Ethereum ETFs See Seventh Consecutive Week of Net Outflows

ETHEREUM ETHEREUM closed another week in the red, recording net outings in the middle of a continuous hesitation in investors.

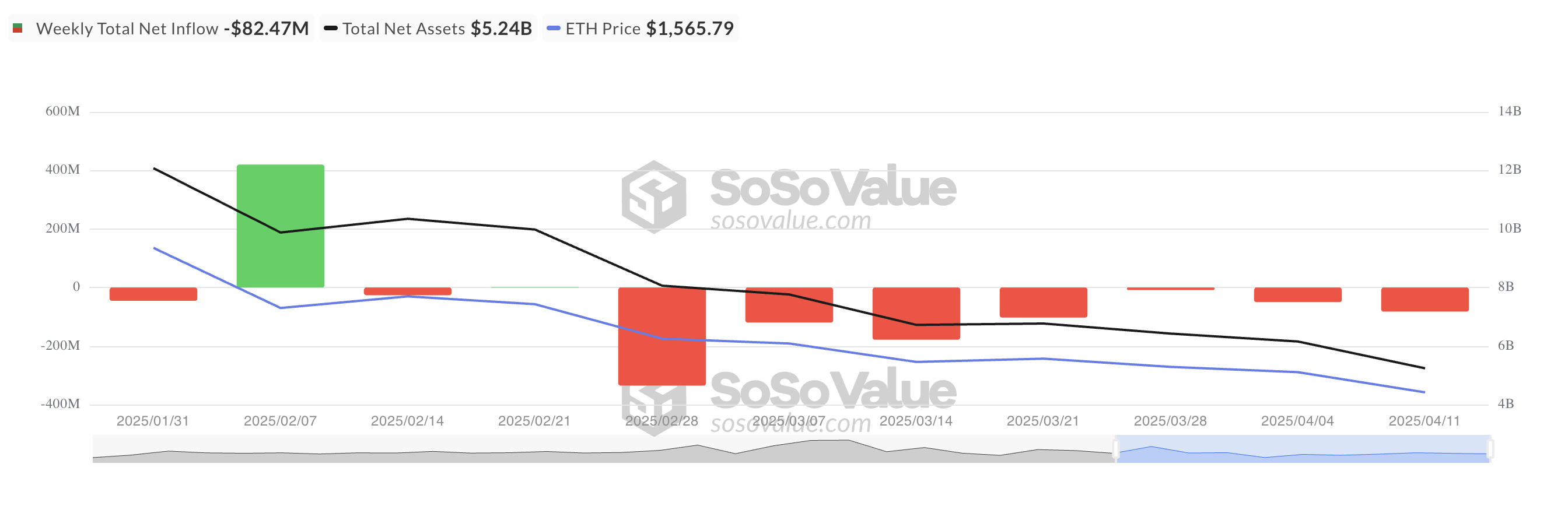

In particular, there has not been a single week of net entries since the end of February, highlighting the decreasing institutional interest for products related to ETH.

FNB Ethereum face stable outings

The FNB supported by Ethereum recorded their seventh consecutive week of net outings, highlighting a sustained institutional hesitation towards the asset.

This week only this week, the net outings of the ETH ETH ETH totaled $ 82.47 million, marking an increase of 39% compared to the $ 49 million recorded the outings the previous week.

With the constant drop in institutional presence on the ETH market, the sales pressure on the medal has soaked.

During last week, ETH’s price decreased by 11%. The stable outputs of the funds supported by the medal suggest that the downward momentum may persist, increasing the probability of a price drop below the bar of $ 1,500.

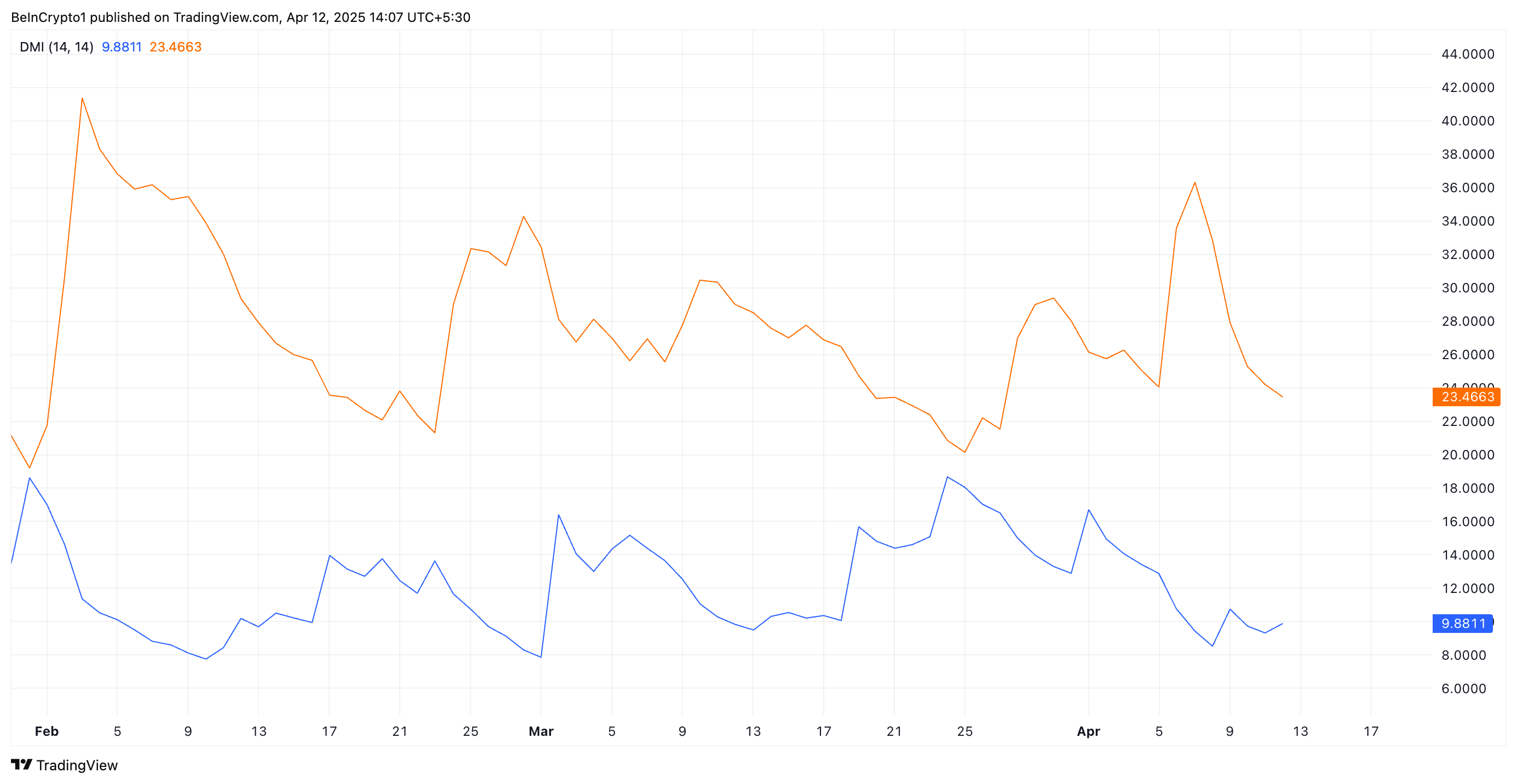

On the price table, the technical indicators remain downsides, confirming the mounting pressure on the market sale side. For example, at the time of the press, the readings of the directional movement index of ETH (DMI) show its positive directional index (+ DI) resting below the negative directional index (-DI).

The DMI indicator measures the price of the price trend of an asset. It consists of two lines: the + DI, which represents the movement of prices upwards, and the -Di, which represents the movement of prices downwards.

As for ETH, when the + DI rests under -DI, the market is in a downward trend, with a downward price movement dominating the feeling of the market.

Ethereum’s price could drop below $ 1,500

The absence of institutional capital could delay any significant rebound in the price of the ETH, which has attenuated the short -term recovery prospects. If demand is looking further, ETH could get out of its narrow range and follow a downward trend.

Altcoin could fall below $ 1,500 in this scenario to reach $ 1,395.

However, if the ETH testifies to a positive change in feeling and peaks of demand, its price could increase to $ 2,114.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.