Experts Raise Red Flags Over Finances

The initial classification of the Public Offer (IPO) of Circle has raised concerns among industry experts, which sound alarms on financial health, distribution costs and the assessment of the company.

While this decision marks an important step towards traditional financial integration, expert skepticism questions the long -term perspectives of the company.

Analysts highlight the red flags with the IPO of the Circle

On April 1, Beincrypto reported that Circle had filed an IPO. The company plans to list its ordinary class A shares on the New York Stock Exchange (NYSE) under “CRCL”.

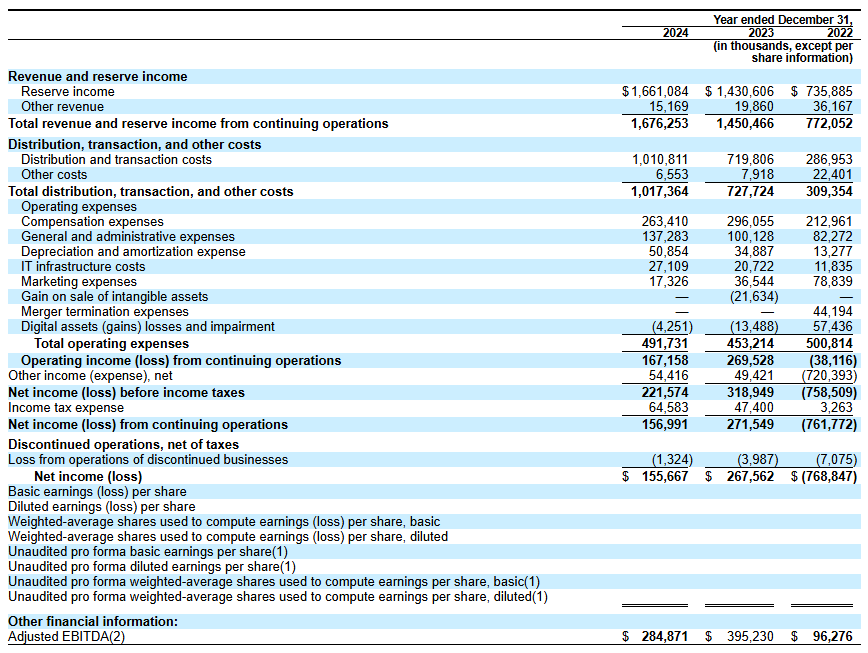

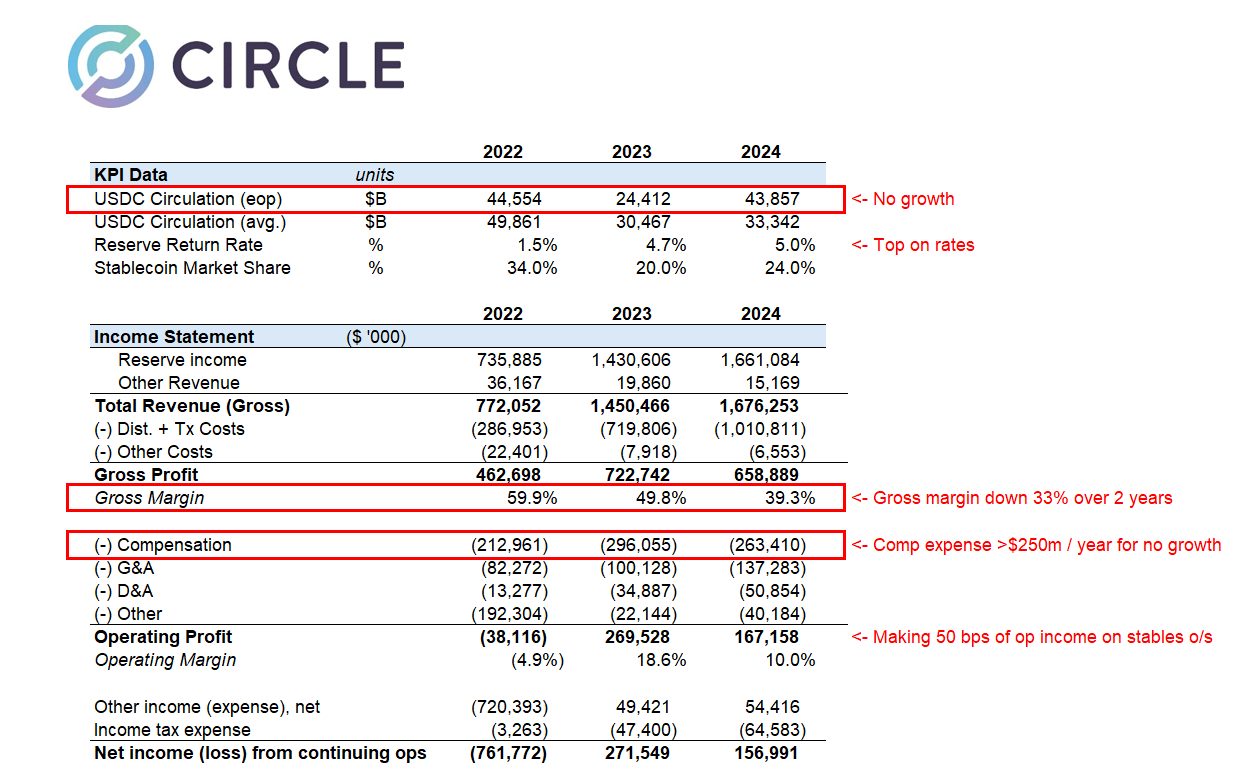

The Introduction on the Stock Exchange of Circle reveals revenues of $ 1.67 billion in 2024, a notable increase compared to previous years. However, a more in -depth examination of the company’s finances has revealed certain challenges.

Matthew Sigel, manager of digital asset research in Vaneck, noted that income had increased by 16% from one year to the next. However, at the same time, the company declared a decrease of 29% of the EBITDA from one year to the next, indicating a decrease in operational profitability. In addition, net profit dropped by 42%, reflecting a significant drop in overall profitability.

Sigel highlighted four factors contributing to the decline in these financial measures. He explained that the rapid expansion of the company and the new service integrations had a negative impact on net income.

In addition, stopping services like Circle rendered reduced other sources of income. This, in turn, exacerbated the drop in profitability.

“Costs related to restructuring, legal regulations and expenditure related to acquisition also played a role in the decline in EBITDA and net profit, despite the overall growth in income,” added Sigel.

Above all, it focused on increasing Circle distribution and transaction costs. Sigel revealed that the cost increased due to higher costs paid to partners like Coinbase and Binance.

A related article of distant investors on X (formerly Twitter) highlighted these expenses.

“In 2024, the company spent more than a billion dollars on” distribution and transaction costs “, probably much higher than the attachment in% of income,” said the message.

This invites speculation that the circle can spend too much to maintain its market share in the competitive sector of stables. The historical performance of the company still feeds skepticism.

Farside investors added that in 2022 Circle recorded an amazing loss of $ 720 million. In particular, the year was marked by important disorders in the crypto industry, including the high -level collapses of FTX and Three Arrows Capital (3AC).

This suggests that the circle can be vulnerable to market shocks. Thus, he calls into question the risk management capacities of the company, in particular on the market of intrinsically volatile cryptography.

“The raw figures for creation and redemption are much higher than we would have thought of for the USDC. Raw creations in one year are much multiple than the exceptional balance,” said that wacky investors.

In addition, analyst Omar expressed doubts about the evaluation of $ 5 billion in Circle.

“Nothing to love in the classification of IPOs Circle and no idea of how it prices $ 5 billion,” he questioned.

He drew attention to several concerns, including the gross margins of the company seriously affected by high distribution costs. The analyst also stressed that the deregulation of the American market is ready to disrupt Circle’s position.

In addition, Omar stressed that Circle spends more than $ 250 million per year in compensation and an additional $ 140 million in general and administrative costs, which raises questions about its financial efficiency. He also noted that interest rates – loop income engines for the circle – will probably decrease, with additional challenges.

“The 32x ’24 profit for a company that has just lost its mini-monopoly and in front of several opposite winds is expensive when growth is structurally disputed,” said Omar.

In the end, the analyst concluded that the IPO depot was a desperate attempt to guarantee liquidity before facing serious market difficulties.

Meanwhile, Wyatt Lonergan, general partner of Vaneck, shared his predictions for the IPO of Circle, describing four potential scenarios. In the basic case, he planned that Circle would capitalize on the story of the stable and guarantee key partnerships to stimulate growth.

In a bear case, Lonergan has hypothesized that poor market conditions could lead to a redemption of Coinbase.

“Circle Ipos, the market continues to tanker, Circle Stock goes with it. Bad commercial fundamentals mentioned. Coinbase moves to buy at a discount on the price of the IPO. The USDC is finally theirs.

Finally, he described a probable scenario where Ripple offers an evaluation of Circle to a failure of $ 15 to 20 billion and acquired the company.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.