ETH Price Stuck Below $3,000 as Exchange Balances Drop

Ethereum (ETH) Price had trouble resuming momentum after losing the threshold of $ 3,000 on February 2, remaining below this level since. In the past 30 days, the ETH has dropped by more than 20%, reflecting a weakness and an uncertainty in progress on its next movement.

Technical indicators like the DMI suggest a clear lack of trend, with optimistic pressures and weakening hideouts in recent days. Meanwhile, ETH’s offer on exchanges fell to its lowest level in six months, which could point out the accumulation and reduce the sale pressure, potentially preparing the land for a recovery attempt.

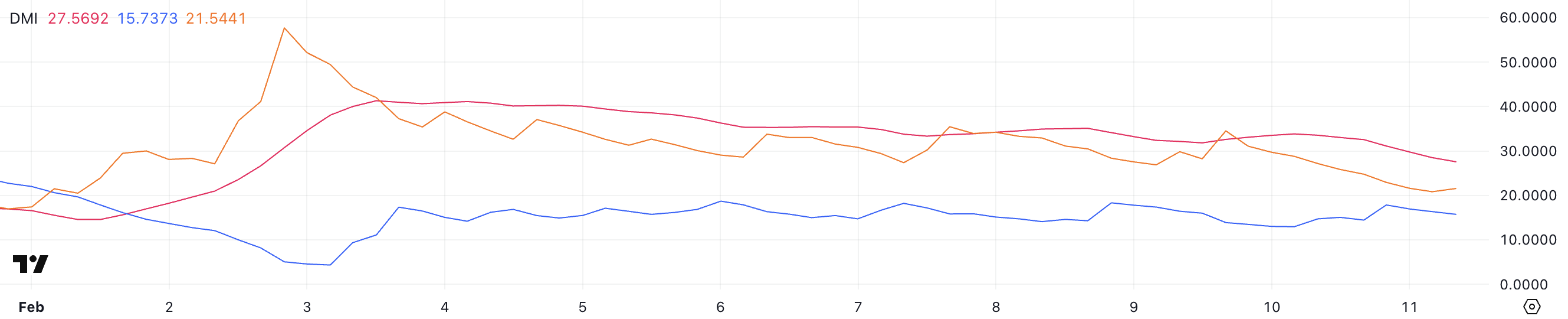

Ethereum DMI shows the absence of a clear trend

Ethereum’s DMI graph reveals a weakening trend because the ADX fell to 27.5 of 33.8 in the last day. ADX, or average directional index, is a key indicator used to measure trend resistance. Readings above 25 generally point out a strong trend, while values below 20 indicate a low or non -existent trend.

The downward movement of the ADX suggests that the recent trend of Ethereum loses momentum rather than gaining strength, which could indicate the indecision of the market.

Looking at the directional indicators, + DI went from 17.8 to 15.7, while -Di also went from 22.9 to 21.5. This suggests that the pressure of purchase and sale has weakened, leaving Ethereum without a clear directional bias.

With -Di always above + DI, the bears maintain a slight edge, but the downward ADX indicates that the trend does not gain ground.

This configuration points to a consolidation or inversion phase of potential trend rather than a continuation of a strong bearish dynamic. Until there is a clear divergence in directional indicators or an increase in ADX, the next Ethereum movement remains uncertain.

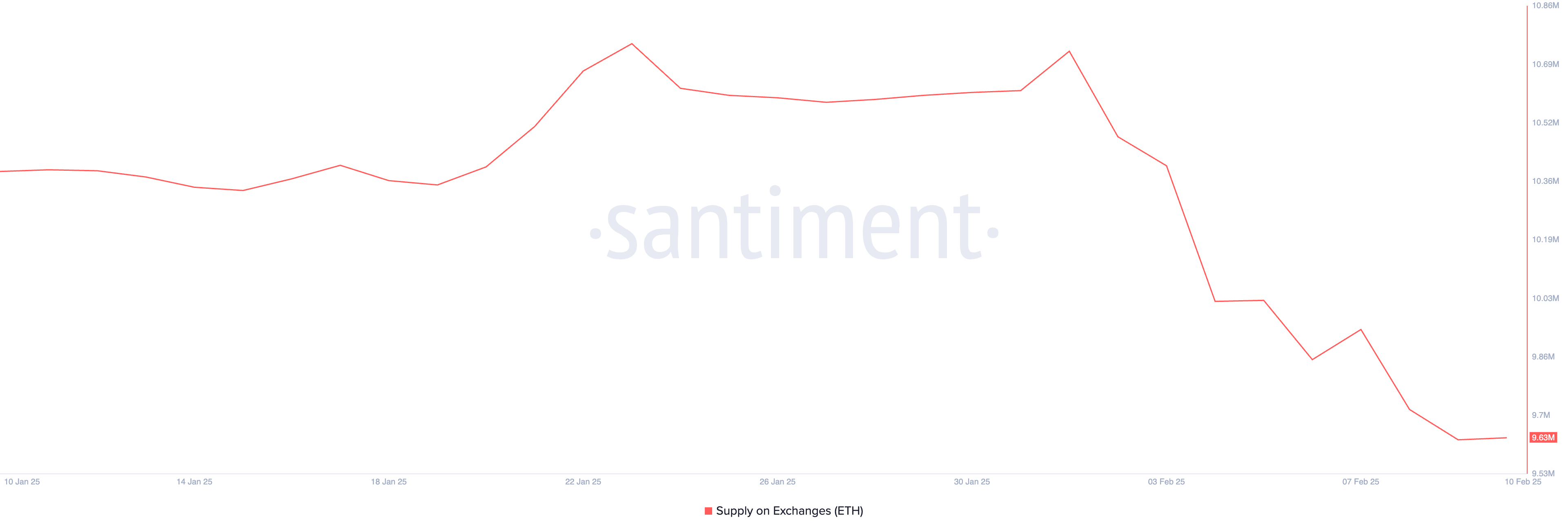

ETH ETH offer has reached its lowest level in six months

ETH ETH offer has experienced a significant change in recent weeks. After going from 10.35 million from January 19 to 10.73 million on February 1, exchange sales have since decreased sharply, falling consecutively to 9.63 million – the lowest level in six months, dating back to August 2024 .

This regular decrease in the ETH held on exchanges indicates a significant change in the behavior of investors, which has an impact on short -term prices’ action.

ETH’s offer on exchanges is a key measure in understanding the feeling of the market. When exchange sales increases, this often suggests that investors are preparing to sell, because more ETH are easily available for trading. This can create a sale pressure, leading to lowering conditions.

Conversely, when Ethereum’s offer on exchanges decreases, this implies that investors move their assets to private wallets, reducing the immediate liquidity of the sale.

This trend is generally considered optimistic, because it suggests confidence in the outfit rather than sale. With the ETH exchange offer now at its lowest level in six months, it could indicate a strong accumulation, reduce the sale pressure and potentially prepare the track at an upward price.

Can ETH price prediction: Can Ethereum go back to $ 3,000?

The Ethereum prices table shows that its EMA lines always indicate a lower structure, with short -term mobile averages positioned below those in the long term.

This suggests that the ETH price has not yet established a confirmed upward trend. However, if the purchase of Momentum is strengthening and the ETH can recover a sustained movement upwards, it can first question resistance to $ 2,798.

A successful breakthrough above this level could open the door to additional gains to $ 3,024. If the bullish momentum persists, ETH could possibly target the next major resistance to $ 3,442, signaling a full upward trend reversal.

On the other hand, the non-establishment of an upward trend could leave the Vulnerable ETH price to a retaining of its key support at $ 2,524.

A ventilation lower than this level, in particular with an increasing sale pressure, would confirm a downward continuation, which potentially led the ETH lower to $ 2,163.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.