Ethereum Transaction Fee Revenue Drops 95% – Here’s Why

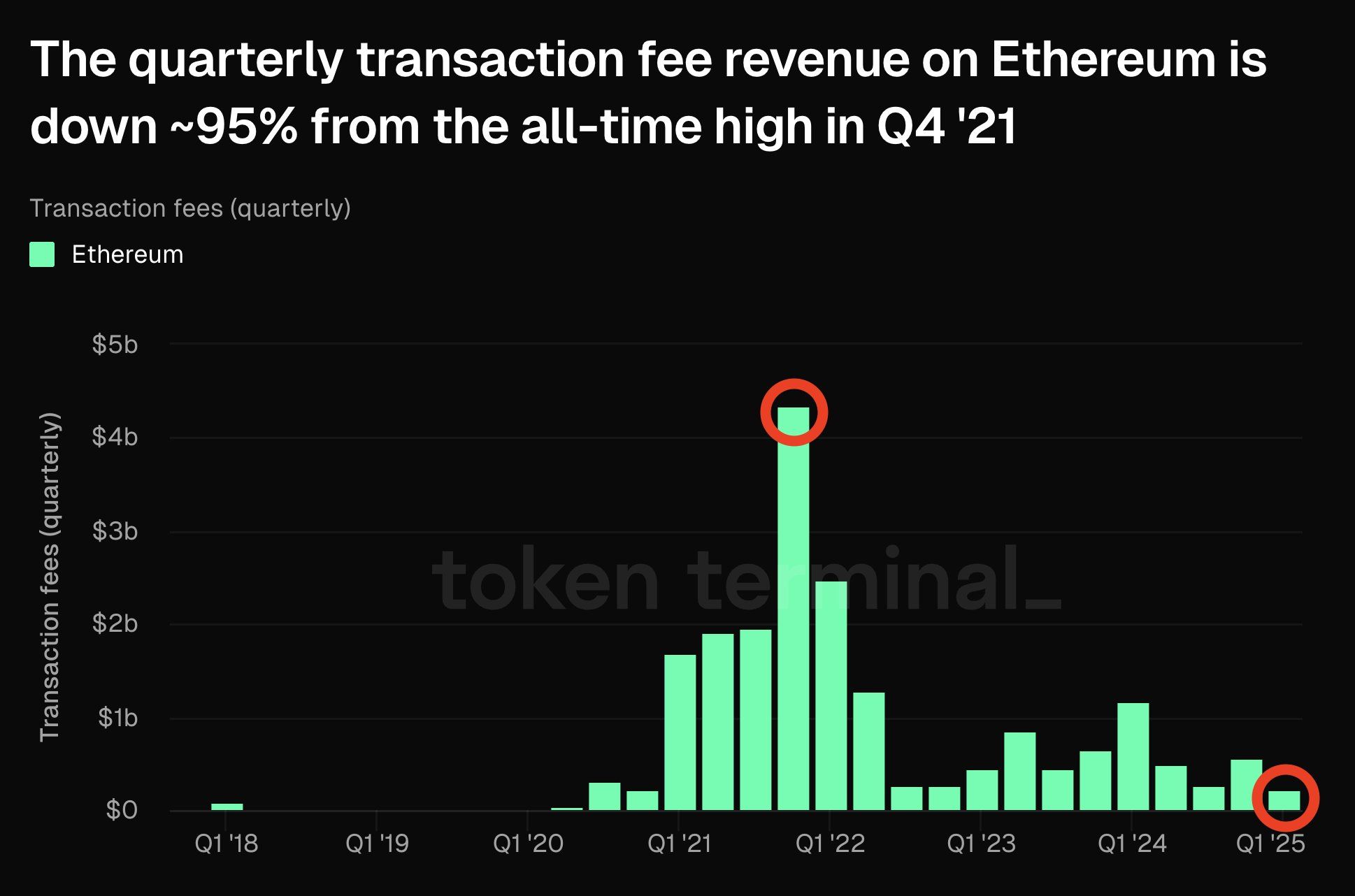

Ethereum (ETH), the second world blockchain by market capitalization, saw its quarterly revenues of transaction costs drop considerably by around 95% compared to its summit of all time in the fourth quarter 2021.

This drop can mainly be attributed to a decrease in contributions from layer 2, associated with a significant drop in activity within the non -buble (NFT) token market.

What stimulates the drop in income for Ethereum transaction costs?

Token Terminal highlighted this change in the last article X (formerly Twitter). Based on their estimate, income for Ethereum’s transaction fees for the first quarter of 2025 should reach around $ 217 million.

This figure represents a spectacular reduction of 95% compared to the top of all times of $ 4.3 billion recorded in the fourth quarter of 2021. At that time, Ethereum revenues jumped 1,777% in annual shift, according to Bankless. It went from $ 231.4 million in the fourth quarter of 2020 to 4.3 billion dollars in the last quarter of 2021.

In addition, Ethereum’s DEFI ecosystem has experienced significant growth in the total locked value (TVL), decentralized exchange volumes (DEX), NFT sales and layer 2 TVL. However, the dynamics have changed since then.

This is obvious of Ethereum’s recent performance. In 2025, monthly income greatly decreased in January, recorded $ 150.8 million and February only $ 47.5 million. Assuming that the downward trend in transaction costs continues, Mars could also see figures just as low.

In addition, in the fourth quarter of 2024, Ethereum generated only $ 551.8 million in transaction costs, emphasizing continuous decrease trend.

One of the main downward contributors is the transition to layer solutions 2. These have become more and more popular for their ability to treat transactions outside the chain while establishing itself on the main maintenance of Ethereum.

In addition, the activation of EIP-4844 has considerably reduced the cost of data from Ethereum’s chain publication, which further reduces contributions to L2 costs. According to a report of corners, this upgrade has made transactions cheaper, but has also reduced the income that Ethereum d’Ethereum collects from L2 activity.

“The costs linked to layer 2, which were raised in 2023 and at the beginning of 2024, have since decreased due to the costs of costs introduced by EIP-4844,” said the Coinshares report.

The drop in NFT activity has also played an important role. The fourth quarter of 2021 marked the peak of the enthusiasm of the NFT, with platforms such as Opensea recording billions of dollars in monthly trading volume. Nevertheless, interest has now decreased, resulting in a sharp drop in the volume of transactions and, consequently, costs of costs.

ETH is undergoing its worst quarterly decrease since 2018

This drop extends beyond the income of transaction costs. The price of Ethereum has followed a similar decrease trend. After reaching an ATH in November 2021, ETH fell considerably, now trading 58.8% below this peak.

Even during the electoral euphoria, when many cryptocurrencies, including Bitcoin (BTC), saw new peaks, Ethereum did not follow the pace.

“ETH has experienced the strongest decline in the first quarter, lowering -40%, marking its greatest quarterly loss since 2018,” wrote an analyst on X.

During last month alone, ETH fell by 25.1%. At the time of the press, the Altcoin was negotiated at $ 1,997, which represents a slight gain of 0.45% in the last day.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.