Facebook’s Meta Stakeholders Reject Bitcoin Investment Proposal

Meta Platforms, the Facebook and Instagram parent company, voted massively against a proposal aimed at diversifying its Bitcoin corporate treasure.

This indicates that Big Tech remains cautious about the adoption of the best cryptocurrencies despite an increase in the interest of companies.

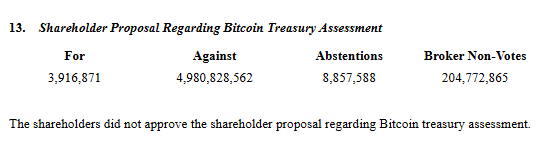

According to documents shared on X, the shareholder request received only 3.9 million votes in favor, while more than 4.9 billion things opposed it. 8.9 million additional shares abstained and 205 million were broker’s not voting.

This vote follows the proposal of Ethan Peck, a shareholder of Mata, earlier this year.

Peck had called Meta to convert part of his cash and bitcoin bond reserves, citing increasing institutional adoption and the potential of the assets to outdo traditional financial instruments.

However, the Meta board of directors rejected the proposal before the vote, declaring that the company already has robust cash management practices.

The board of directors argued that there was no imperative reason to consider Bitcoin, although it does not completely reject digital assets as a concept.

“Although we do not judge the investment of cryptocurrencies in relation to other assets, we believe that the assessment requested is not necessary given our existing processes to manage our business treasure,” said the Meta board of directors.

However, Meta did not exclude blockchain technology entirely. The company would have organized discussions at the start of the stadium with the cryptography infrastructure companies on a potential integration of Stablecoin to support world payments.

Meanwhile, the vote puts an end to months of speculation that Meta could follow in the footsteps of companies as a strategy, which has aggressively accumulated bitcoin as a reserve asset.

The decision of the Facebook parent company also reflects the recent shareholders’ refusals on Amazon and Microsoft, both of which decreased similar proposals.

Some of the speculations surrounding the meta come from the bonds of the CEO Mark Zuckerberg to cryptographic culture, including the fact that one of his goats is named Bitcoin.

In particular, market analysts had floated the idea that Meta could lead a new wave of technological companies embracing digital assets.

“If a meta or Microsoft adds BTC to its balance sheet, it will undoubtedly have a more important impact than all small businesses doing it. A bit like when Tom Hanks has become cocovated, which made it feel real even if the cases had already been mounted,” said Bloomberg ETF analyst Eric Balchunas.

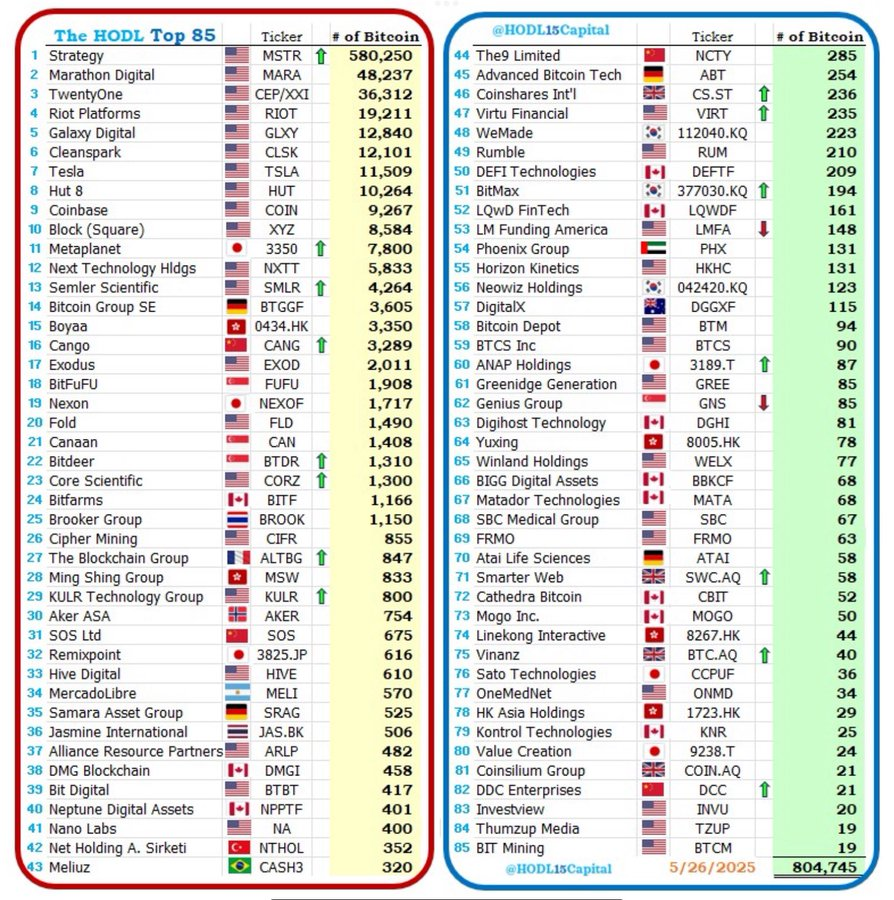

In May 2025, more than 85 public companies collectively hold more than 804,000 BTC, according to Hodl15 Capital. The strategy leads the pack with more than 580,000 BTC under its control.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.