Experts See Big Future for Ethereum Despite Market Struggles

In the midst of the challenges of the current market in Ethereum (ETH), industry experts make striking comparisons between the current position of cryptocurrency and the technology giants of early growth such as Amazon (AMZN), Microsoft (MSFT) and Tesla (TSLA).

They say that investment in ETH is now akin to buying strong growth actions ten years ago, with the expectation that Ethereum will ultimately experience substantial gains in the future as adoption increases.

Ethereum the next great growth asset?

In a detailed article on X (formerly Twitter), Defi Dad argued that many investors are fundamentally poorly tariff. According to him, ETH is evaluated as a stable and value -oriented stock rather than a strong growth asset that it has the potential to become.

“Please stop trying to analyze ETH as it is Procter & Gamble.

The analyst suggested that it is a critical moment to “direct” the potential domination of Ethereum in the blockchain space. He stressed that Ethereum is distinguished by its continuous innovation, but rather than prioritizing the immediate growth of users, the network has focused strongly on security. This commitment to reliability positioned Ethereum as the most reliable regulation layer in the industry.

“Ethereum’s strategy to develop the domination of the EVM could / should be compared to Amazon,” he added.

In addition, he highlighted the role of layer 2 (L2) solutions in the Ethereum ecosystem. Although the L2 is not yet significantly profitable for Ethereum, the expert believes that they work as an essential distribution network.

Defi Dad also stressed that Ethereum, just like Bitcoin (BTC), has turned into an asset of trust, attracting investors and governments of Wall Street which were initially skeptical about cryptocurrencies. He stressed that Ethereum is now the favorite blockchain for banks and institutions entering the chain space, even if it retains the potential to disturb these same entities.

Another expert echoed this perspective. He suggested that the price of Ethereum could feel upwards if investors were starting to place confidence in the vision of L2 scaling solutions. While the market recognizes the potential future benefits of these scalability improvements, Ethereum demand could increase, which has increased its price.

“It is like growth actions (Uber, Netflix, etc.): first get users, that income occurs,” wrote Ignas on X.

East Ethereum in a descending spiral? Market trends suggest this

These prospects are involved in difficult market conditions for ETH. Since the end of 2024, ETH has been on a persistent downward trend. In fact, Altcoin lost 29.4% of its value in last month alone.

At the time of writing the editorial staff, ETH was negotiated at $ 1,948, reflecting a modest increase of 2.6% in the last 24 hours.

Beincrypto recently reported that the daily active addresses of Ethereum have reached an annual hollow, which raises concerns concerning the drop in risk of adoption and inflation. The domination of the Ethereum market has also slipped to levels for the last time in 2020, exacerbating the concerns of investors.

In a hard blow to ETH’s prospects, Standard Charterd recently reduced its target of 2025 for Ethereum by 60%, reducing it from $ 10,000 to $ 4,000.

“We are expecting ETH to continue its structural decline, and we reduce our price target level at the end of 2025,” noted Geoffrey Kendrick, global manager of digital assets of Standard.

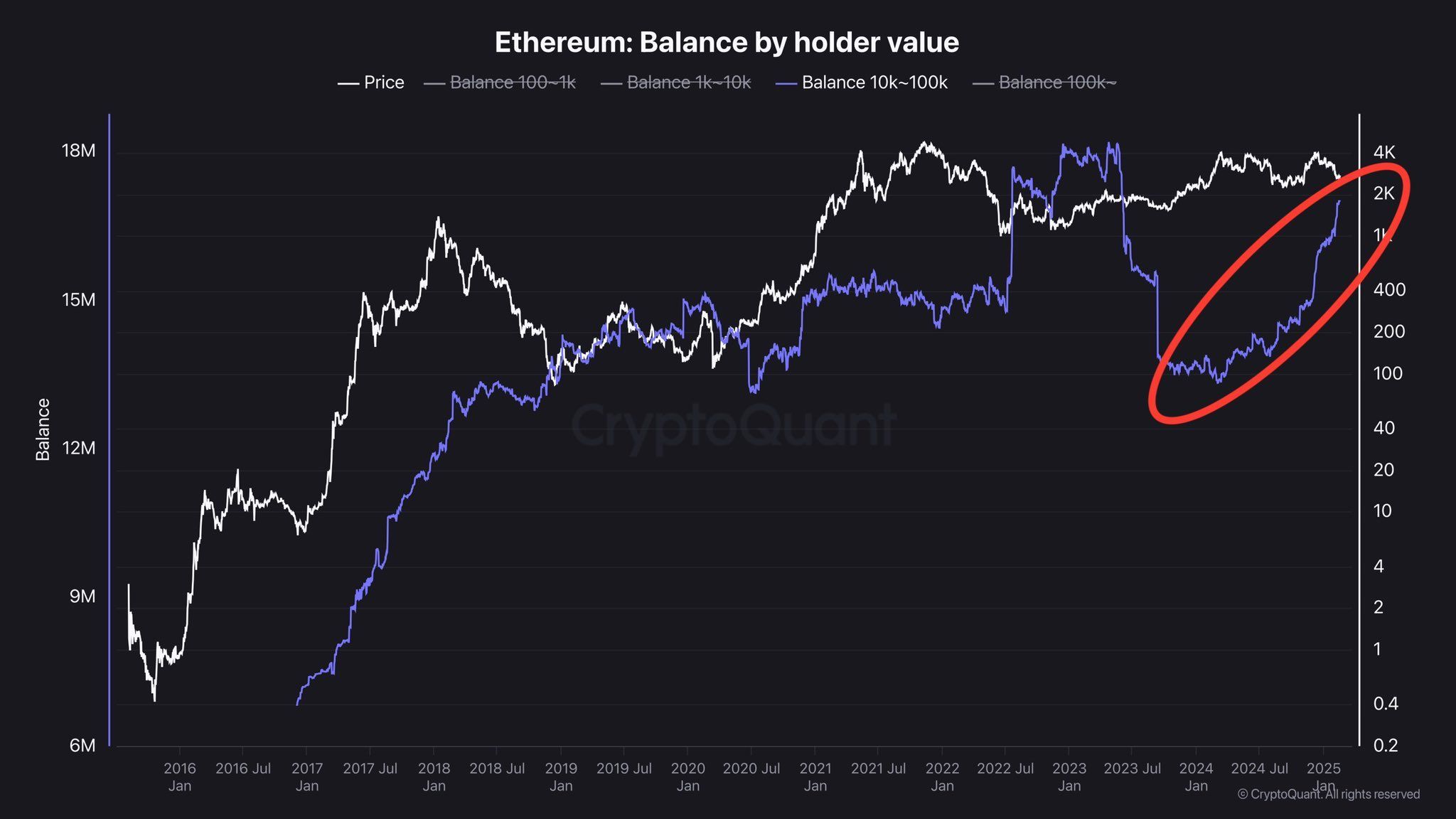

Despite this, the data on the chain suggested a contrasting story. Analyst Quinten François revealed that whale portfolios – significant investors holding large quantities of ETH – have accumulated the part more and more.

“Big holders buy aggressively.

This alluded to an optimistic potential long -term feeling among institutional and high net investors.

Although Ethereum’s short -term perspectives remain uncertain, these developments indicate that institutional actors are still positioned in the ETH ecosystem. It remains to be seen if Ethereum follows the trajectory of technology giants or faces new challenges on the market.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.