Ethereum Price Could Rally 40% If This Key Ratio Holds

Ethereum shows signs of force through chain and technical indicators, with conditions now resembling those seen just before its last summit of all time in 2021.

While Eth Price currently oscillates around $ 3,753, a sharp drop in the activity of long -term holders and an increase in the force of Ethereum against Bitcoin pave the way to a potential escape of 40% in the coming weeks.

Eth dormant remains silent while institutions buy aggressively

In the past two weeks, the age of Ethereum has consumed metrics collapsed with an increase of 795 million on July 10 to only 12.47 million today; A drop of more than 98%. This metric follows the quantity of eth eth which is moved by old wallets which have not transformed for a long time.

When it falls strongly, this generally means that long -term holders hold their parts, not sold them in gatherings.

In simple terms, Ethereum makes new local heights, and the oldest holders do not flash. It is a strong signal of conviction for the price of ETH; The type of behavior you do not generally see near the markets on the market.

Consumed of age measures the amount of eth in sleep, the parts that have not been moved for a long time, suddenly become active, often used to follow if long -term holders come out or hold hard.

At the same time, institutional accumulation warms up. One of the remarkable examples is Sharplink Gaming, who added 19,084 ETH to his reserves in a single decision, worth more than $ 67.5 million.

Combined with previous purchases, Sharplink holds 345,158 ETH, at the time of the press, worth more than $ 1.22 billion. Thus, while the elderly elderly does not move, major buyers are quietly responsible.

The ETH / BTC ratio repeats its configuration of all time

Since June 2025, the ETH / BTC ratio has increased from 0.021 to 0.031, marking a movement of 50% in the force of Ethereum against Bitcoin. The current price of Ethereum of $ 3,753 is also almost identical to the place where it was in October 2021, just before the ratio climbed 30% over five weeks; A decision that brought the price of the ETH at its top of $ 4,878.

At the time, a ratio of 30% (ETH / BTC) coincided with the increase in ETH from $ 3,800 to $ 4,870, a price gain of almost 28%. If the ratio now follows this same path compared to its current level, a similar movement of 28% of $ 3,753 would put Ethereum almost $ 4,800 to $ 4,900, aligning almost exactly with the previous ATH rupture zone.

And if the level of psychological resistance (the highest of all time) is broken, there may not be a lot of resistance at the level of key price discovery above $ 5,000.

The ETH / BTC ratio follows how Ethereum works compared to Bitcoin and often signals when the ETH wins market share before large rallies. Meanwhile, ETH / BTC has already increased by more than 50% since June and continues to flash a large impetus via multiser Multi-EAMS.

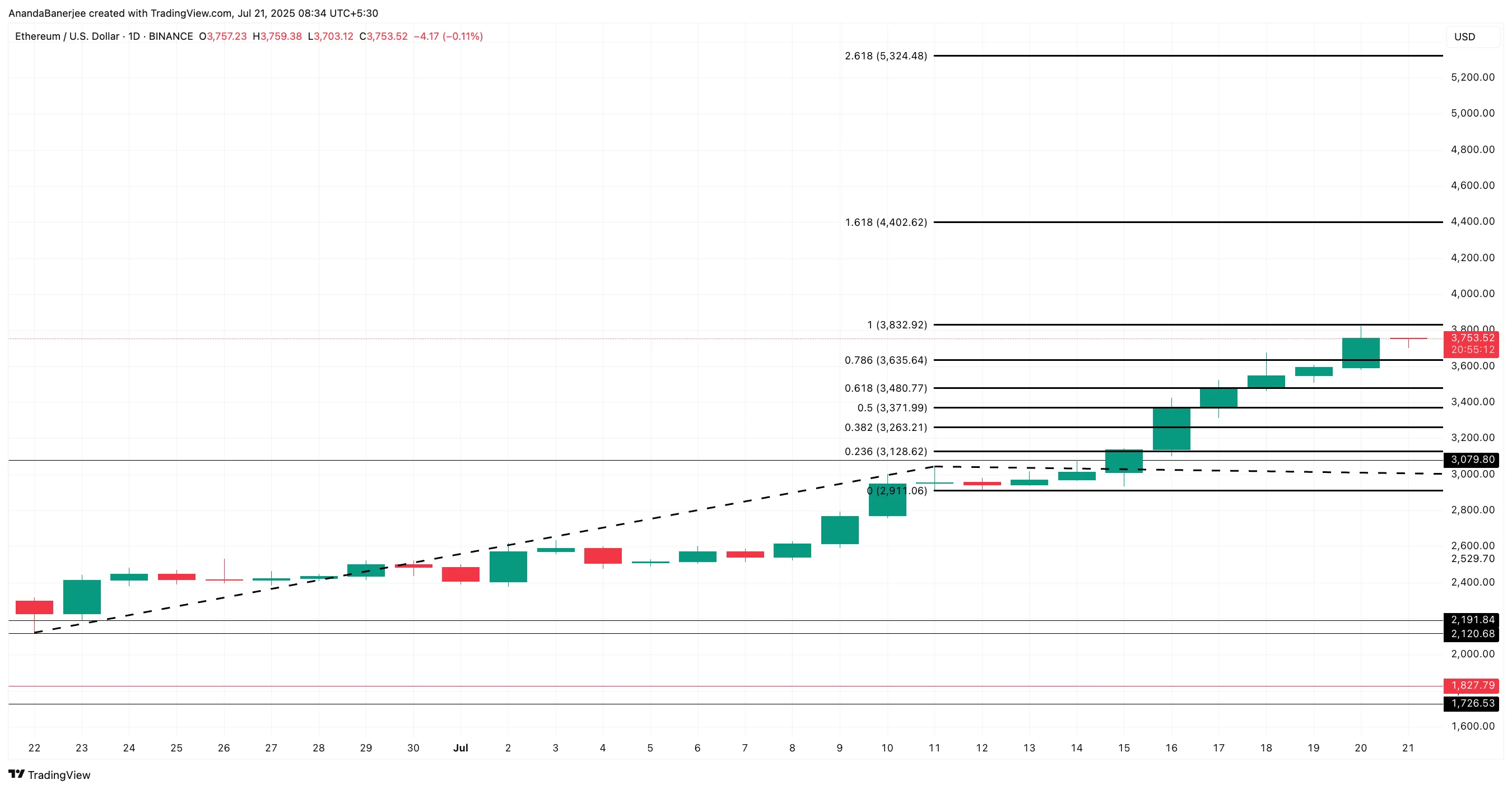

The Ethereum price structure projects a 40% rally

The action of Ethereum prices follows a familiar roadmap, now moving in tandem with a chain conviction and relative force against bitcoin. After recovering a resistance from the keys close to $ 3,635 (0.786 FIB level), the asset consolidates a little less in the $ 3,832 area. From there, the top of all previous time serves as a psychological barrier.

But first, the ETH price must exceed $ 4,402 – the next resistance of the keys.

In 2021, Ethereum joined almost 28% of the same area that the ETH / BTC ratio climbed 30% in just over five weeks. Based on the current levels, a similar decision of $ 3,753 would again put Ethereum near its current level.

But this time, with inactive long-term holders and the ETH which acquires, there is a clear case so that the price discovery extends beyond this brand. If the previous summit is broken with conviction, the structure suggests a continuation to $ 5,324, which represents a movement of 41.86% of the current price.

However, a ventilation of less than $ 3,128 would invalidate this structure and suggest that the rally has not succeeded, which makes it the key support level to monitor.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.