Ethereum Price Risks Dropping Below $3,000 as Demand Declines

Leading altcoin Ethereum has defied the general market trend, recording a 2% price drop over the past 24 hours. This comes amid a continued decline in demand for the coin.

As buying pressure subsides, ETH is likely to fall below $3,000 soon. This analysis has the details.

Ethereum demand is running out of steam

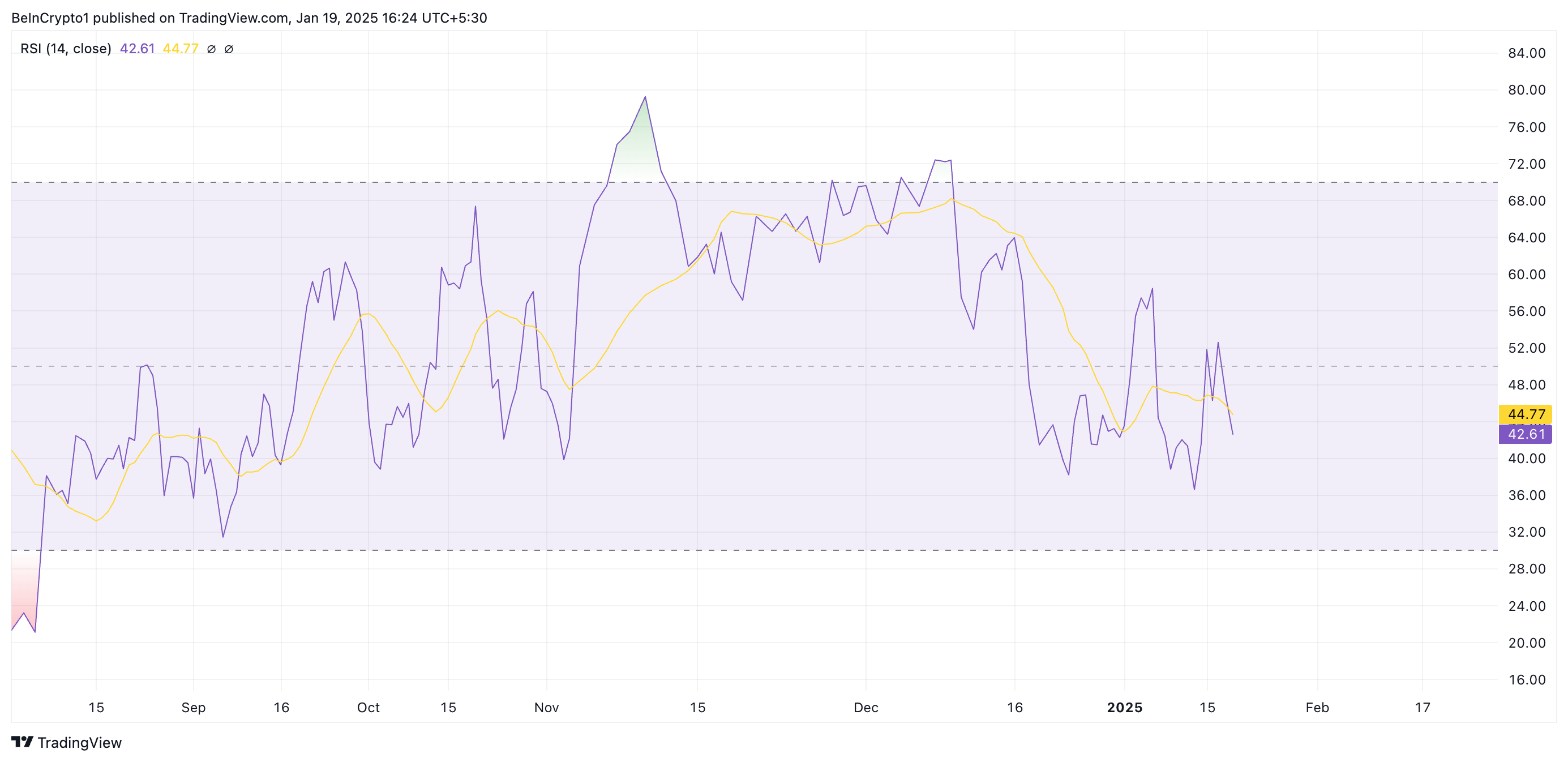

An assessment of ETH momentum indicators on the ETH/USD daily chart reveals the decline in demand for the altcoin. For example, its Relative Strength Index (RSI) is in a downtrend and below the neutral line 50. At the time of writing, its value is 42.61.

An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought, while values below 30 suggest that it is oversold.

ETH’s RSI pattern signals weakening momentum and suggests that the asset could lose buying interest, which could lead to further price declines.

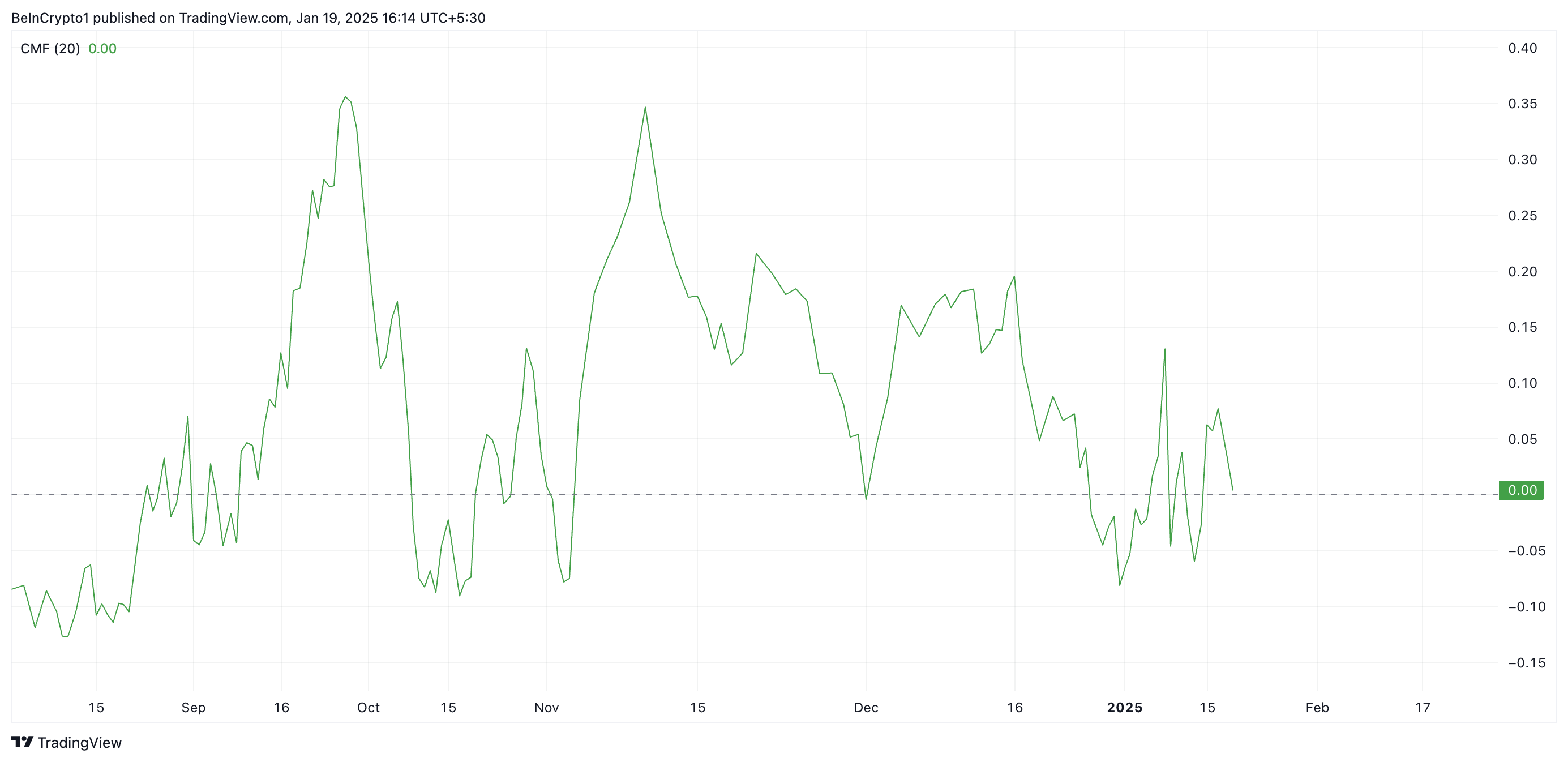

Additionally, at the time of writing, the coin’s Chaikin Money Flow (CMF) is about to fall below the zero line, confirming weakening demand for ETH.

The CMF indicator measures the amount of money flowing into or out of an asset over a specific period of time. When the CMF is about to fall below the zero line, selling pressure increases, indicating downside potential and possible price decline.

ETH Price Prediction: Drop to $2,811 or Rise to $3,476?

At press time, ETH is trading at $3,175, below the resistance formed at $3,249. With the buying pressure weakening, the coin price may fall below $3,000 to trade at $2,811 in the near term.

However, if market sentiment improves, it could push the ETH price above $3,249 towards $3,476.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.