Ethereum Price Rallies 60% Following $3.4 Billion ETH Acquisition

Ethereum experienced a remarkable price increase, up 60% in the last month, reaching $ 2,543. This gathering is largely motivated by an important accumulation by investors, totaling 1.34 million Eth Eth worth more than $ 3.42 billion.

Despite growth, some critical investors are starting to go out, aimed at securing their profits before potential risks occur.

Ethereum Investors Gobble Up Supply

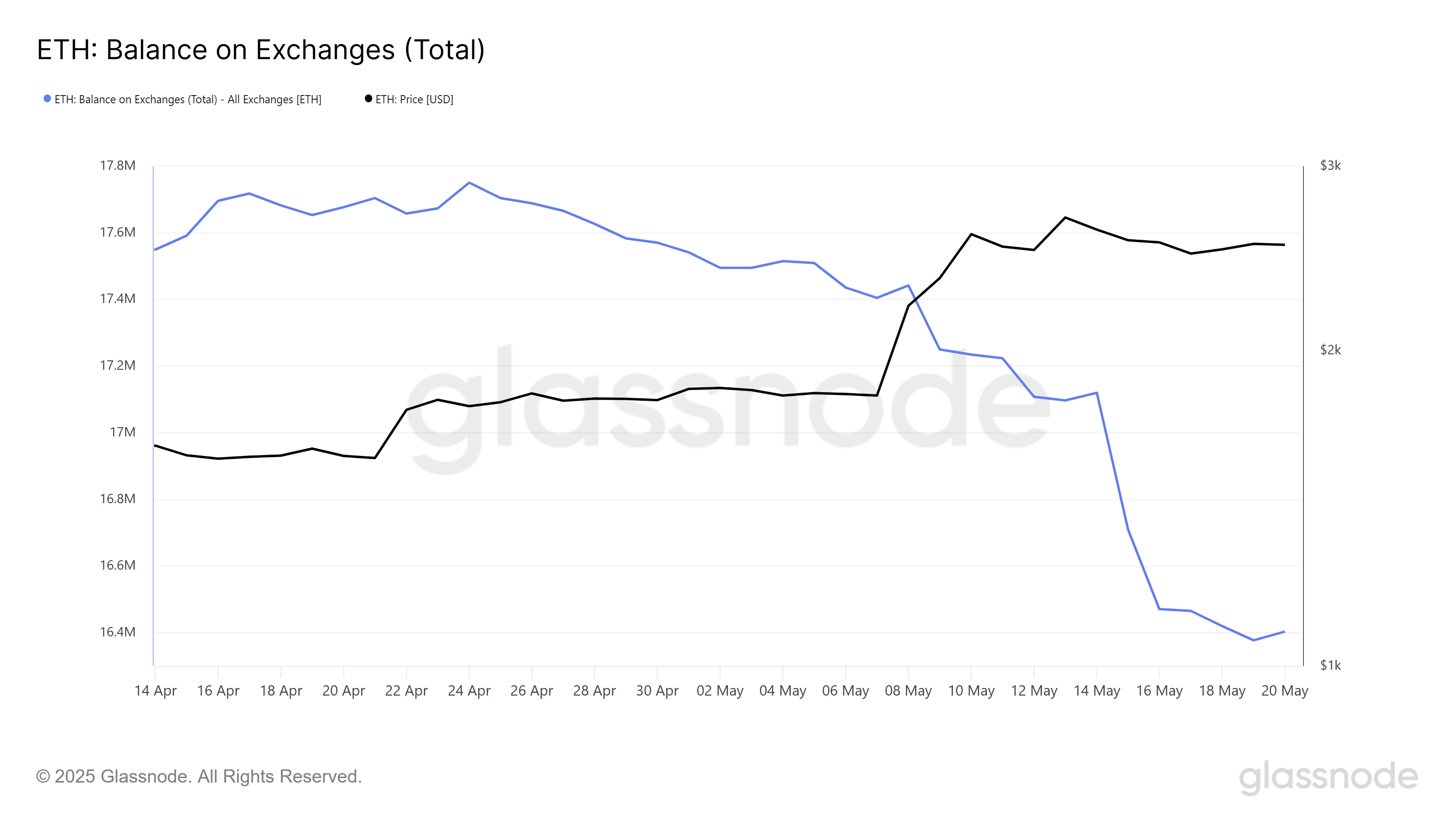

Ethereum’s balance on exchanges fell 1.34 million ETH last month (April 21 to May 21), marking a significant change in market conditions. This reduction in supply is estimated at more than $ 3.42 billion and is largely due to the upgrading of Pectra, which has strengthened investor confidence in long -term growth of Ethereum.

The drop in the exchange supply reflects an increasing belief that Ethereum could continue its upward trajectory. This precipitation to acquire Ethereum has created an FOMO effect (fear of missing), contributing to the rise in prices.

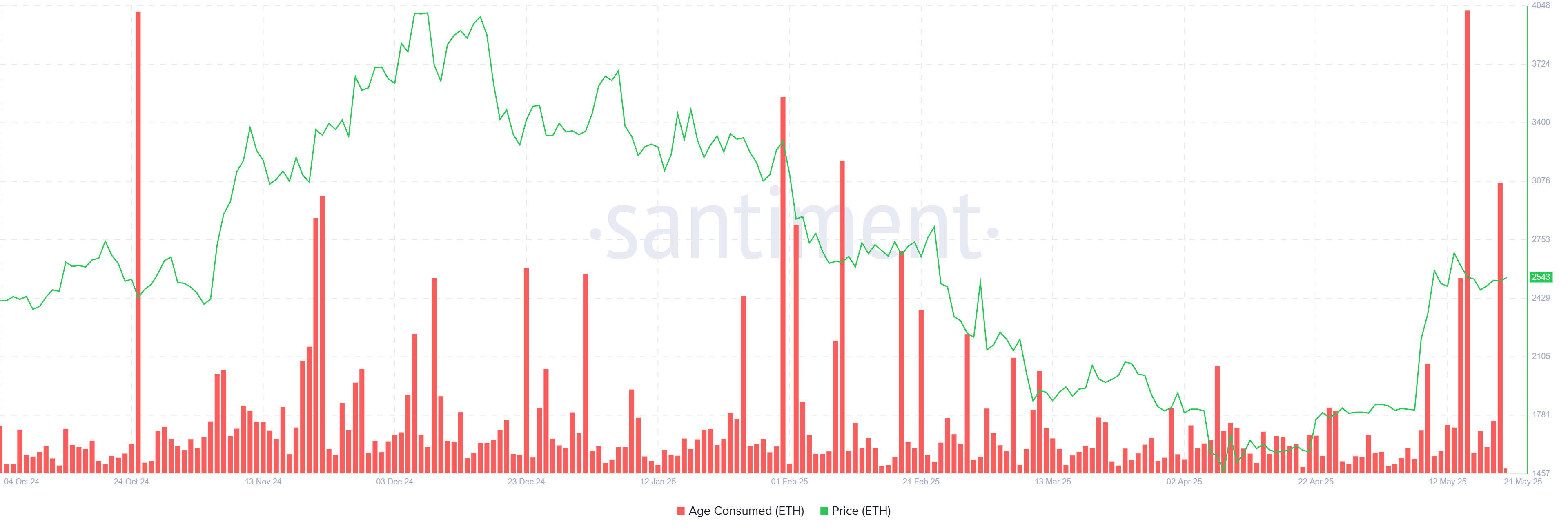

However, the macro-environment dynamic surrounding Ethereum is mixed, with long-term holders (LTH) with behavior that suggests caution. The metric consumed by age has increased twice this week, indicating that large parts of Ethics are sold by LTH to lock the profits.

This is the largest wave of sales in the past seven months, which suggests that these holders believe that Ethereum may have reached its top on the market. LTH sales draws attention to potential risks that could affect Ethereum’s future performance. If this tendency of profit is continuing, it could hinder the growth prospects of cryptocurrency.

ETH price rolling

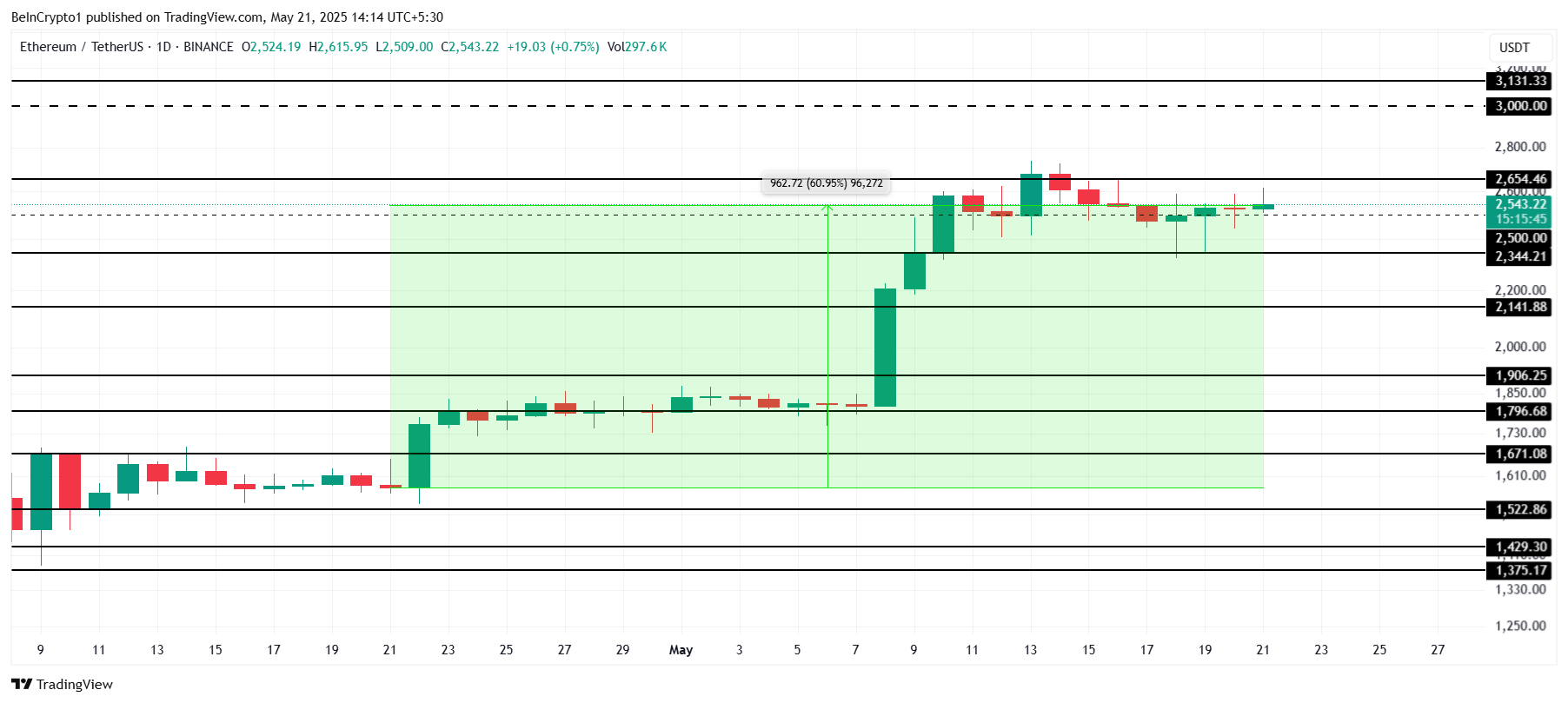

Ethereum Price is currently negotiating at $ 2,543, marking a 60% rally in last month. However, the price faces a resistance to the bar of $ 2,654. The violation of this resistance is crucial for Ethereum to continue its increase.

The price will probably exceed this level if Bitcoin constitutes a new summit of all time (ATH), Car Ethereum has a strong correlation with bitcoin. This decision could bring Ethereum closer to $ 3,000, further strengthening its upward perspectives. If the wider market remains positive, the price of Ethereum could see an in continuous rise.

However, the market has its risks. If the sale pressure of LTHs is intensifying and the accumulation phase stops, the price of Ethereum may have trouble maintaining its trajectory upwards. The loss of support for $ 2,344 would probably have a drop to $ 2,141, invalidating the current thesis and creating a lower perspective for cryptocurrency.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.