Ethereum’s $4,000 Breakout is Just a Matter of Time: 3 Signals Hint the Wait’s Almost Over

Ethereum has increased by almost 3% in the past 24 hours, and the weekly loss has been reduced to only 3.5%. The price now approaching the psychological level of $ 4,000, technicians and chain measures show signs that escape may not be far away.

Three signals in particular connect well.

Short -term holders accumulate again

A reliable way to assess the upcoming momentum is to follow the activity of the portfolio of short -term holders. These are addresses that held Ethereum between 1 and 3 months old, often linked to a new accumulation. According to Hodl Wave data, the percentage of these addresses increased from 9.57% to 11.93% in just under a month, showing a renewed purchasing activity.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

These holders often come during consolidation and play a role in the initiation of eruptions.

The Hodl waves show the percentage of the Ethereum offer held on different durations. The 1 to 3 month cohort is particularly important to identify accumulation during transition phases.

SOPR suggests that sellers lose steam

Supporting this purchasing activity is the behavior of the SOPR metric or a production ratio spent. This indicator follows if the parts sold are in profit. A declining sopr, while the price remains stable or climbs, often indicates that taking advantage has slowed down.

This is exactly what is happening now. SOPR has dropped, even if the price of Ethereum has grown slightly. The last time it happened, at the end of July, ETH gained momentum shortly after. It is a typical fundamental ground. If this behavior continues, he adds strength to the idea that $ 4,000 is at hand.

SOPR helps to measure the conviction of the market. When sellers do not take advantage despite price gains, this suggests growing confidence in a new increase.

Resistance is thinning when buyers intervene; Good for the action of Ethereum prices?

The data on the intotheblock chain in / out of the monetary model show that the current resistance zone is low. Only 11.95 million addresses is just above the current Ethereum price of $ 3,720. This means that fewer holders are able to sell the profitability threshold, which reduces the chances of high resistance between here and the level of $ 3,937.

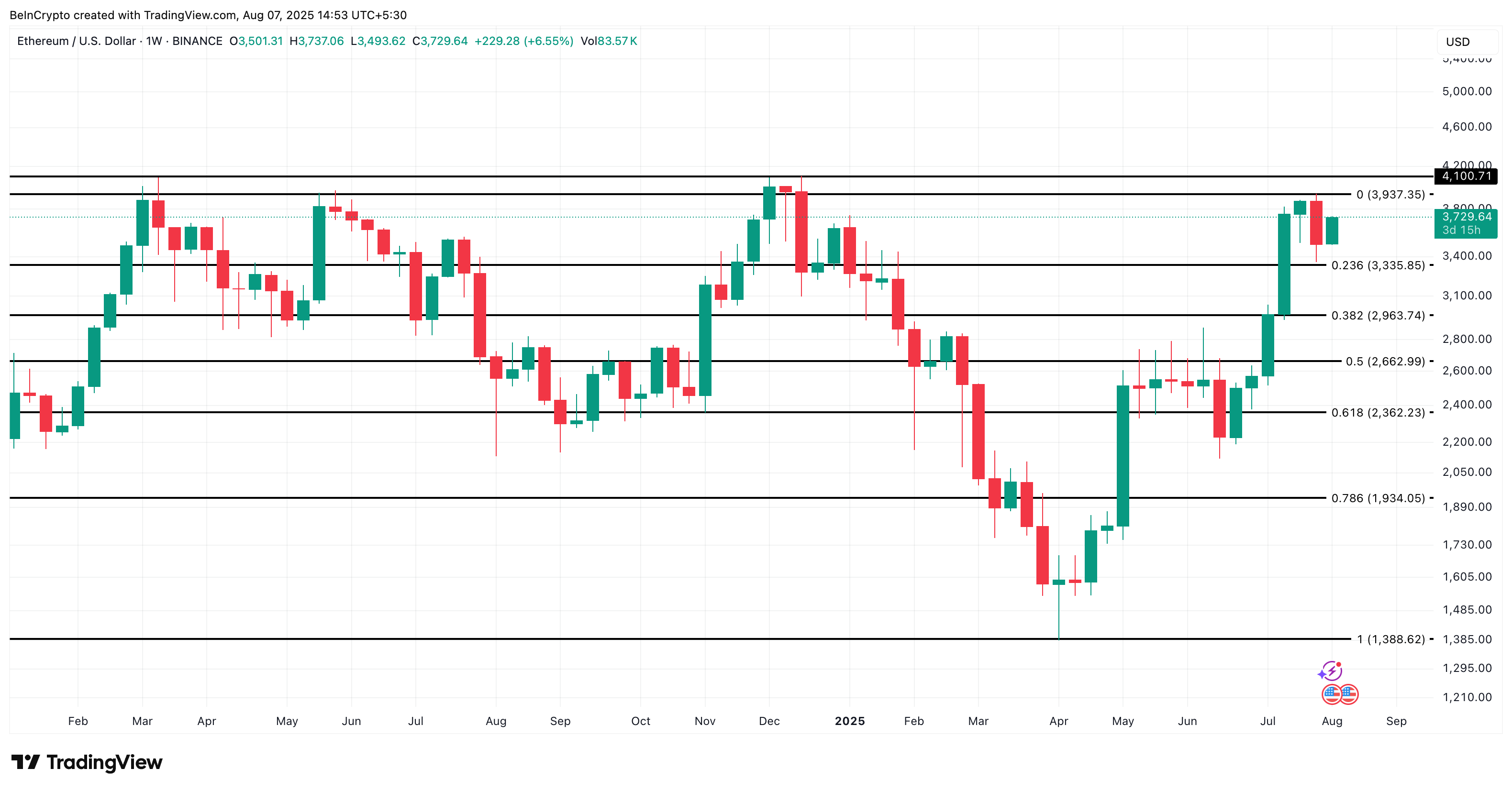

This level; $ 3,937, is essential according to the weekly price table. In previous cycles, Ethereum was rejected nearly $ 4,100; March 2024 and twice in December 2024. But this time, Eth Price has not yet tested $ 4,000, despite detention over $ 3,300 since June. It has been holding the bar of $ 4,000 in suffering for a long time.

Note: a weekly graphic is used to cut the movement linked to the beach; Something eTh has been stuck for a while now.

If Ethereum convincingly erases $ 3,937, the above sale of sale makes a rally exceeding $ 4,000 more and more likely. However, if the sales pressure increases with SOPR diving in accordance with price corrections or if short -term buyers turn into sellers, $ 3,335 would be a key level to monitor.

A violation under this, even more over a larger period, can turn the lower structure, invalidating the current hypothesis.

The escape of the Post Ethereum of $ 4,000 is only a matter of time: 3 signals suggest that the wait almost appeared on Beincrypto.