Ethereum ETF Inflows Hit 2025 Peak — How Will ETH Price React?

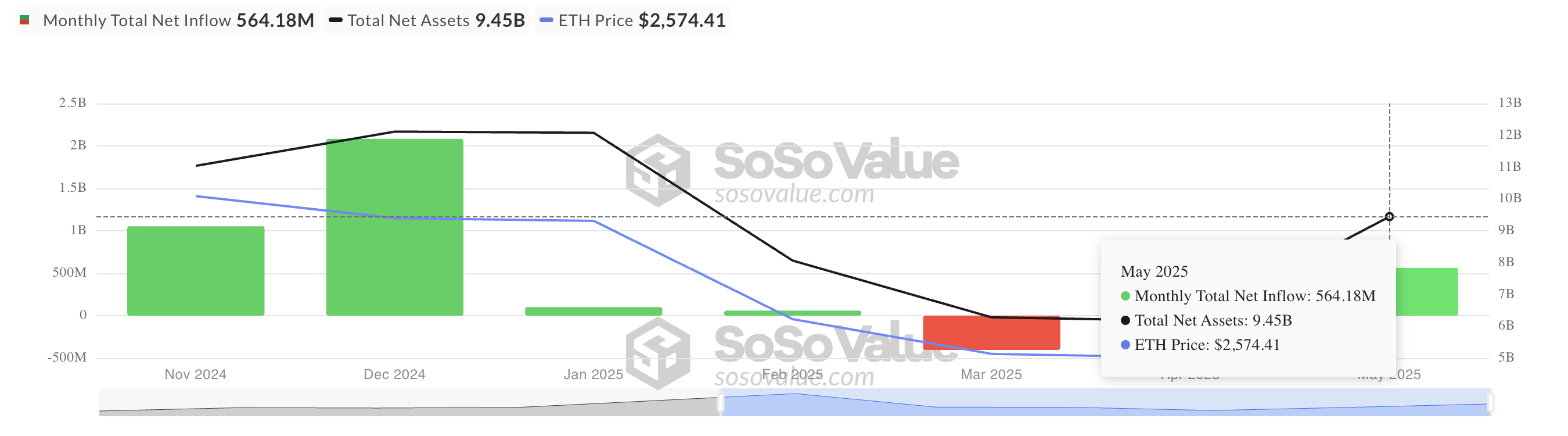

The Ethereum price rally can rekindle the interest of investors in the funded funds on the ETH (ETF). During the 31 -day period, capital entries in these Investmemt products exceeded $ 550 million, marking the highest monthly Netflow in ETH FNB since the start of the year.

While the price of the play witnessed a decline during last week, the technical indicators refer to a possible short -term rebound.

ETH ETF logs the highest monthly entries of 2025

According to Sosovalue data, ETH SPOT ETF recorded a combined influx of $ 564.18 million in May, exceeding all previous monthly totals this year.

The influx of capital was largely motivated by the high performance of ETH, the first Altcoin exceeding the critical level of $ 2,000 and the attempt to consolidate gains above $ 2,500 during the month. This renewed bullish feeling encouraged institutional investors to increase their exposure thanks to punctual ETFs and the position before a sustained rally in the medal price.

Ethereum is preparing for the following mention

The readings of the daily graph show that the ETH witnessed an increase of 49% between May 8 and 13, before settling in a consolidation phase which has now formed an optimistic pennant model.

A bullish pennant model is formed when a strong upward price movement (mast) is followed by a consolidation period which resembles a small symmetrical triangle (the pennant). This model suggests that buyers temporarily stop before continuing the upward trend.

If Eth leaves the upward pennant, it could trigger a renewed rally which reflects the initial overvoltage of 49%. Such an escape would confirm a continuous upward dynamic and attract additional capital entries.

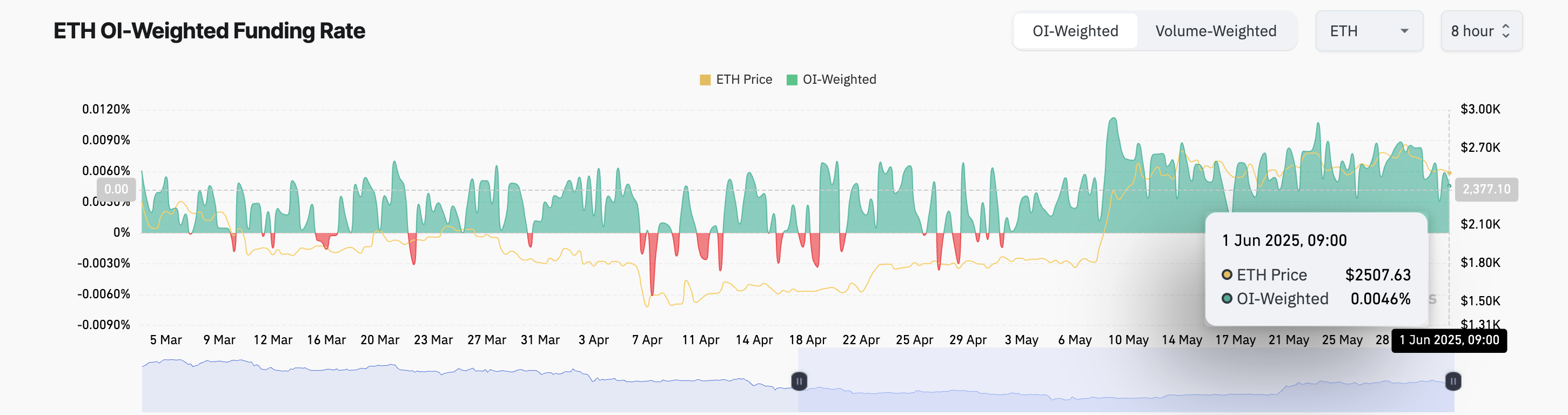

In addition, the rate of financing of the part continues to print values higher than zero, indicating a preference for long positions even in the middle of the current consolidation phase. When writing these lines, ETH’s financing rate is 0.0046%.

A positive financing rate like this means that long-position holders pay short position holders, indicating a bullish feeling and that more traders are betting on price increases.

Can the next Ethereum movement: can bulls push ETH 49% higher from here?

ETH is currently negotiated at $ 2,489, located above the lower line of his pennant, which is supporting $ 2,479. If a bullish break occurs, the price of ETH could rally to the length of the mast (49%) to negotiate at $ 3,907.

However, if sales overlap, the price of the medal could decompose below the pennant and negotiate at $ 2,419.

The post-and Ethereum entries reached the peak of 2025-How will the ETH price react? appeared first on Beincrypto.