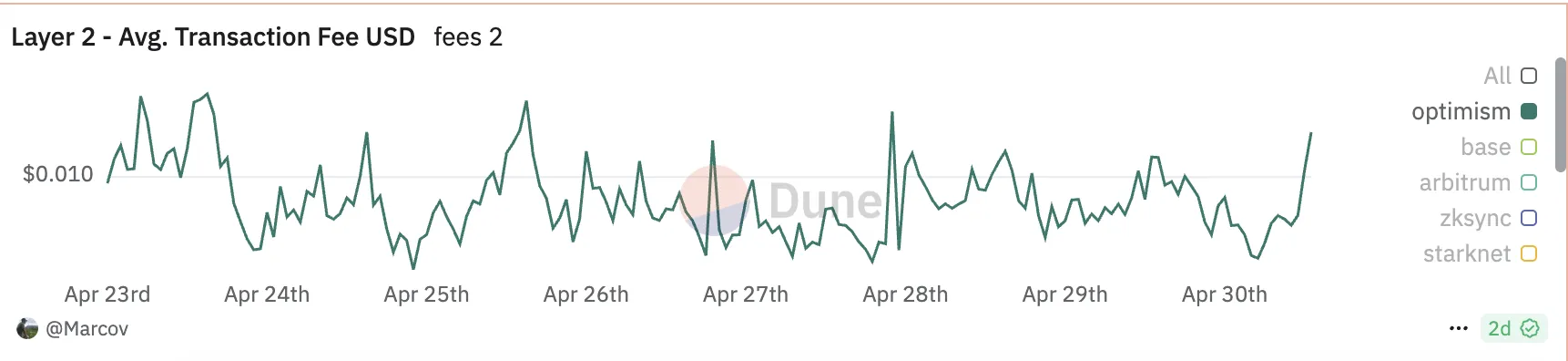

Many users and developers migrate from Ethereum to layer 2 (L2) solutions such as optimism and arbitrum. These networks offer considerably lower transaction costs and faster execution, reducing user activity on maint d’Ethereum.

For example, on April 30, the average transaction costs on optimism were only $ 0.024. On the other hand, the realization of a transaction directly on Ethereum costs an average of $ 0.18 on the same day, which is more than seven times more expensive.

In addition, thanks to the recent manner of the memes play, “Ethereum Killers”, like Solana, has gained significant traction in recent months, moving users from L1.

Together, these trends led to a drop in the number of Ethereum transactions, hence the low burning rate of the network.

How do the fundamental principles of Ethereum accumulate?

The drop in demand from Ethereum users and the subsequent increase in ETH supply have raised important questions about the strength of its fundamental principles.

When he was asked how Ethereum is currently compared to other layer 1 (L1) networks in the middle of a broader weakness on the market, Vincent Liu, director of investments at Kronos Research, offered his point of view.

“The fundamentals of Ethereum remain strong compared to the other layers 1, in particular when you consider its total locked value (TVL) of $ 368.921 billion, which positions it at the top of the classification,” said Liu.

Although Liu has recognized that Ethereum ranks fifth in 24 hours, behind Tron, Solana, Hyperliquid, Bitcoin and BNB chain. He stressed that the network “always demonstrates significant demand and use”.

Temujin Louie, CEO of Wanchain, shares a similar perspective. While speaking with Beincrypto, Louie noted:

“Compared to the other layers 1, the fundamentals remain the strength of Ethereum. Unlike many layers 1 with aggressive inflation as part of their design, Ethereum post-fusion architecture potentially makes it deflationist. However, the advantages of the EIP-1559 activity on the channel.

Although the increase in activity through layer 2 solutions (L2) and “Ethereum killers” as Solana may have contributed to a drop in demand from users on Ethereum itself, Louie estimates that the L1 network “remains a leader in decentralization and has an almost innovative assessment which continues to secure its place on the market”.

What about the ETH price?

Even with solid fundamentals, the drop in activity on Ethereum poses challenges for short and mid-term ETH. Commenting on this, Liu explained that the lower network activity generally indicates a lower demand for ETH.

At the same time, the increase in the emission of parts on the SAPE network The deflationary model of Ethereum, which was designed to support the assessment of prices.

“This combination could lead to lower price movements,” warned Liu, “in particular while investors are turning to alternative layers which offer better scalability and a drop in costs.”

Kadan Stadelmann, CTO of the Komodo platform, also underlined the role of macroeconomic factors:

“If Ethereum undergoes an prolonged drop in use, the price could lower considerably depending on the drop in use, especially if the Fed pursues its quantitative tightening policy compared to quantitative relaxation. In the short term, this could mean that the price is decreasing at the beach by $ 2,000. If the trend continues, however, then Ethereum could be found in a period of consolidation or a punctual decrease tendency.

Eth Eyes $ 2,000 Breakout in the middle of RSI strengthening

ETH is currently negotiated at $ 1,834, noting a price drop of 1% during the last day. Despite the brief decline, the bullish pressure on the punctual markets of the medal continues to strengthen, reflected by the index of relative force of the climbing of the play (RSI).

At the time of the press, this momentum indicator is 57.68. ETH RSI readings report growing upper conditions. This indicates that Altcoin has a place for a movement up if the purchase of the pressure increases.

In this scenario, its price could exceed $ 2,027.

However, if the purchase of the pressure loses momentum, the ETH value could fall to $ 1,733.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.