Ethereum Spot ETF Struggles as Outflows Top $370 Million

Ethereum faced major challenges this month. It has lost 10% of its value in the last 20 days and is currently negotiated at $ 2,021.

This drop in prolonged prices has shook the confidence of investors, leading to coherent capital outings from funds (ETF) negotiated on the Stock Exchange ETH since the beginning of March.

The confidence of investors in ETH penetrates like punctual ETFs bleed

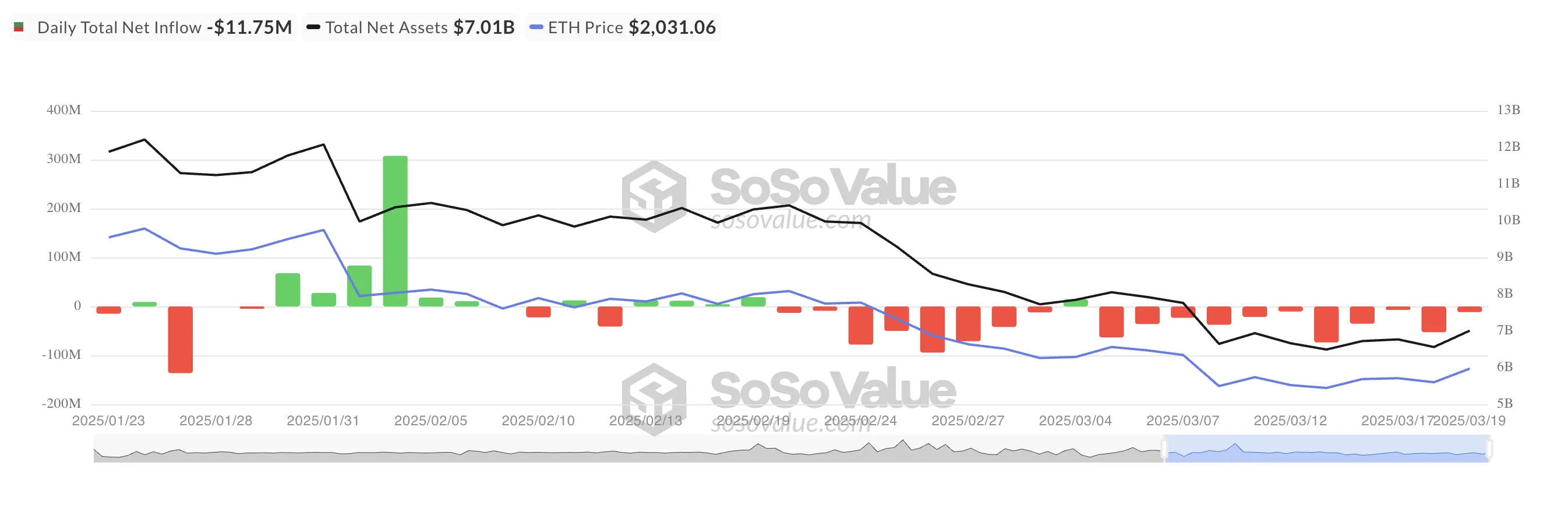

According to data on the Sosovalue chain, the ETH spot ETH have now recorded 11 consecutive days of outings, with total withdrawals exceeding $ 370 million.

The feeling of investors has remained extremely lower, with only one day of entries recorded this month. The total value of the net assets of all American spots currently amounts to $ 7.01 billion, diving 44% up to date.

When ETH Spot ETH experience net outings, investors withdraw more funds than they bring, reflecting the confidence in the price performance of the room. Supported outings are major indicators of investor’s lower feeling and can intensify the sale pressure on the price of ETH.

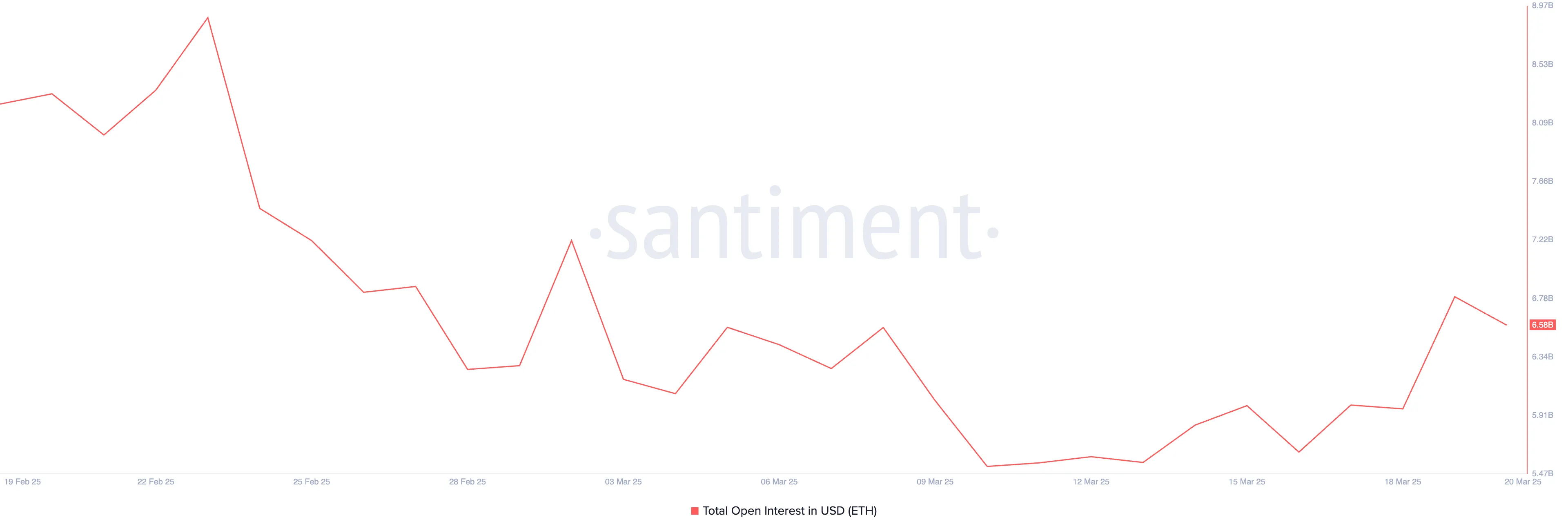

In addition, the decline of open interest (OI) of the medal reflects the decreasing request. At the time of the press, it is 6.58 billion dollars, down 20% in last month.

The OC of an asset measures the total number of derivative contracts in progress, such as future and options, which have not been settled. When it decreases, this indicates that traders firmly positions rather than opening new ones.

These signals have reduced market participation and weaken the momentum for ETH. He suggests uncertainty and lack of conviction in the Altcoin prices department, contributing to his decline.

Ethly recovery as MacD Golden Cross stretches the purchase pressure

In the midst of the broader recovery of the market last week, the divergence of Mobile ETH Mobile Convergence (MacD) formed a golden cross. Its macD (blue) line is now above its signal line (orange) on the daily graph as the bullish pressure begins to take momentum.

The MacD indicator measures the strength and management of the momentum of an asset. It helps traders to identify potential trend reversals and momentum changes. When a golden cross emerges, it suggests increasing the momentum up, often interpreted by traders as a purchase signal.

If the purchase of pressure is strengthened, ETH could reverse its current decline trend and climb $ 2,224.

Conversely, if the drop in prices persists, ETH could fall below $ 2,000 to negotiate $ 1,924.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.