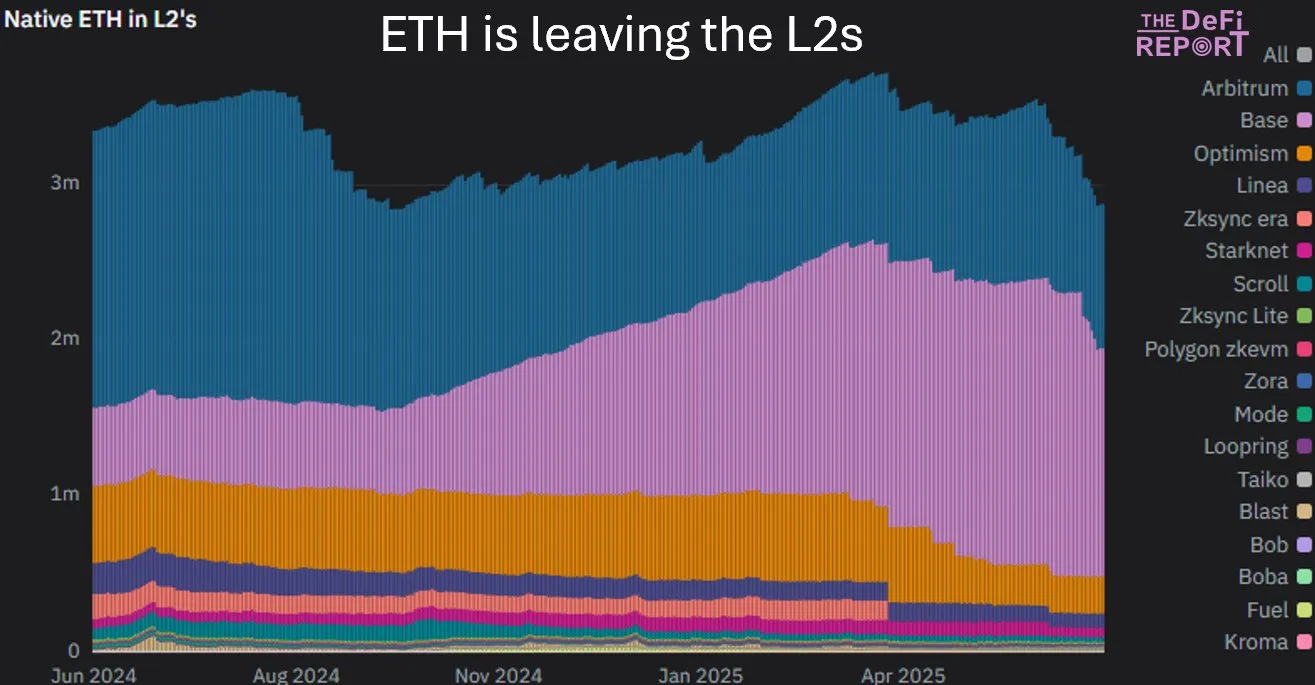

Ethereum Reserves Drop 25% on Layer 2 Networks

In recent months, Ethereum (ETH) reserves on layer 2 networks (L2) have dropped, the global ETH balance falling by around 25%.

The ETH on optimism has dropped up to 54% since March, while the arbitrum and the base experienced decreases of 17% and 14%, respectively.

What leads to this drop?

The Table of the DEFI report clearly illustrates this trend, in particular since the beginning of 2025, when the main L2 networks such as optimism and the base have experienced significant ethn withdrawals. According to analyzes, the weakening of prices of native tokens Ethereum L2 is a critical factor.

Easts such as optimism has dropped by more than 38% in the last 90 days. Meanwhile, Arb d’Arbitrum decreased by 21%. This slowdown has reduced the attraction of investors, encouraging them to move to other platforms.

At the same time, part of the ETH returns to Mainnet Ethereum, which is considered safer because of its high safety.

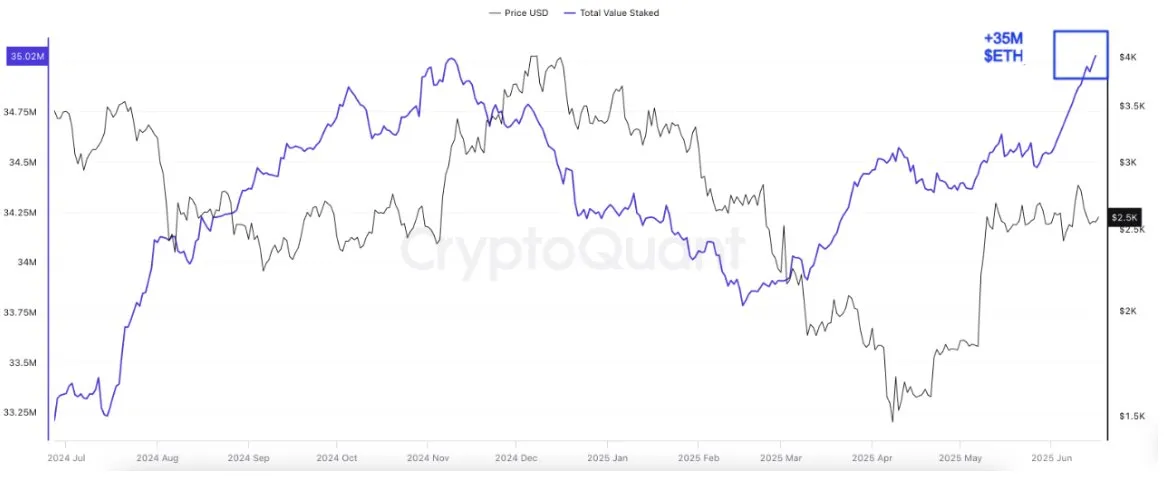

In addition, the amount of the ETH being marked out and the number of long -term detention addresses have reached new heights, which indicates that investors prioritize the value preservation strategies on trade on Ethereum L2.

Another potential factor is the movement of ethn of accumulation addresses. Crypttoque data indicates that large portfolios reaffect assets, increasing the sales pressure on L2.

The accumulation addresses (holders without a history of sales) have reached a summit of all time, now holding 22.8 million ETH. Many public companies also include ETH as a reserve asset.

“In the first half, more than June, more than 500,000 ETH were started, pushing the total amount locked at a new summit of more than 35 million ETH. This growth signals confidence and a continuous decrease in liquid supply,” said a cryptographic analyst.

Impact on Ethereum ecosystem

This decrease marks a change compared to 2024, when the L2 was considered a threat to Mainnet because of their ability to attract users and transaction costs. However, the opposite trend takes place now, the main recording of increased activity.

This could strengthen Ethereum’s position, in particular following the successful upgrade of Pectra last month, which improved performance and reduces costs. However, L2 as optimism and the basis must improve to regain confidence; Otherwise, they risk losing their critical role in scaling the network.

The departure of the ETH compared to the L2 can last until the success of the Pectra upgrade or the strategy adjustments of this month in the midst of the volatility of the market. However, to recover, L2S must focus on improving liquidity and reducing dependence on easily manipulated tokens.

Developers could consider implementing more transparent incentives while collaborating closely with centralized exchanges to stabilize capital flows.

In addition, the growth of the Spaking ETH – now counting almost 29% of the total supply – reflects long -term confidence in Ethereum. If the L2 fails to adapt quickly, they can lose their competitive advantage while the main solidifies its main position.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.