Ethereum Price Retests Crucial Support Level As Traders Fear Signal Potential Rebound Amid High Demand

Ethereum (ETH) price fell to retest a crucial support level above $3,700. The large-cap altcoin, with a fully diluted valuation of around $453 billion, fell 5% over the past 24 hours to trade at around $3,754 on Thursday in the middle of the North American session.

The decline in ETH’s price coincided with that of Bitcoin (BTC), which fell 4% to hover around $107.5K at press time. Following the sudden drop in the price of ETH today, over $218 million was liquidated from the Ethereum leveraged market, with the majority involving long traders.

Is Ethereum Price Ready for the New ATH?

Technical tailwinds amid weak market rebound signals bullish sentiment

From a technical analysis perspective, the ETH/USD pair retested a crucial support level around $3,700. Since the October 11 crypto crash, the ETH/USD pair has bounced from this support level three times, signaling a potential market reversal to come.

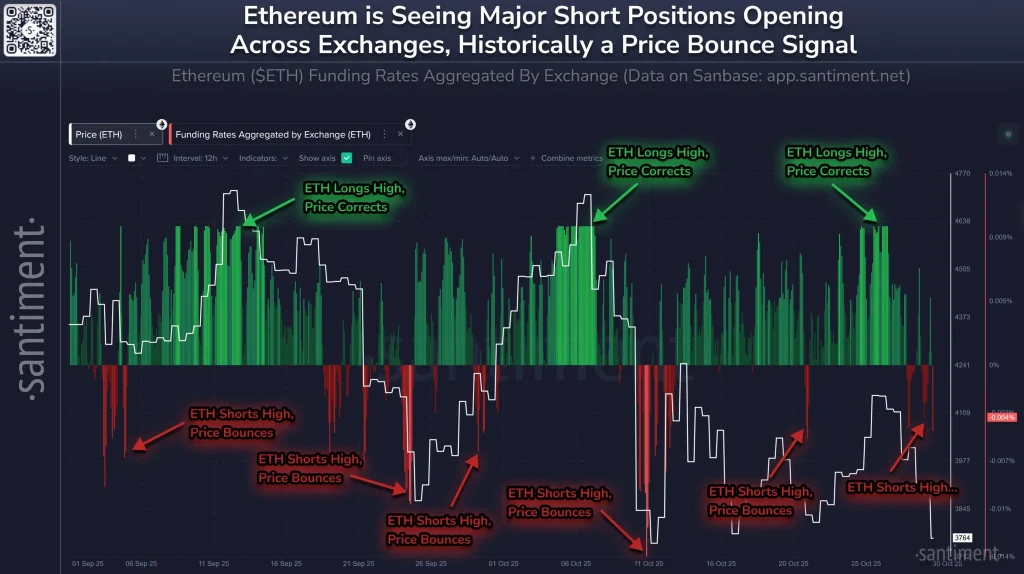

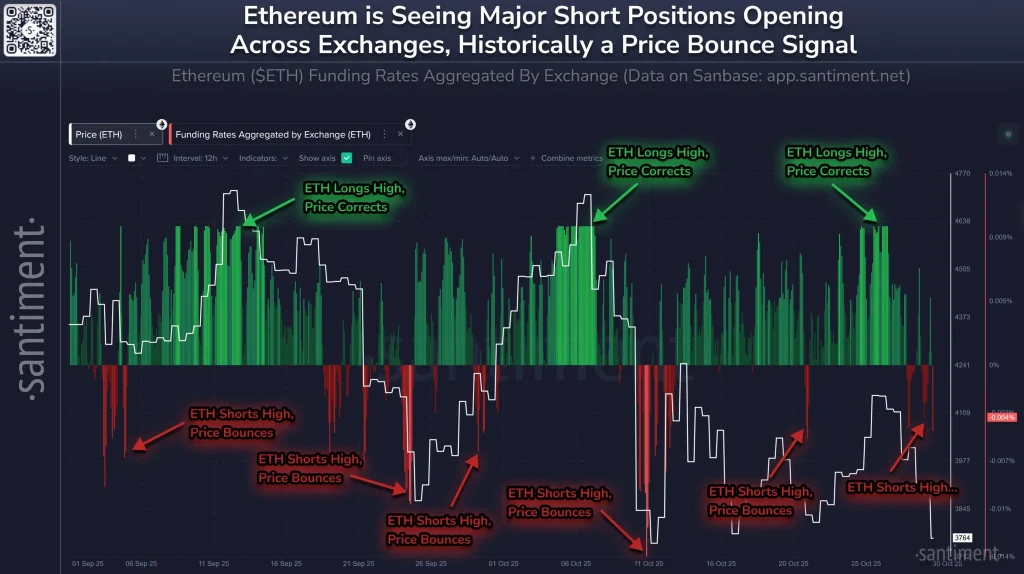

According to Santiment’s market data analysis, Ethereum has attracted a significant number of short positions, which historically coincides with a market reversal.

Bitcoin’s Continued Capital Rotation Bolsters Ether’s Bullish Outlook

The chances of Ethereum price hitting a new all-time high soon have been boosted by Bitcoin’s notable capital turnover. Notably, the ETH/BTC pair signaled a market reversal after years of a downtrend.

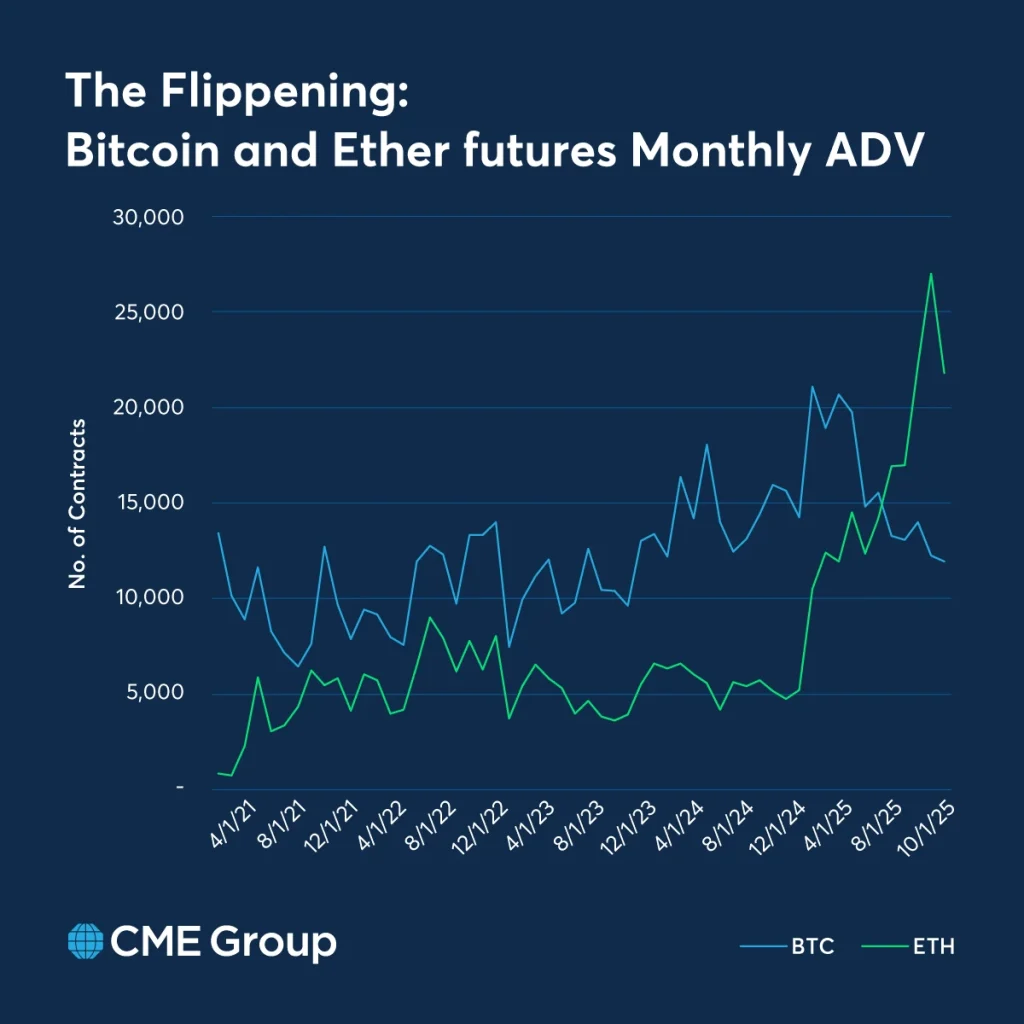

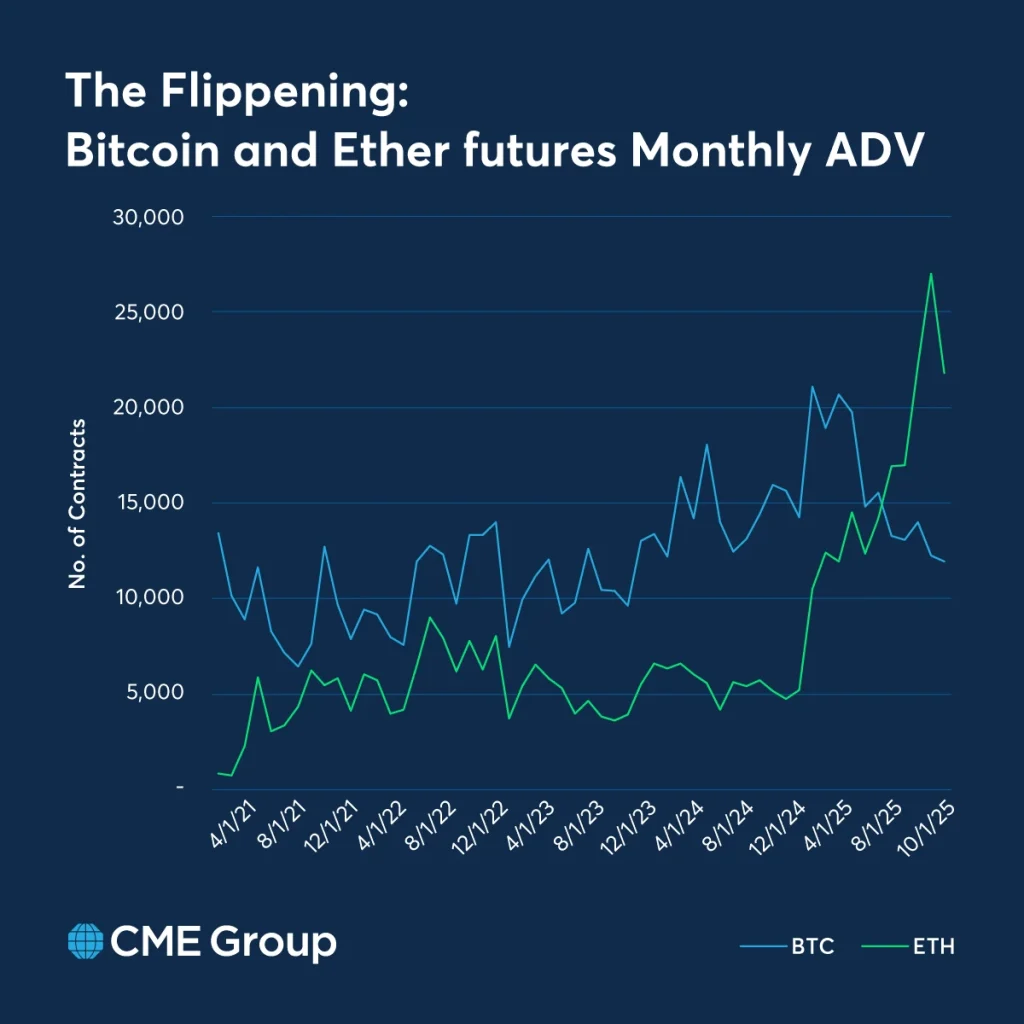

The notable capital rotation from Bitcoin to Ethereum is also observable through their futures market. According to market data from CME Group, the number of Ethereum futures contracts is significantly higher than that of Bitcoin.

As such, the ETH/USD pair is well positioned for further upside in the coming weeks, especially if the bulls hold above $3.7K.

Trust CoinPedia:

CoinPedia has been providing accurate and timely updates on cryptocurrencies and blockchain since 2017. All content is created by our expert panel of analysts and journalists, following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, Trustworthiness). Each article is checked against reputable sources to ensure accuracy, transparency and reliability. Our review policy ensures unbiased reviews when recommending exchanges, platforms or tools. We strive to provide timely updates on everything crypto and blockchain related, from startups to industry majors.

Investment Disclaimer:

All opinions and ideas shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the writer nor the publication takes responsibility for your financial choices.

Sponsored and advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are clearly marked and our editorial content remains entirely independent from our advertising partners.