Ethereum Price Analysis Today: key Short-term Targets for ETH to Consider Ahead

The analysis of post-andereum prices today: short-term key objectives for ETH to consider in advance appeared first on Coinpedia Fintech News

- The data on the chain show that the whales have accumulated the ether tirelessly in the past few days.

- The price of the ETH must constantly close above $ 1,687 in the coming days to invalidate the correction of several weeks.

- Ethereum continued to bleed in Solana, and the trend should continue in the coming months.

Ethereum (ETH) Price followed Bitcoin (BTC) from a bullish perspective on Tuesday, April 22, ending a market correction of several weeks. Large capitalization Altcoin, with an entirely diluted assessment of around 205 billion dollars, recorded a 36% increase in its average negotiation volume of 24 hours to oscillate around $ 20 billion at the time of writing this.

For the first time since April 6, Ether’s prize rallied beyond $ 1.7,000 Tuesday during the American world session.

Ethereum Whales gradually returns

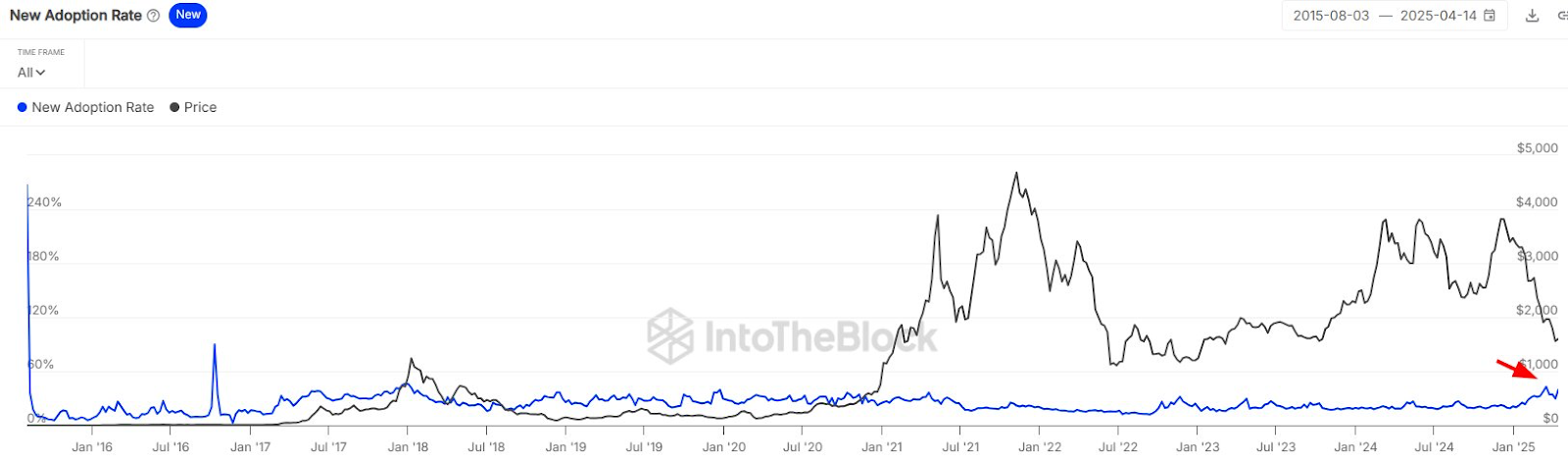

According to intotheblock market data, Ethereum’s adoption rate has gradually increased, signaling the potential decoupling of mad speculation. The growing tokenization of active world assets (RWAS) on the Ethereum network has contributed to increasing activity on the chain and attracting more whale merchants.

Lookonchain’s chain data show that a whale investor has accumulated 48,477 ETH in crypto exchanges since February 15 and is currently seated with a loss of around $ 21 million. Meanwhile, the cash flow of the FNB of American points have decreased considerably in recent days, reporting growing market confidence.

Mid-term price objective

For the first time since the second inauguration of American president Donald Trump, Ether Price, against the US dollar pierced by the daily fall of the logarithmic trend. After establishing a robust level of support above $ 1,500 in the last two weeks, Ether’s price is well prepared for a reversal of the market.

From the point of view of technical analysis, the daily MacD indicator approaches the optimistic flipped area. Meanwhile, the daily relative force index (RSI) has formed a bullish divergence and a reversal will be confirmed if the indicator systematically firm above the 50%level.