Ethereum Staking Surges Despite Market Dip

The price of Ethereum remained under significant pressure during the last month, but the implementation activity increased.

Chain data show a significant increase in the amount of ethn locked in staunch contracts, even if Altcoin is struggling to resume momentum upwards.

Eth’s jealous is developing while ETF’s outings reach $ 524 million

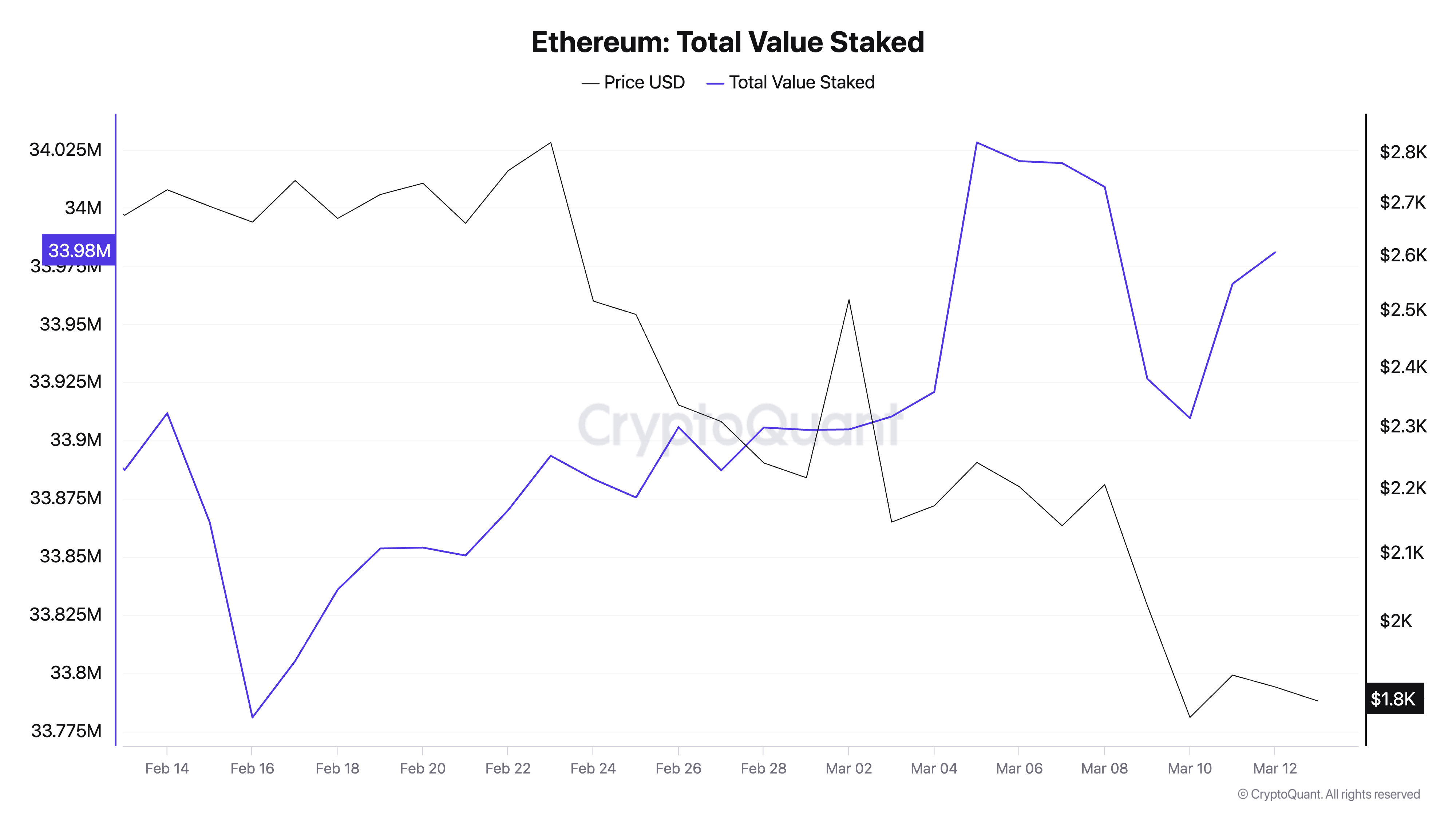

Since the fall of its bottom of the year to February 16, the quantity of marked ethn has increased. With 33.98 million Eth Eth currently locked in development contracts, this figure increased by 1% in the last month.

This has happened despite the significant drop in the value of the ETH in the last 30 days. Trading at $ 1,897 at the time of the press, the price of ETH has dropped by 30% since February 16.

The divergence suggests that many investors continue to see the medal as a long -term asset rather than an opportunity for short -term negotiation. They demonstrate confidence in the performance of ETH’s future prices by locking their parts instead of selling in the middle of opposite winds.

In addition, this ETH increased to the ETH could indicate an institutional and retail sale growing interest in passive return, even if the action of short -term prices remains unacvailable.

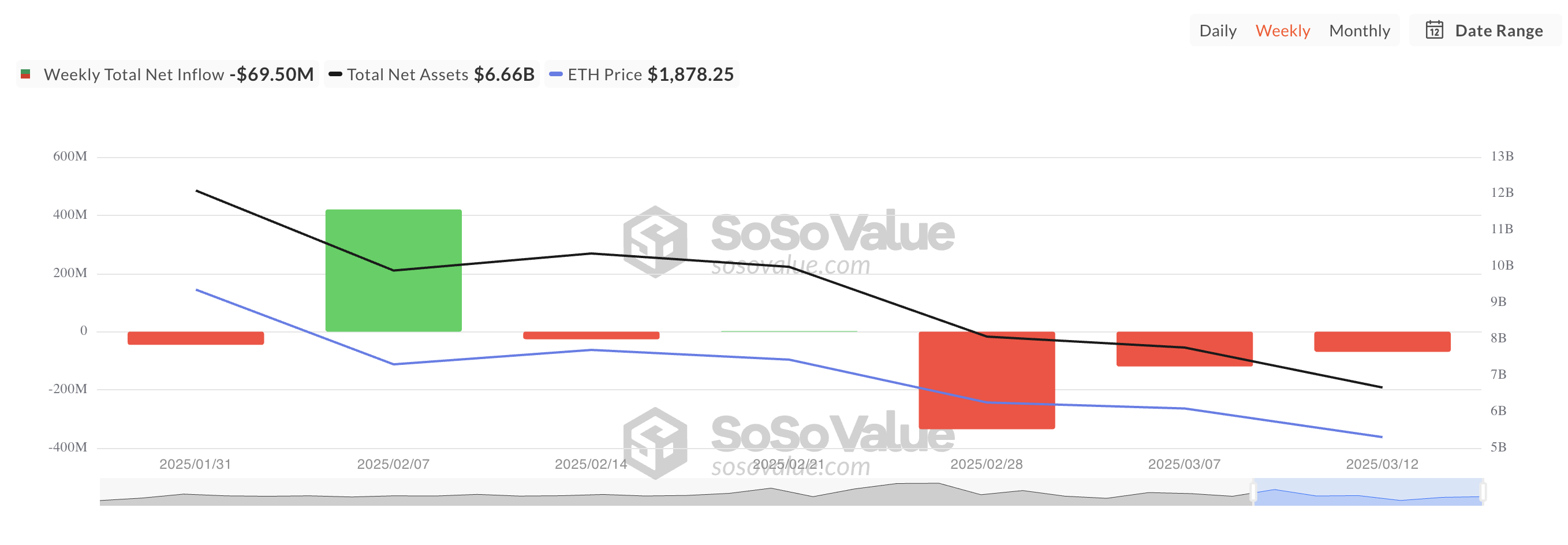

However, this optimistic position contrasts with the recent drop in stock market entrances to the spots (ETF), raising questions about the broader feeling of the market. Sosovalue data show that these funds have recorded outings totaling $ 524.68 million in the past three weeks.

When ETH ETFs see clear outings like this, investors withdraw more funds than they do.

The deeper withdrawal of Ethereum – or a bullish reversal?

ETH is negotiated at $ 1,897 at the time of the press, breaking below the key support formed at $ 1,924. The negative readings of its balance of powers (BOP) reflect the current sales activity among ETH holders.

To date, this indicator, which compares the strength of the bulls against bears, is less than zero at -0.27. When the BOP of an asset is negative, its sellers exert more control over price action, confirming the downward pressure on the price.

If this trend persists, ETH could continue its drop in negotiating at $ 1,758.

On the other hand, if the feeling returns and becomes completely optimistic, it could generate the price of the ETH over the resistance of $ 1,924 and around $ 2,224.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.