Ethereum Leads Q1 2025 DApp Fees With $1.02 Billion

In the first quarter of 2025, Ethereum solidified its main position in the decentralized demand platform sector (DAPP), generating $ 1.021 billion in costs.

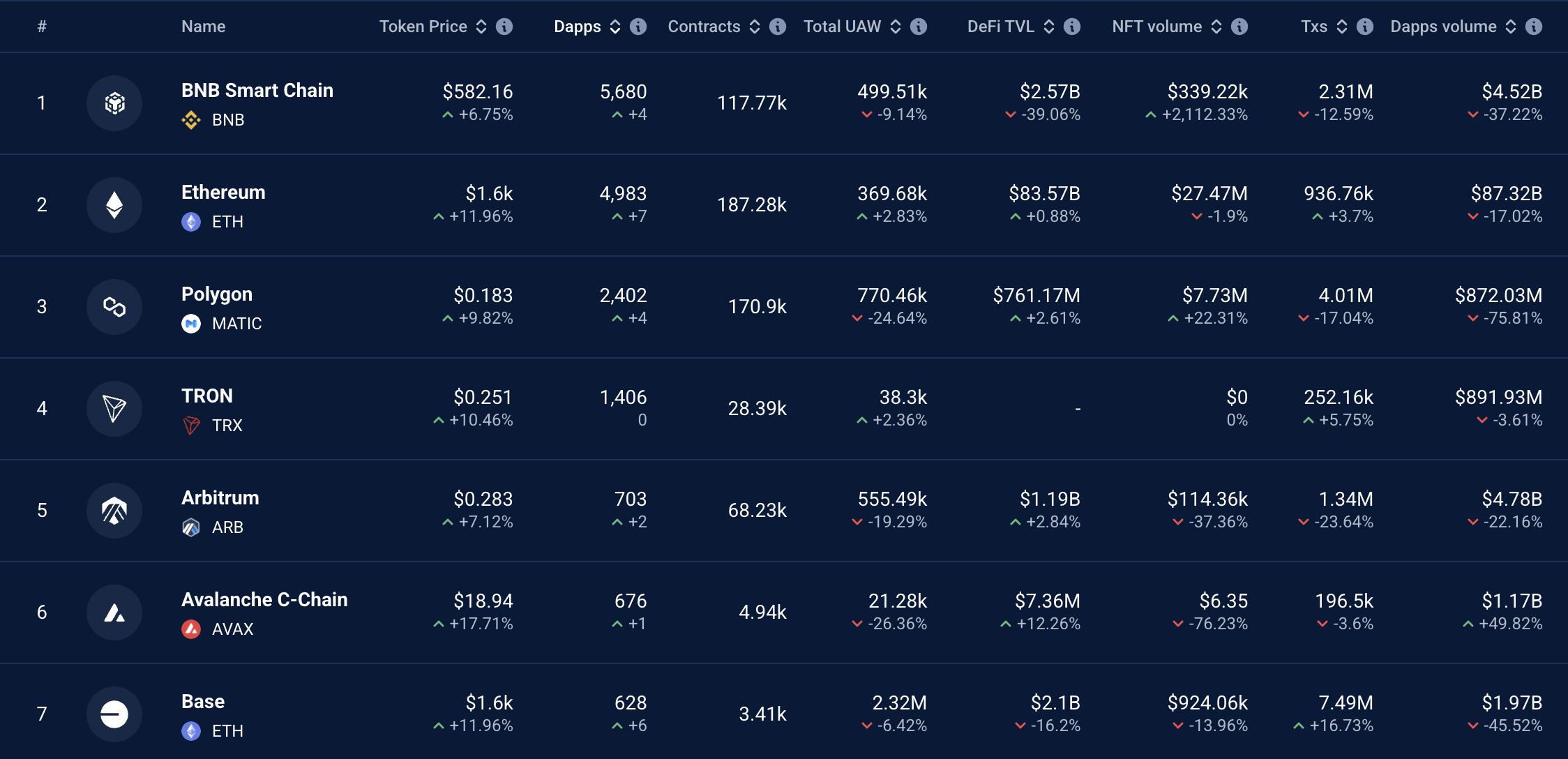

Other networks such as base (Coinbase’s Layer-2), BNB Chain, Arbitrum and Avalanche C-Chain also recorded significant income but were far behind Ethereum.

Landscape of income for blockchains

According to Token Terminal, Ethereum has maintained its highest position among DAPP platforms, DAPP costs revenues reaching $ 1.021 billion in the first quarter of 2025. This figure highlights the domination and strong growth of Ethereum within the DAPP ecosystem.

Base, a Coinbase Layer-2 network, ranked second with $ 193 million in DAPP costs, showing notable growth but still behind Ethereum. The BNB channel followed in third dollars in third, Arbitrum with $ 73.8 million and C-Chain Avalanche in fifth with $ 27.68 million.

DAPP costs are a key measure to measure the user’s activity and value of a blockchain. On Ethereum, popular DAPPs include protocols DEFI like Uniswap and Aave, NFT platforms like Opensea, Blockchain Games and Social Applications. The growth in income for DAPPs in Ethereum indicates strong demand sustained for these requests despite competition from other networks and often high transaction costs (gas costs) on the principal.

Why Ethereum leads

Several factors explain the continuous leadership of Ethereum in the income of DAPP fees. First, Ethereum was the first blockchain to support intelligent contracts, laying the foundations for his DAPP ecosystem. According to Dappradar data, Ethereum remains the blockchain with the largest DAPPs, hosting more than 4,983 DAPP active, under the BNB channel.

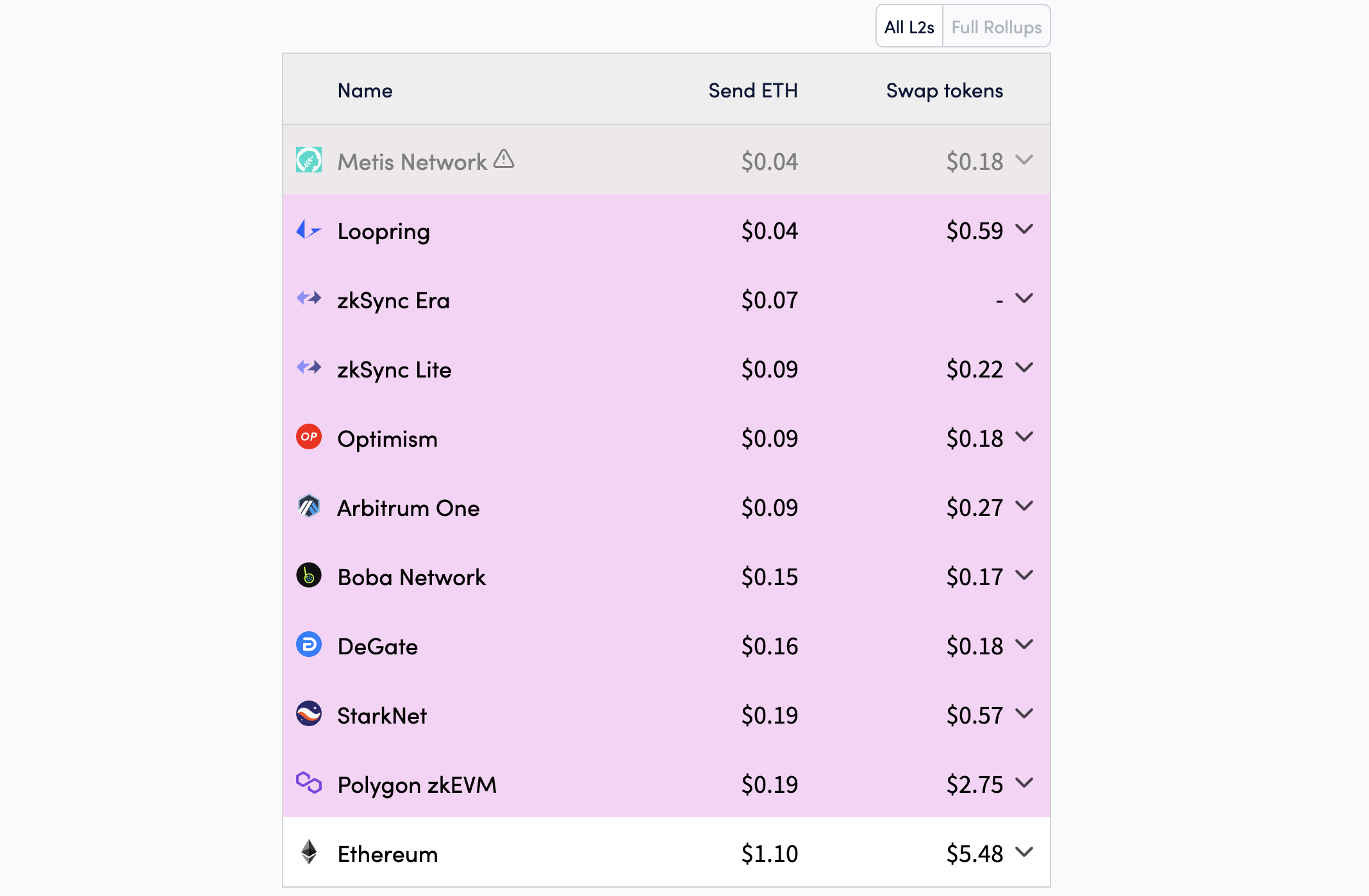

Secondly, Ethereum’s high security and reliability make it the favorite choice for developers and users. Despite the main high transaction costs, Ethereum has improved performance thanks to upgrades like Dencun (implemented in 2024), which reduced costs on layer 2 networks and improved scalability.

Third, Ethereum’s DEFI ecosystem remains the main engine of costs. According to Defillama, the total locked value (TVL) in Ethereum DEFI protocols reached $ 46 billion, which represents 51% of the total TVL on the DEFI market.

While Ethereum directs, other networks also have significant growth. According to Token Terminal, base, Coinbase’s Layer-2, generated $ 193 million in DAPP fees, an increase of 45% compared to the fourth quarter of 2024.

The BNB channel, with $ 170 million, remains a solid competitor due to low costs and a diversified DAPP ecosystem, including platforms like Pancakeswap. Arbitrum, another layer 2 Ethereum, recorded $ 73.8 million, driven by the expansion of DAPPS DEFI and Blockchain. With $ 27.68 million, Avalanche C-Chain excels in finance and NFTS but cannot correspond to the Ethereum scale.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.