Strategy and Metaplanet Buy Bitcoin Despite Recession Fears

Despite the recent chaos and the fears of a recession, the strategy of public enterprises and Metaplanet double the new purchases of Bitcoin. The strategy bought BTC worth $ 285 million, while Metaplanet spent $ 26.3 million.

Metaplanet’s activity is particularly remarkable because the yields of the Japan treasury over 30 years soar. For public enterprises in Japan, conventional economic practice is to withdraw from the dollar, but engaging in Bitcoin is a daring strategy.

The strategy (formerly Microstrategy) is one of the largest Bitcoin holders in the world, and it is going through a chaotic period. In recent weeks, he has alternated between massive BTC purchases and steep acquisition breaks, which has caused a lot of speculation.

Today, however, his chair, Michael Saylor, announced a new purchase of major Bitcoin at $ 285 million:

“The strategy has acquired 3,459 BTC for ~ 285.8 million dollars at ~ ~ 82,618 $ per Bitcoin and reached the BTC yield of 11.4% YTD 2025. At 13/04/2025, the strategy holds 531,644 BTC acquired for ~ 35.92 $ to ~ $ 67556 $ 35.92 billion.

A large part of this chaos is due to the fears of an American recession, which made the price of Bitcoin which is wildly swinging. When Bitcoin was down, it prompted speculation that Microstrategy may have to empty his assets.

However, since the BTC began recovering, Michael Saylor’s company is back on the market.

Above all, the strategy is not alone in its Bitcoin acquisitions. Metaplanet is a Japanese company with substantial BTC assets and ambitions to acquire even more.

Two days before the strategy made its own major purchase, the CEO of Metaplanet, Simon Gerovich, announced a similar investment:

“Metaplanet acquired 319 BTC for ~ 26.3 million dollars at ~ 82,549 $ per Bitcoin and reached BTC yield of 108.3% YTD 2025. At 14/04/2025, we hold 4525 BTC acquired for ~ 386.3 million dollars to ~ 85,366 $ per bitcoin, Gerovich.

Metaplanet’s commitment here is particularly remarkable because it contradicts the short -term macroeconomic winds. The global market is full of risk -opposed behavior at the moment, and bond yields of Japan have reached the highest level in more than two decades.

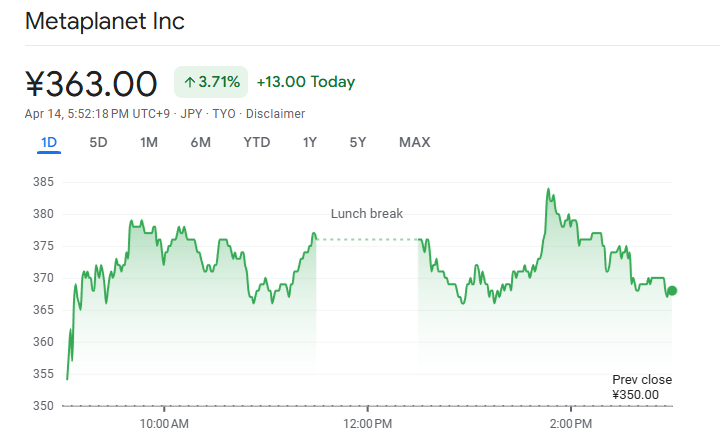

Despite this clear signal, the Japanese metaplanet continues to make significant Bitcoin investments. The latest purchases also had a positive impact on the company’s stock market. It is currently up 3% today, after having suffered notable losses last month.

In short, the main corporate bitcoin holders like Strategy and Metaplanet are not yet interested in shrinking. Despite the recent chaos, he is seriously convinced that BTC will win as a price or will represent a stable reserve of value.

Be that as it may, when public enterprises like this publicly adopt a bullish position, this can consolidate confidence on the entire market.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.