Bitcoin ETFs Experience Outflows Ahead of FOMC

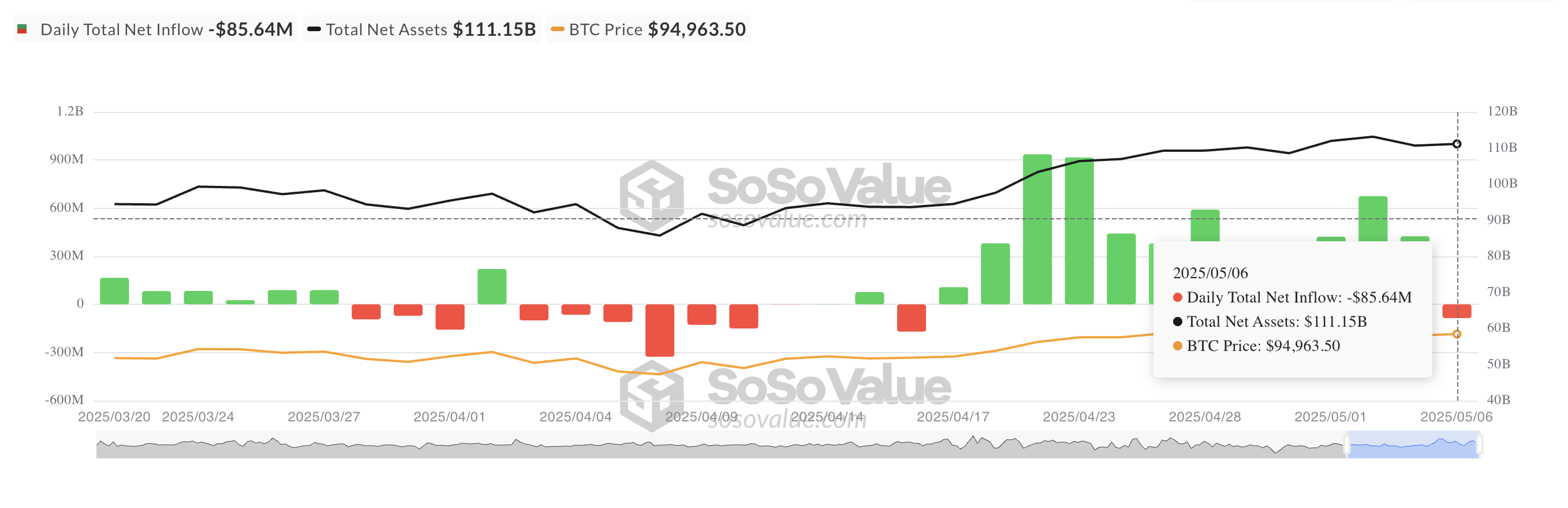

Tuesday, the Bitcoin Spot ETF recorded net outputs, slamming a three -day entry sequence which had brought back more than a billion dollars.

With the uncertainty surrounding the next political decision of the federal reserve, institutional investors seem to reduce their exposure in anticipation of increased volatility of the market.

The institutions withdraw from the BTC ETFs while the Fed’s decision is looming

Tuesday, BTC Spot ETF experienced net outings of $ 85.64 million, marking a change in feeling among institutional investors just before the last political meeting of the American federal reserve today.

The outings occurred after three consecutive days of large entries, totaling more than a billion dollars, in these funds supported by BTC. This suggests a decline because market players are preparing for potential volatility surrounding the announcement of today’s FOMC.

It can also be considered a strategic step to avoid short -term losses in the event of an unfavorable political signal or unexpected market reaction.

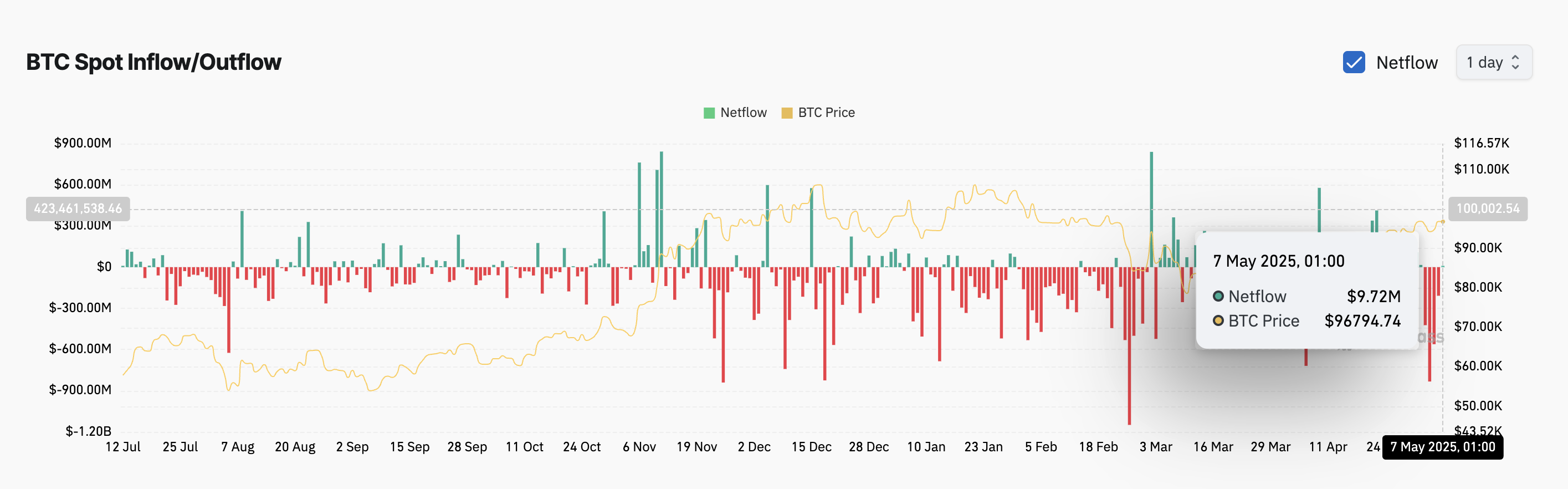

Despite FNB outputs, data on the chain today reveals an increase in net entrances. This indicates that if institutional actors can reduce their exposure to FNB, they could run capital in direct punctual positions, perhaps to capitalize on short-term price fluctuations before and after the Fed announcement.

According to CorciLass, the punctual net inputs of the BTC are at $ 9.72 million. When an asset sees occasional entries, the number of its coins or tokens purchased and moved to the punctual markets has increased, which indicates the increase in demand.

This indicates an increase in accumulation among market participants to the point of the BTC, a trend that can stimulate the assessment of prices if the purchase pressure remains.

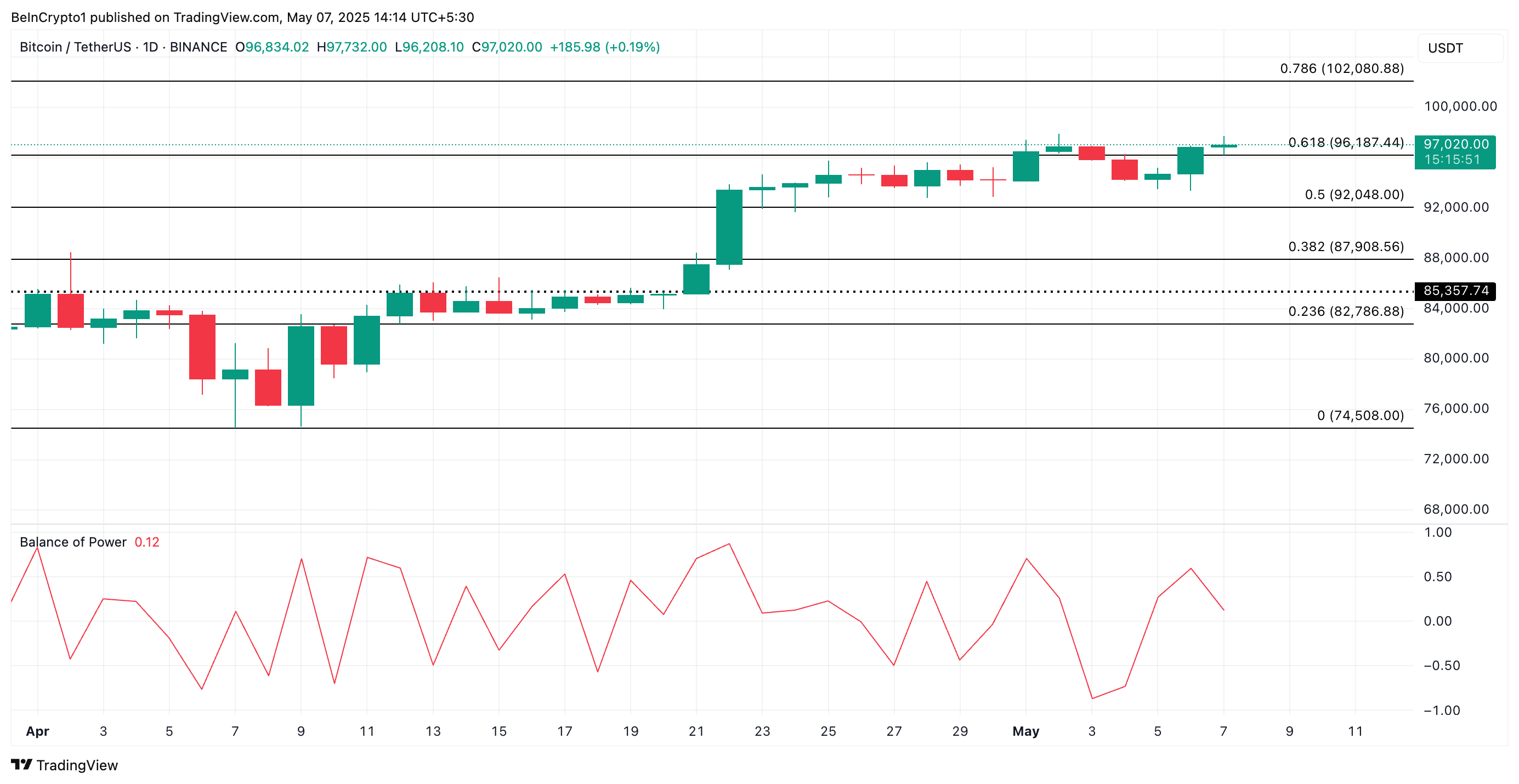

Bitcoin increases on the Buyer’s strength

BTC is traded at $ 96,679 at the time of the press, noting an increase of 2% in the last day. The positive power balance of the part (BOP) reflects the constant increase in the cash purchase activity before the FOMC meeting. To date, it is 0.10.

This indicator measures the strength of buyers compared to sellers by comparing the closing price to the negotiation range over a specific period. When its value is positive, buyers dominate the market, suggesting bullish momentum and upward pressure on the price of an asset.

If the BTC requests rockets and market conditions remains the meeting before the FOMC, it could climb to $ 102,080.

However, if the volatility of the market triggers a downward transition, the BTC could lose recent gains, violate support at $ 96,187 and fall to $ 92,048.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.