Ethereum Price Dips Again as Bearish Momentum Builds

Ethereum (ETH) is down almost 9% in the last seven days and continues to negotiate below the $ 3,000 mark – a level that he has not recovered since February 1. Recent technical indicators suggest that the lowering momentum is built, with a weakening of the trend resistance and an intensification of pressure.

The oscillators of momentum as the RSI have greatly fell, while the key resistance levels continue to hold firmly against the upward attempts. While the ETH is struggling to regain the ground, the merchants are watching closely to see if the support levels will be held or if the additional decline is imminent.

Ethereum has taken up maximum as the strength of trends fades

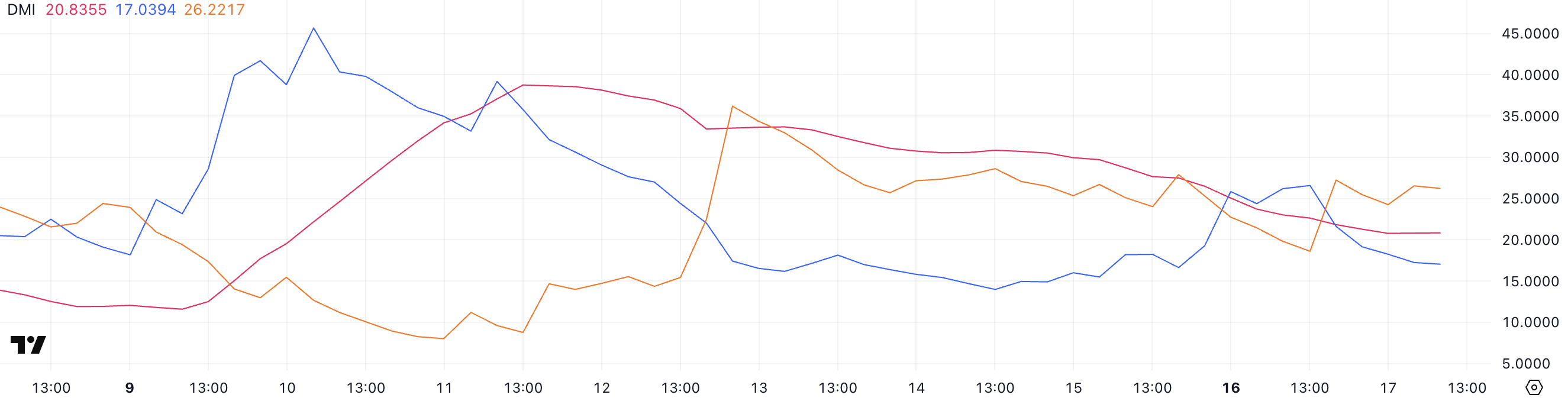

The Directional movement index of Ethereum (DMI) shows that its ADX fell to 20.83 from 27.64 two days ago, stressing to weaken the strength of the trends.

ADX, or average directional index, measures the strength of a trend, whether up or down. The values above 25 generally indicate a strong trend, while the values below 20 suggest a low or undecided market.

The ADX of ETH now oscillates near the lower border, it suggests that the recent directional momentum is discoloning and that the market could enter a period of lateral or indecision movement.

Looking at the directional indicators, the + Di d’Ethereum fell to 17 of 26.57 yesterday, after a brief leap of 16.62 two days ago. This indicates that the upward pressure quickly cooled.

Meanwhile, the -DI increased to 26.22 from 18.60, indicating a growing downward dynamic. This divergence between the drop + DI and the rise up suggests that the sellers gain the upper hand, potentially pushing the ETH into a short -term trend.

Combined with the weakening of the ADX, the current configuration indicates an increase in risk down unless the bulls regain control soon.

ETH faces the pressure after a clear RSI reversal

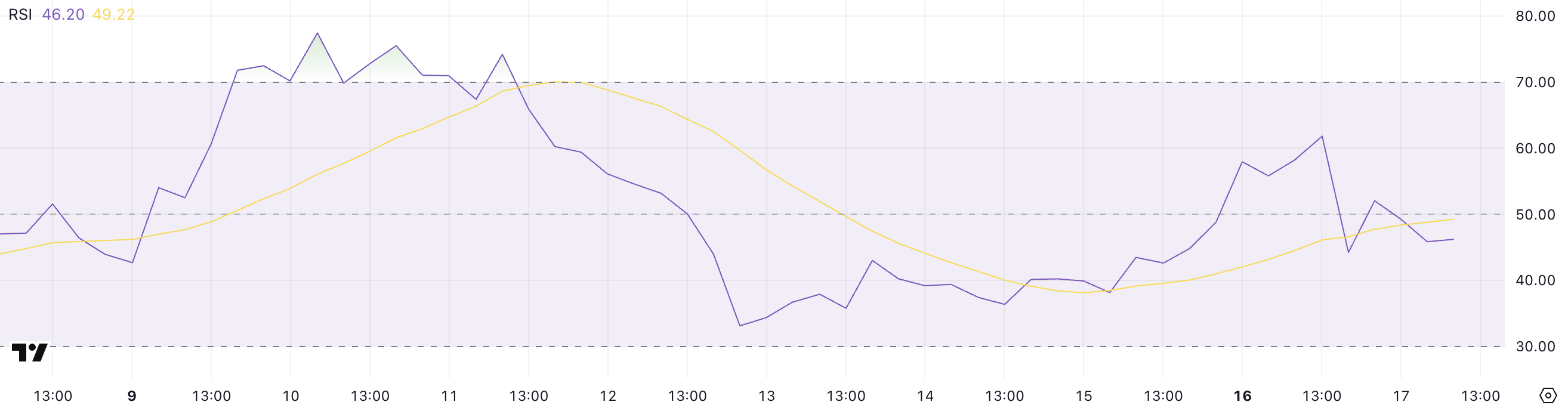

Ethereum’s relative force index (RSI) fell to 46.2, down 61.82 yesterday, after having drew 38.14 two days ago.

The RSI is a Momentum oscillator which measures the speed and extent of recent price changes to assess the conditions of overchat or occurrence.

The values above 70 generally indicate an exaggerated asset which may be due to a decline, while the readings less than 30 suggest occurring conditions which could precede a rebound.

The neutral area is between 30 and 70, where prices are generally considered balanced or consolidating.

The Ethereum RSI is now at 46.2, falling into a neutral territory after briefly closing the excessive area.

This drop indicates the discoloration of the bullish momentum and can suggest that the recent purchase interest has weakened. Although reading around 46 does not point out an immediate trend reversal, it reflects uncertainty and could open the door downwards if the sales pressure increases.

If the RSI continues to slide around 30, it could confirm that ETH enters a more pronounced bearish phase.

Ethereum fights below resistance like the Ema Bearish trend

The EMA (Exponential Mobile Mobile) lines) of Ethereum are currently indicating a downward trend, with Evil prices that find it difficult to resume momentum.

Recently, ETH tried to cross the level of resistance at $ 2,679 but failed, strengthening that the sellers remain in control. If the market tests and loses support for $ 2,479, more downwards could lead to ETH around $ 2,386, and potentially as low as $ 2,326 if the downwater pressure is intensifying.

These levels mark the key areas where buyers can intervene, but until then, the short-term structure remains downward.

However, a change of momentum could occur if Ethereum Reteste and successfully breaks the resistance of $ 2,679.

An escape above this level would be a strong signal of bullish intention, potentially triggering a movement around $ 2,790 and even $ 2,878 if the inversion of trends is installed. The EMA structure would then begin to flatten or curl up, signaling a renewed force.

Until it happens, the ETH remains vulnerable to additional losses, traders closely looking at how it reacts around the key support and resistance levels.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.