FAMILY ECONOMY: A Missed Opportunity for Collective Prosperity

In each society, the family is the smallest and most fundamental unit. It is in the family structure that values are first cultivated, of modeled behavior and in the form of identity. Consequently, a large part of what individuals end up achieving in broader society are often rooted in what has been planted and nourished at home. However, with regard to commercial and economic collaboration, families are often overlooked as viable ecosystems of the company. Why then?

Consider the paradox. While families are comfortable to extend financial support to each other, thanks to tuition fees, hospital bills or even start -up funds, they often hesitate to collaborate in business. If we can give money freely, why is it so difficult to exchange value via trade in the same circle?

These questions have become a subject of personal curiosity, which prompted me to carry out a brief interview with information with friends and colleagues via WhatsApp. The answers I received were striking. Many have expressed concerns about the protection of their wealth of family members who could abuse resources or feel in law. We feared that doing business with the family could lead to tense relations, unattended expectations and even financial losses.

Register For TEKEDIA Mini-MBA Edition 17 (June 9 – September 6, 2025)) Today for early reductions. An annual for access to Blurara.com.

Tekedia Ai in Masterclass Business open registration.

Join Tekedia Capital Syndicate and co-INivest in large world startups.

Register become a better CEO or director with CEO program and director of Tekedia.

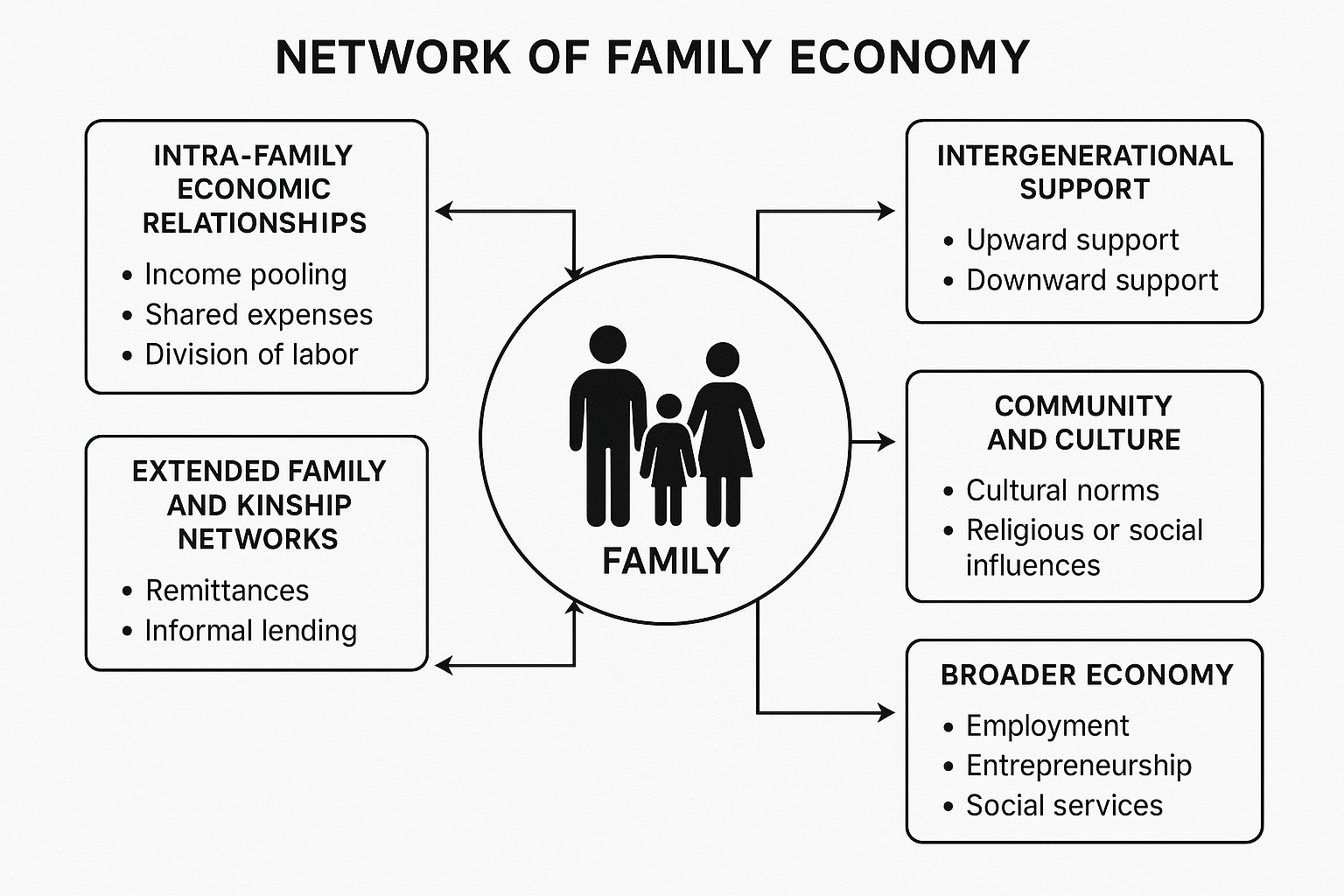

These concerns are valid and reflect broader cultural and emotional complexities around the family economy. Many people are comfortable giving the family but not to transginate with them. Generosity is considered noble, while commercial interactions are considered risky. This state of mind has important consequences on the way in which wealth is created, managed and transferred within families.

Now imagine a different scenario. Imagine a family economy with a market size of 20 million nairas in a quarter. Each family member has a unique and marketable skill such as sewing, catering, advice, photography, web design, carpentry or event planning. Instead of looking for these services outside, family members choose to attend each other and pay the fair market value.

The impact of this internal economic circulation would be deep. First, this would stimulate liquidity within the family, which gives each member greater financial flexibility to reinvest, save or spend in a broader company. Second, this would promote mutual respect and professionalism. When the services are provided with skill and compensated fairly, it strengthens confidence and redefines family members as assets rather than dependent people.

More importantly, this model reflects the commercial logic of the real world. If we cannot convince our own members of our family to support our services or buy our products, how ready we are ready to face the free market? Families can and must serve both testing fields and entrepreneurship support systems.

However, this approach is not without challenges. Doing family business requires clear maturity, structure and limits. It requires defined contracts, roles and honest communication. Many family businesses fail because they count too much on emotional links rather than solid commercial practices. When expectations are not clearly managed, the resulting disappointment can damage relations and reputation.

To overcome this, families must adopt a new state of mind. They must start to consider themselves not only as support units, but as strategic collaborators in wealth creation. Confidence must be won by professionalism, not supposed according to blood ties. Training and mentorship can be introduced into the family to raise standards and equip members for lasting success. Conflict resolution mechanisms must also be part of the design, just as they are in any other serious enterprise.

This idea of a family economy is not just theoretical. In many world cultures, especially among immigrant communities and indigenous groups, family businesses are at the heart of financial stability. These families pool resources, share knowledge and strengthen intergenerational wealth by intentionally working together. There is no reason why such a model cannot be adopted more widely in African contexts and other emerging markets, where entrepreneurship is often a path to survival and growth.

In the end, the family can become both a launch and a loyal customers for entrepreneurs. This change requires discipline and a desire to professionalize relationships within the home. Not all companies will succeed, and all family members will not be adapted to collaboration. But with planning and mutual responsibility, the potential is immense.

We must reconsider the role of the family in our economic aspirations. Rather than considering our loved ones only as support recipients, we can start to see them as partners in value creation. We must not wait for foreigners to validate our ideas when we have capable minds and voluntary hands in our own houses. The family economy remains an unexploited gold mine, and our first real investment could just need to start at the family table.