Ethereum (ETH) Might Test $1,700

Ethereum (ETH) faces a clear correction, lowering 11% in last week when the lower time continues to dominate. The relative resistance index (RSI) remains low, showing a lack of high purchase pressure, while the direction of directional movement (DMI) confirms that the sellers still control.

In addition, exponential mobile averages (EMA) are in a firmly lower structure, suggesting that ETH could soon test the critical support levels at $ 1,756 and potentially fall below $ 1,700 for the first time since October 2023.

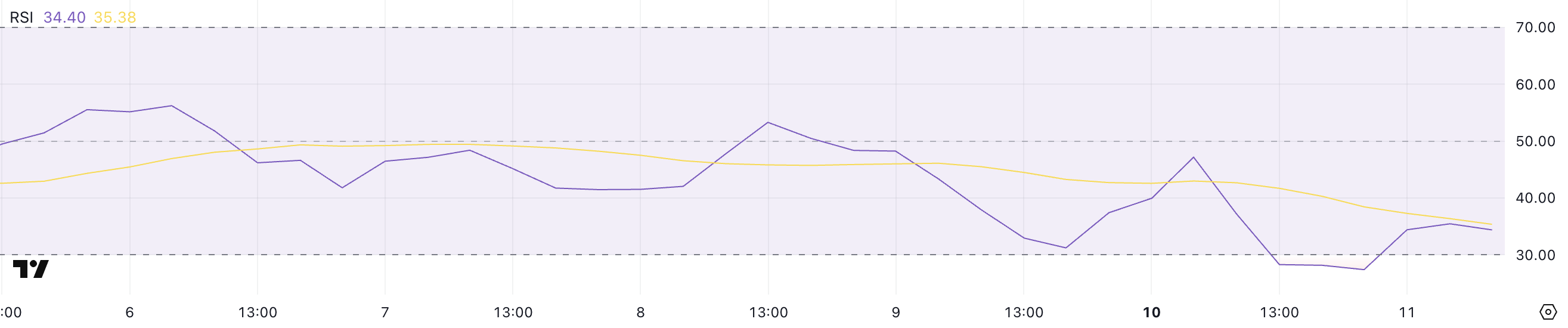

ETH RSI shows the lack of purchase pressure

The relative resistance index of Ethereum (RSI) is currently at 34.4, recovering slightly after having briefly plunged at 27.4 yesterday. The RSI remained below the brand 50 for three consecutive days, indicating that the lower momentum is still dominant.

The RSI measures the speed and extent of recent price changes to assess whether an asset is exaggerated or occurred.

As a general rule, an RSI greater than 70 indicates excessive conditions, suggesting a potential for a decline, while a RSI less than 30 signals has exceeded the conditions, which implies that the sales pressure can be overexteent and a rebound could be imminent.

With RSI of Eth now at 34.4, he suggests that if the asset is still in lowering territory, the extreme sale pressure observed yesterday has released slightly.

The brief decreases below 30 reported an occurrence condition, which often leads to short -term rallies. However, for the ETH to take up an upward impulse, the RSI should go up above 50, indicating a change in feeling of the market.

Until then, any ascending movement could face resistance, and the wider trend remains low unless the sustained purchase pressure grows ETH out of this lower area.

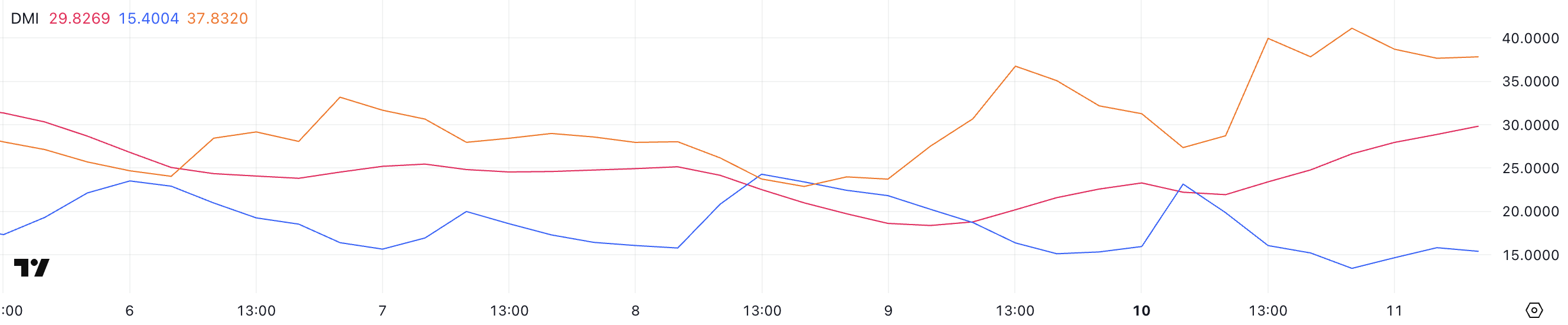

Ethereum DMI shows that the current downward trend is strong

The graph of the Directional Movement Index (DMI) of Ethereum shows that its average directional index (ADX) is currently at 29.82, going from 21.9 yesterday.

The ADX measures the strength of a trend, with values above 25 indicating a strong trend and readings below 20 suggesting a weak or non -existent trend. Given the net increase in the ADX, he confirms that the lowered trend of the ETH is strengthening.

The + DI (positive directional index) fell to 15.4 from 23.1 in the last day, while the -Di (negative directional index) rose to 37.8 from 27.3, reinforcing the domination of sellers on the market.

With the -Di clearly above the + di, he indicates that the lowering momentum intensifies and the sellers continue to control the action of ETH prices.

The drop in + DI suggests that the purchase of pressure is weakening, which makes it more difficult for ETH to stage a recovery. Unless the + DI is starting to increase and meet above -DI, the price of the ETH is likely to stay under pressure.

Since the ADX approaches 30 years and climbing, the downward trend seems well established, and any gathering of short -term help can face strong resistance before a trend reversal can occur.

Ethereum is still in less than $ 2,000

The Ethereum Exponential Mobile Mobile lines (EMA) display a highly downward configuration, with short -term EMAs positioned below those in the long term.

This alignment confirms the continuation of the momentum, the ETH having dropped by more than 11% in the last 24 hours. If the current trend persists, the ETH could test critical support at $ 1,756, a level that could determine if additional reductions are imminent.

A ventilation lower than this support would expose the price of Ethereum to a potential drop below $ 1,700, a level not seen since October 2023, further strengthening the lower feeling on the market.

However, if ETH manages to reverse its downward trend, the first resistance to the key to recovery would be $ 1,996. A successful escape above this level could trigger a stronger recovery, pushing the ETH to the next resistance at $ 2,320.

If the bullish momentum accelerates, Ethereum could extend the gains to $ 2,546, a level that will mark a complete change in trend structure.

For this to happen, ETH would need a sustained purchase pressure and an Ema Haussier crossover, reporting a transition outside its current lower phase.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.

![Egoras, Backed by Tekedia Capital: A Journey of Growth [video] Egoras, Backed by Tekedia Capital: A Journey of Growth [video]](https://i0.wp.com/tkcdn.tekedia.com/wp-content/uploads/2025/04/06092754/egoras-2.jpg?w=390&resize=390,220&ssl=1)