‘Ancient Bitcoins’ Might Cause a Major Supply Issue for BTC

According to a new Fidelity report, 17% of all BTCs officially consider as an “ancient bitcoin”, which means that he has not distanced at least ten years. These assets are worth around 360 billion dollars.

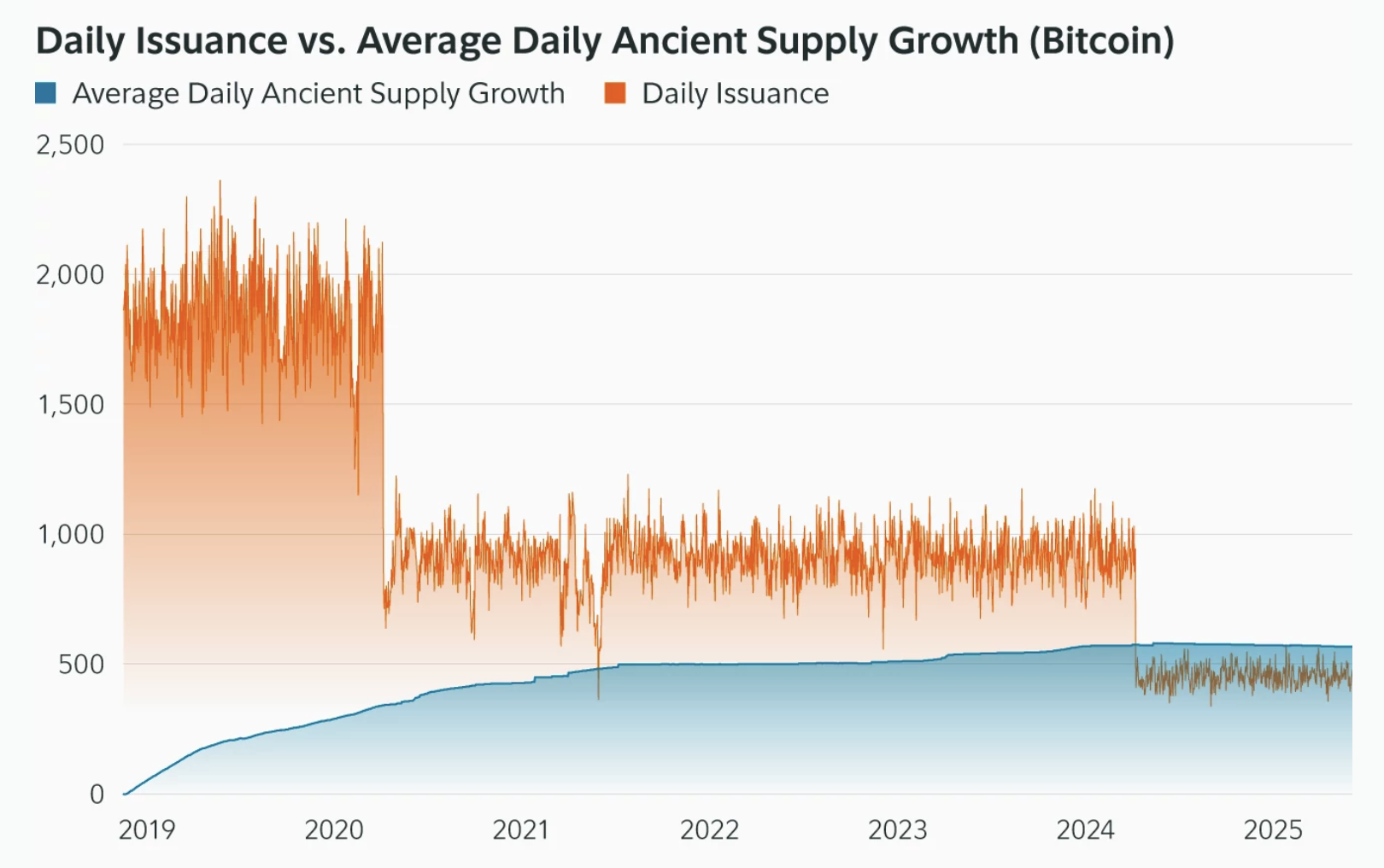

Concern, Fidelity says that more BTC becomes old a day than new minors cannot replace it. Between this trend and corporate acquisitions, the Bitcoin function as a circulating currency can be in danger.

Does the old bitcoin take over

Thanks to the Tas trend, Bitcoin does not lack whales that keep their assets for years at the same time.

However, the cryptography industry is over 15 years old now, and the number of “old” token can only develop. Fidelity conducted a study on the old bitcoin, determining a series of important conclusions:

Fidelity is a leading Bitcoin transmitter, so he naturally has a strong interest in carrying out this research. On the surface, the assertion that 17% of all bitcoins are old seems extremely remarkable.

The company estimates that 3.4 million BTC enter this category, which represents more than $ 360 billion in value. However, Fidelity’s results on mining could be even more substantial:

More specifically, the company said that more bitcoin becomes old per day than new tokens are exploited. The mining industry becomes less profitable and the ETF issuers buy much more BTC than minors.

Fidelity noted that 566 tokens become old per day, while only 450 new ones replace them.

Why the ancient “lost” supply is a major concern

An important concern is that part of the old offer is actually lost, for reasons such as the private keys thrown or the inaccessible wallets. Chain data suggests that around 20% of all extracted bitcoins have already been permanently lost.

In addition, more than 1.8 million bitcoins linked to Satoshi Nakamoto have stayed dormant for over ten years. When the parts are really lost, the effective traffic supply supply, which changes the dynamics of supply demand.

The reduced active offer can amplify price volatility. As the Bitcoin power ceiling approaches, each incremental elimination of active circulation causes a stronger available float.

In addition, the risk of concentration increases when fewer parts remain active. Whales can move the market more easily if the active offer decreases.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.