Ethereum Transaction Fees Hit Lowest Level Since 2020

Ethereum’s transaction fees have dropped at their lowest point over four years, marking a significant change in the activity on the chain.

The drop occurs when the network faces assembly challenges, including the drop in market performance and the weakening of fundamentals.

Ethereum faces the drop in costs and inflation problems

According to Intotheblock, the total transaction costs of Ethereum fell by almost 60% in T1 2025, falling to around 208 million dollars on April 4. The company noted that it was their lowest level since 2020.

“Total ETH fees have decreased to their lowest level since 2020 this quarter, mainly caused by the increase in the gas limit and transactions passing to L2S,” said Intotheblock.

Several factors have contributed to this drop. The largest engine is the adoption of layer 2 networks, in particular the Coinbase base. The Dencun d’Ethereum upgrade, launched in March 2024, made transactions on these layers of scaling much cheaper.

Consequently, more users bypass Mainet d’Ethereum and move to faster and profitable alternatives. According to L2Beat, Base currently deals with more than 80 transactions per second, leading all other layer 2 networks.

Despite the advantages of falling costs, the underlying measures of Ethereum show signs of tension.

Michael Nadeau, founder of the DEFI report, reported a sharp drop in eTH burning rates. He noted that ETH had burned major platforms like Uniswap, Tether, Metamask and 1inch, which have collapsed by more than 95% since November 2024.

Nadeau explained that the discoloration of the enthusiasm of retail and the slower than expected scale of L2 contribute to the reduction of the deflationary pressure of Ethereum.

“The annualized inflation of the ETH is now 0.75%. We must expect it to continue to increase, going beyond the inflation of the BTC. We must also expect the fundamentals of Ethereum to continue to erode in next year, “he added.

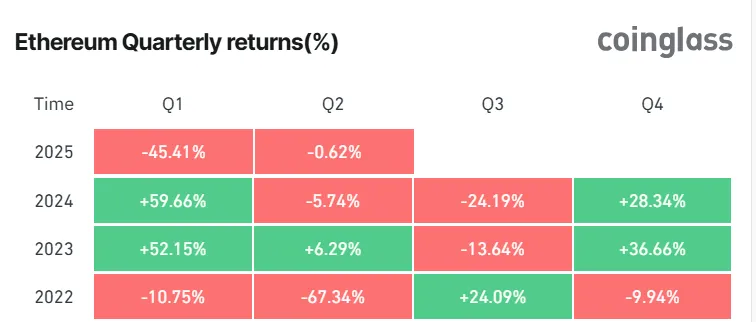

Meanwhile, the network’s financial performance reflects these concerns. ETH’s price has dropped more than 45% in T1 2025, marking its worst quarterly performance since 2022.

Compared to Bitcoin, Ethereum also underperform, losing 39% of its value against BTC this year. This drop pushed the ETH / BTC ratio to its lowest point in almost five years.

However, long -term investors do not retreat. Intotheblock stressed that Ethereum whales had accumulated more than 130,000 ETH as the price has been falling below $ 1,800 – it has been the lowest since November 2024 – meaning a strong feeling of purchase.

Beyond that, industry experts believe that the next Pectra upgrade, scheduled for May, could give the assets a new start.

According to them, Pectra can help restore confidence and stimulate renewed growth through the Ethereum ecosystem with its improved wallet features and user experience.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.