Fed Interest Rate Remains Unchanged – How Will Crypto React?

The American federal reserve has held the stable interest rates of 4.25% to 4.50% in its FOMC decision on June 18, marking the fourth consecutive break since December 2024.

The markets were largely expecting the decision. CME Fedwatch data has shown a probability of 99.9% of a rate rate in Reunion. Cooling inflation, resilient labor markets and current trade risks have shaped the decision.

The Fed interest rate continues to frustrate American markets

Bitcoin owned nearly $ 105,000 after the announcement, while Ethereum exchanged nearly $ 2,500. However, a broader feeling of crypto can weaken because the Fed strengthens a higher position.

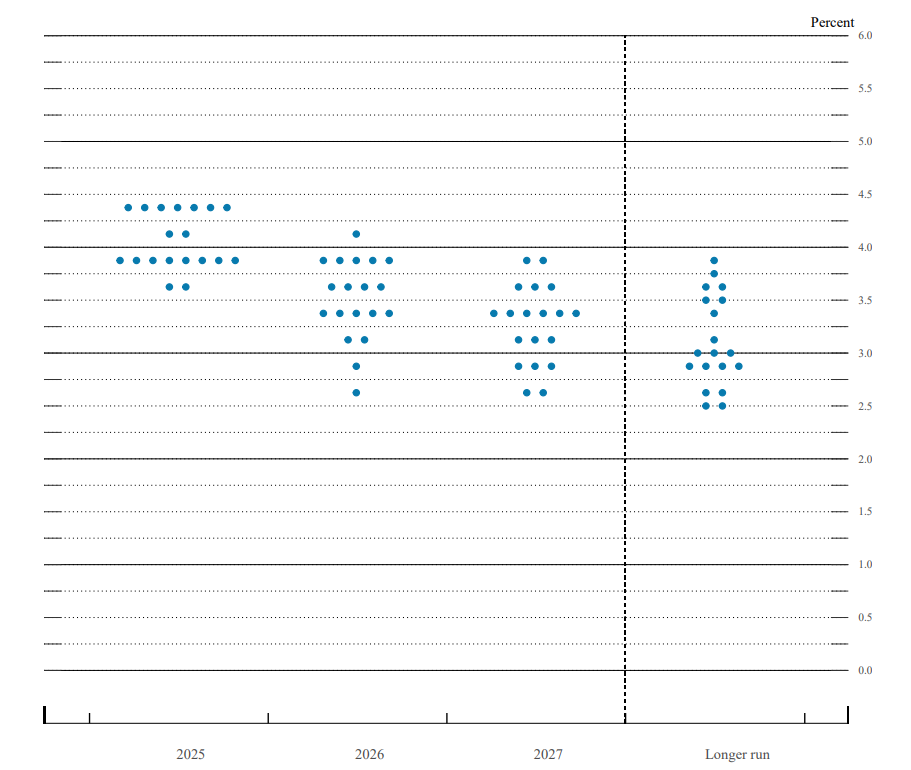

The Fed has published its updated summary of economic projections and the plot dowry in parallel with the decision.

FOMC participants now expect only A drop in a rate in 2025Lower two projected in March. Most political decision -makers have kept their 2025 forecasts aligned with current levels, signaling a stricter policy will persist longer.

The point layout has also shown a slow path to standardization:

- In 2026The majority expect rates around 3.25% to 3.50%.

- By 2027projections converge on 2.75% to 3.00%approaching the long -term neutral rate of the Fed.

- THE longer -term points stay 2.5%Recognizing no major change in structural expectations.

This marks a notable quarter of fellows. Only four participants projected any reduction in 2025, stressing the prudence of the Fed in the middle of the sticky services and the prices focused on prices.

Fewer cuts this year means that capital will remain expensive. This reduces afflux of liquidity in speculative assets such as altcoins and DEFI tokens. The story of the stronger dollar also exerts pressure on cryptographic assessments.

The domination of bitcoin could increase in the short term, while institutional traders move from altcoins and run in better quality active. At the same time, interest can develop in generating performance products such as marked ETH or American treasury bills.

Unless economic data is getting worse or inflation is strongly softened, cryptographic markets will probably not see the rise in short -term Fed policy.

The Fed increased rates in July 2023. Since then, inflation has regularly fell by 5.3% to 2.4% in June, approaching the target target of the Fed. But inflation of services and costs related to prices remain sticky.

Cryptographic markets are particularly sensitive to nourished signals. Lower rates generally increase liquidity and risk appetite, which leads to capital in Bitcoin, Ethereum and Altcoins.

Conversely, a high -speed prolonged environment limits the increase in increase.

Economic concerns, warming up due to the Iran-Israeli conflict, the rate policy also becomes a political problem. Donald Trump has openly pressure the Fed to cut faster, while current decision -makers remain cautious.

For the future, the FOMC meeting on July 31 will probably depend on data on inflation and employment in June. For the moment, Crypto merchants will dissect each word from Powell to obtain advice on the Fed calendar – and tolerance to the volatility of the market.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.