Ethereum ETFs Predicted To Explode In H2 2025

Welcome to the morning briefing of the US Crypto News – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee to read how Ethereum (ETH) can enter a new phase. Although attention has often changed elsewhere, an increase in capital, institutional adoption and bullish stories suggests that something deeper takes place.

Crypto News of the Day: ETFS ETFs leads to an increase in momentum on the channel

Ethereum is ready for a massive influx of institutional capital, according to the director of investments in Bitwise Matt Hougan. Hougan has projected up to $ 10 billion on entry into the FNB Ethereum (funded funds) in H2 2025.

This upward estimate is based on an increasing dynamic observed in June, where ETHEREUM ETF has recorded $ 1.17 billion in entries.

The Bitwise executive cites a combination of stablescoins and actions moving on Ethereum, strengthening the story of traditional investors.

This is aligned with the growing pivot of Ethereum to tokenized actions, which could attract traditional finance (tradfi) or institutional capital.

“Ethereum is intended for token actions,” said the network.

Indeed, this declaration presents itself as more than a simple slogan, Ethereum witnessing an increase in institutional documents. Beyond the infrastructure for decentralized finance (DEFI), the Ethereum network is now the fundamental layer of real assets (RWAS), including actions and payment systems.

From Paypal, Visa, Stripe and Mastercard, to Sony, Nike, Starbucks, Reddit, Fidelity, JP Morgan and even Ernst & Young, the major institutions are based on Ethereum or integrate into its architecture.

“Ethereum quietly becomes the fundamental layer of the modern world,” joked a user.

The last participant is Robinhood, who revealed plans to issue up to 200 American actions and ETF tokens on the layer 2 (L2) network based on Ethereum, Arbitrum (ARB).

Meanwhile, the fundamental principles and the feeling of the Ethereum market have strengthened with this institutional momentum. Beincryptto said that Ethereum had recorded $ 429 million at the start last week, in addition to $ 124 million in the previous week.

The upgrading of Pectra, a significant improvement in the network on May 7, has considerably renewed the interests of investors. Designed to improve the operations of the validator and the features of users, Pectra represents a fundamental bullish which has aroused optimism concerning the long -term scalability and competitiveness of Ethereum.

Ethereum’s real usefulness becomes its strongest institutional argument

While Bitcoin has dominated the headlines in recent months, largely due to the success of the BTC ETF and the attraction of Macro, Ethereum’s story catches up.

In the opinion of Hougan, it could soon become the most convincing history for traditional investors, much like Bitcoin, as indicated in a recent American publication of Crypto.

If the forecasts take place, $ 10 billion in entries would mark a moment in the watershed for Ethereum, which fills the gap with Bitcoin in institutional wallets.

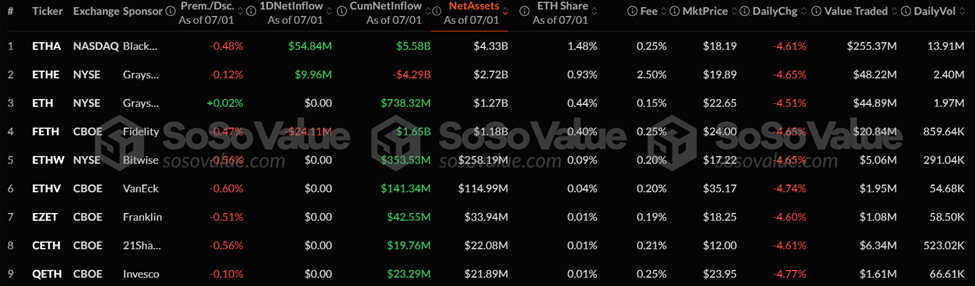

The data show that growing institutional interests, with growing institutional entries in Ethdataven in the face of market volatility, ETHEREUM SPOT ETF continue to attract capital, with Ishares Ethereum Trust (ETHA) of BlackRock leading.

On July 1, Etha recorded $ 54.8 million in entries, actually contributing to $ 5.5 billion since the creation. He also maintained entries for 29 of the last 30 days, effectively passing as the most efficient Ethereum funds currently on the market.

Beyond ETF issuers, Digital Bit, classified Nasdaq, announced plans for an Ethereum cash strategy. It will collect $ 162.9 million by issuing 86.25 million shares and product use to buy more ethereum. THE Firm has also announced a transition from Bitcoin extraction to a strategy focused on Ethereum.

Elsewhere, analysts continue to keep the hope that continuous strong entries in Ethereum ETHE have been able to pave the way for existing characteristics for ETHEREUME EXTRAGE in the market.

Graphic of the day

Alpha the size of an byte

Here is a summary of more news from crypto in the United States to follow today:

Presentation of the actions of the crypto-actions

| Business | At the end of July 1 | Preview before the market |

| Strategy (MSTR) | $ 373.30 | $ 381.50 (+ 2.20%) |

| Coinbase Global (Coin) | $ 335.33 | $ 340.68 (+ 1.60%) |

| Galaxy Digital Holdings (GLXY) | $ 21.31 | $ 21.79 (+ 2.25%) |

| Mara Holdings (Mara) | $ 15.70 | $ 16.02 (+ 2.04%) |

| Riot platforms (riot) | $ 11.27 | $ 11.53 (+ 2.31%) |

| Core Scientific (Corz) | $ 17.25 | $ 17.22 (-0.17%) |

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.