Top 5 Made in USA Cryptos to Watch This Week

Hedera (Hbar), ChainLink (Link), Aptos (Apt), Ondo Finance (Ondo) and Story (IP) are five of the most important to American cryptos to watch this week. Although the IP was the most efficient in the group in the last month, it now undergoes a clear correction, similar to Ondo, which has dropped by more than 22% in the last seven days.

Meanwhile, speculation increases that Hbar and Link could potentially be included in the United States Strategic Reserve, which could have an impact on their prices. With the approach of key support and resistance levels, the next few days will determine whether these parts can find a bullish momentum or cope with the decline.

Hedera (Hbar)

Hedera is currently among the first 10 largest in American cryptos by market capitalization, and there are growing speculations that he could be considered for inclusion in the Strategic Reserve of the United States.

Despite this, Hbar had a hard time in last week, lowering 16.7% while its market capitalization oscillates approximately $ 8.8 billion. The recent slowdown has raised concerns about the resumption of the bullish momentum or to continue to deal with the pressure of the sale.

If Hbar can establish an upward trend, he could try to test the levels of resistance of the keys to $ 0.219 and $ 0.258, with a stronger rally which pushes him towards $ 0.287. However, if the current price retrace is deepened, it can face an additional risk of decrease.

The level of $ 0.179 is distinguished as a critical support zone, where ventilation could point out new losses. That Hbar can recover or prolong its decrease will depend on its ability to arouse a renewal of purchasing interests.

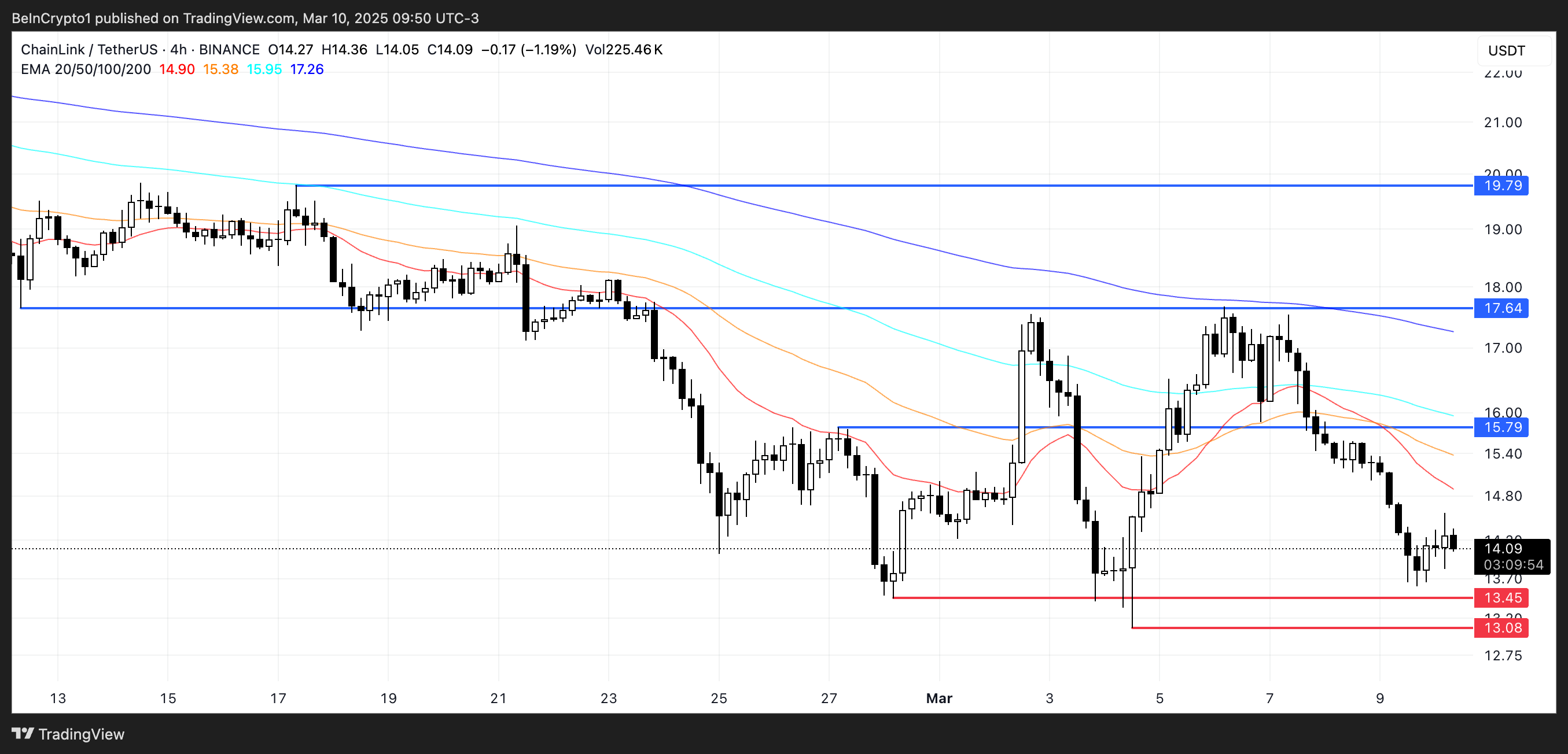

ChainLink (link)

ChainLink is a dominant force in the Oracle sector and has widened its presence in active world (RWA), solidifying its importance in blockchain infrastructure.

Its key role in these industries strengthens the case of its potential inclusion in the American strategic cryptography reserve, alongside XRP and Solana.

Potential inclusion could push the link to the key resistance at $ 15.79, with an additional targeting of $ 17.64 and $ 19.79 if the momentum continues.

However, if the market conditions become lowering, Link can provide support at $ 13.45, with the risk of additional drop to $ 13 or less.

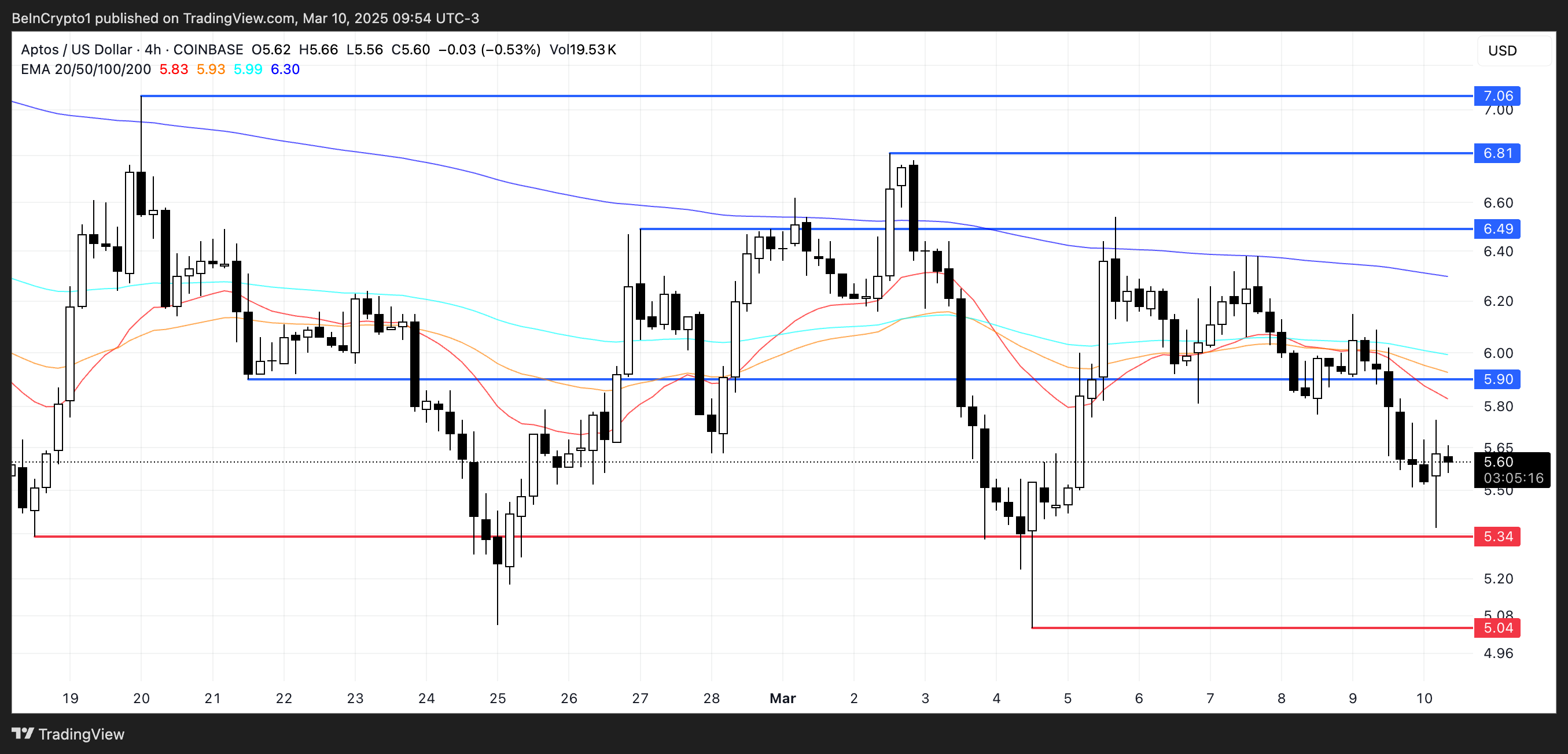

Aptos (Apt)

Aptos has been one of the new most publicized layers of layer 1 blocks in recent years, and speculation on a potential FNB has fueled discussions during last week.

Despite this, Apt has struggled, lowering almost 12% in the last seven days. The recent slowdown raises questions about the question of whether it can resume upward momentum or if a new drop is ahead.

If the correction continues, Apt could test the support at $ 5.34, with a ventilation that potentially sends it as low as $ 5.04. On the other hand, a reversal could see Apt increasing around $ 5.90, with additional resistance to $ 6.49.

If the bullish momentum of yields in previous months could extend the gains to $ 6.81, or even $ 7.06. The question of whether it can turn the trend will depend on a renewal of purchase interest and wider market conditions.

Finance Ondo (Ondo)

Ondo has dropped 22% in the last seven days, but there is one of the most relevant real asset tokens (RWA) on the market. Despite the correction, its market capitalization still oscillates approximately 2.8 billion dollars, reflecting its strong position in the sector.

The recent decline has put pressure on Ondo, which raises questions if it can resume momentum or if a new drop is ahead.

If the decline continues, Ondo could test the support at $ 0.866, with a ventilation that potentially sends it as low as $ 0.82.

Uplining, a resumption of momentum and a renewed interest in RWA coins could push Ondo to the level of resistance of $ 1.09. If the bullish momentum is further strengthened, it could climb $ 1.23

History (IP)

IP has been one of the most efficient cryptos in the United States, increasing 77% in the last 30 days and standing out from the best altcoins.

Despite its high overall performance, IP experienced a 19% correction in last week, bringing market capitalization to $ 1.27 billion.

If intellectual property can recover its strength compared to last month, it could increase around $ 6.96 and potentially test $ 7.95, with the possibility of exceeding $ 8 for the first time, making it one of the largest of American cryptos.

However, if the current downward trend is intensifying, the price can test the support at $ 4.49, and new ventilation could push it as low as $ 3.65.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.