Ethereum (ETH) Poised for 15% Rally, Eyes on $2,200

Ethereum (ETH), the second largest cryptocurrency in the world by market capitalization, drew special attention from crypto enthusiasts. Today, the Lookonchain blockchain analysis platform has produced several articles on X (formerly Twitter), revealing that a whale liquidated 160,234 ETH worth $ 306.85 million.

Crypto Insider liquidated $ 306 million for ETH

However, the level of purchase of this substantial Ethnut hold was around $ 1,900, with a liquidation level of $ 1,805. As the price fell below the level of liquidation, the position of $ 306.85 million in the whale was liquidated.

At the time of the press, ETH is negotiated nearly $ 1,908, having recorded a price wave of more than 0.50% in the last 24 hours. However, during the same period, its volume of negotiation fell by 35%, which indicates a lower participation of traders and investors, potentially due to the continuous uncertainty of the market and significant price fluctuations.

Technical analysis of Ethereum (ETH) and upcoming levels

According to an expert technical analysis, the ETH seems bullied because it has resumed the momentum above the level of $ 1,900. Historically, this level acted as a strong price reversal area and a key area where assets are purchasing purchase.

Based on the action of recent prices and historical models, if ETH retains the level of $ 1,800, it could increase by 15% to reach $ 2,200 in the coming days or even more. At the time of the press, the relative resistance index of the asset (RSI) signals a potential price reversal, because it formed a higher top while the ETH was a low low.

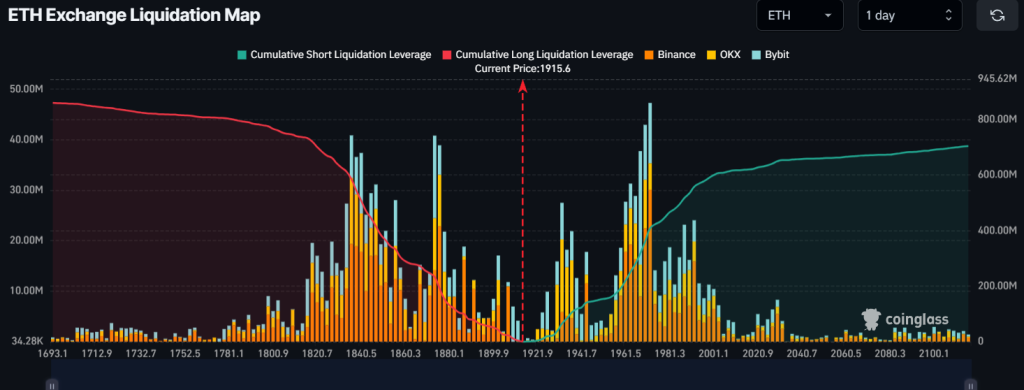

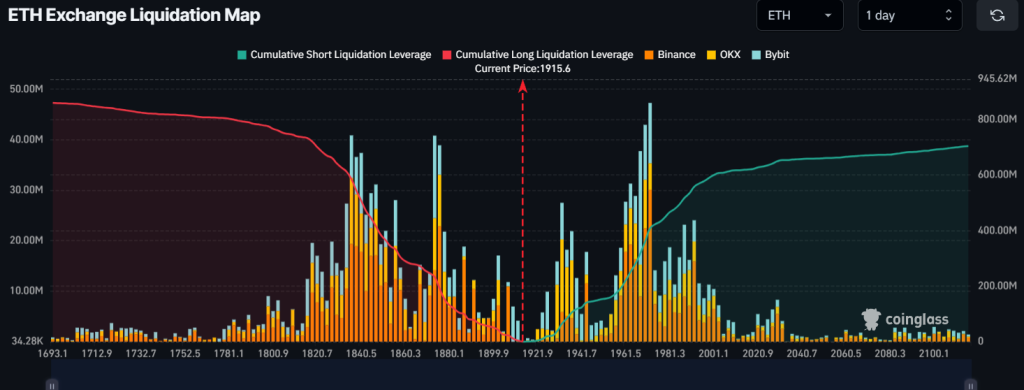

Major liquidation level

At the time of the press, the main levels of liquidation are nearly $ 1,835 on the lower side and $ 1,970 on the upper side, the traders being over-presented to these levels, as indicated by the Coinglass chain analysis company.

The data also reveals that the traders have $ 585 million in long positions, while in terms of $ 1,970, they hold $ 410 million in short positions, indicating that the bulls strongly dominate the assets and could help it maintain the level of crucial support of $ 1,800.