Four Weeks of Crypto Outflows: Is Investor Confidence Collapsing?

Crypto outings totaled $ 876 million last week, completing a successive sequence of negative flows in the previous four weeks.

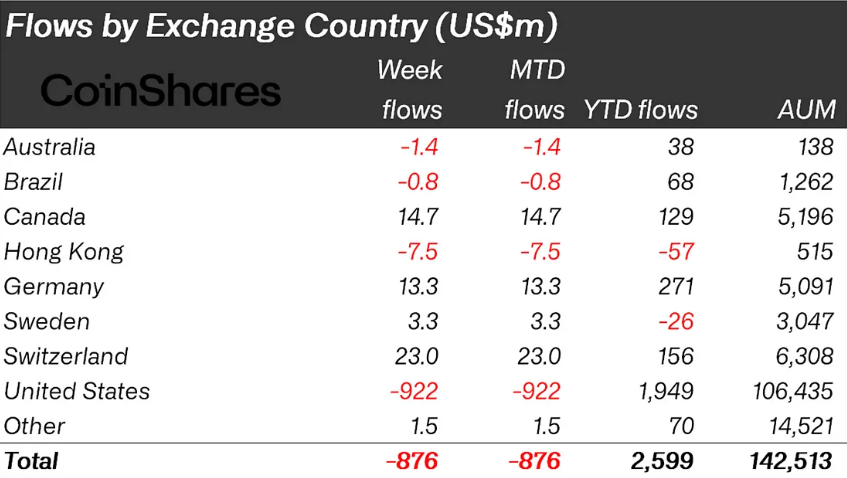

This continuous sale led to cumulative outings of $ 4.75 billion in the last month, considerably reducing the entries for the start of the year to $ 2.6 billion. Consequently, total assets under management (AUM) decreased by $ 39 billion compared to their peak, now at $ 142 billion, the lowest level since mid-November 2024.

Crypto outings reach $ 876 million

The latest Coinshares report indicates that American investors have mainly led outings, withdrawing $ 922 million from digital asset investment products. This lowered feeling in the United States contrasts with other regions, where investors considered the recent decline as an opportunity to purchase.

Meanwhile, Bitcoin remained the main objective of crypto outings last week. According to the report, investors fired $ 756 million from BTC investment products in last week. In particular, short -term products – have designed to take advantage of the drop in prices – have also seen outings of $ 19.8 million, the largest since December 2024.

This suggests that some investors can approach a capitulation point in their Bitcoin investments, closing their short positions like looms.

Notwithstanding, the crypto outings last week marked another significant drop after previous weeks of prolonged withdrawals. During the first week of March, Digital Asset Investment Products experienced record outings of $ 2.9 billion. As Beincrypto reported, it was fueled by a low feeling of investors and increased fear of the market.

This had occurred at $ 508 million in outings the previous week, in the midst of investor caution and $ 415 million before that, following the bellicist rhetoric of the federal reserve and concerns about inflation.

The position of the federal reserve on monetary policy has shaped the behavior of investors in recent months. Since inflation exceeds expectations, the Fed indicated that interest rates can remain high for an extended period, reducing liquidity in the financial markets and weighing on risk assets such as crypto.

“We don’t need to be in a hurry and are well placed to wait for greater clarity,” said Fed president Jerome Powell last week.

With four consecutive weeks of outputs and persistent macroeconomic opposites, the cryptography market remains under pressure. While some assets like Solana (soil) and XRP continue to attract entrances, the global feeling remains down, especially among American investors.

If market conditions fail to improve, other outings could follow in the coming weeks, strengthening the prudent investors’ approach.

The FNB Bitcoin and Ethereum reflect the lowering feeling

The negative feeling extended beyond bitcoin, affecting the products negotiated in exchange for equity linked to blockchain (andp). The latest Coinshares report indicates outings of $ 48 million during the same period for these financial instruments.

This drop reflects a broader feeling of risk, investors showing caution in the digital asset sector. He aligned himself with a recent Beincrypto report, which has shown that the FNB Bitcoin (Fund negotiated on the stock market) recorded four weeks of net outings exceeding $ 4.5 billion.

Likewise, ETHEREUM ETHERE continued their negative trend, recording a second consecutive week of net outings. These negative flows occur despite the anticipation of the peak of the white house cryptography last week. Outings suggest that macroeconomic concerns and strategic market positioning have overshadowed the impact of the event.

The general feeling is that Trump’s prices cause sour feeling and weaken investors’ confidence. However, some cryptographic analysts hold different opinions, attributing the outings of cryptographic investment products to the hedge fund trading strategies.

“… Hell funds do not care about Bitcoin. They cultivated low risk yield. Now that the trade is dead, they have liquidity – leaving the market in free fall … This is a classic case of liquidity games. The ETFs have not only called upon long -term holders – they called on hedge funds during short -term arbitration, “said Crypto Kyle analyst.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.