GIGA, Pushes Up With 16% Rise

The same parts continued to display gains, led by smaller market capitalization tokens. One was Harrypotterobasonic10inu (Bitcoin), which posted a 21% increase in the last 24 hours.

Beincryptto analyzed two other coins for investors to look at when print two -digit gains.

Gighad (Giga)

- Launch date – January 2024

- Power supply in total circulation – 9.60 billion giga

- Maximum power supply – 10 billion giga

- Fully diluted evaluation (FDV) – $ 261.92 million

- Contract address – 63LFDMNB3MQ8MW9MTZ2TO9BEA2M71KZUGQ5TIJXCQJ9

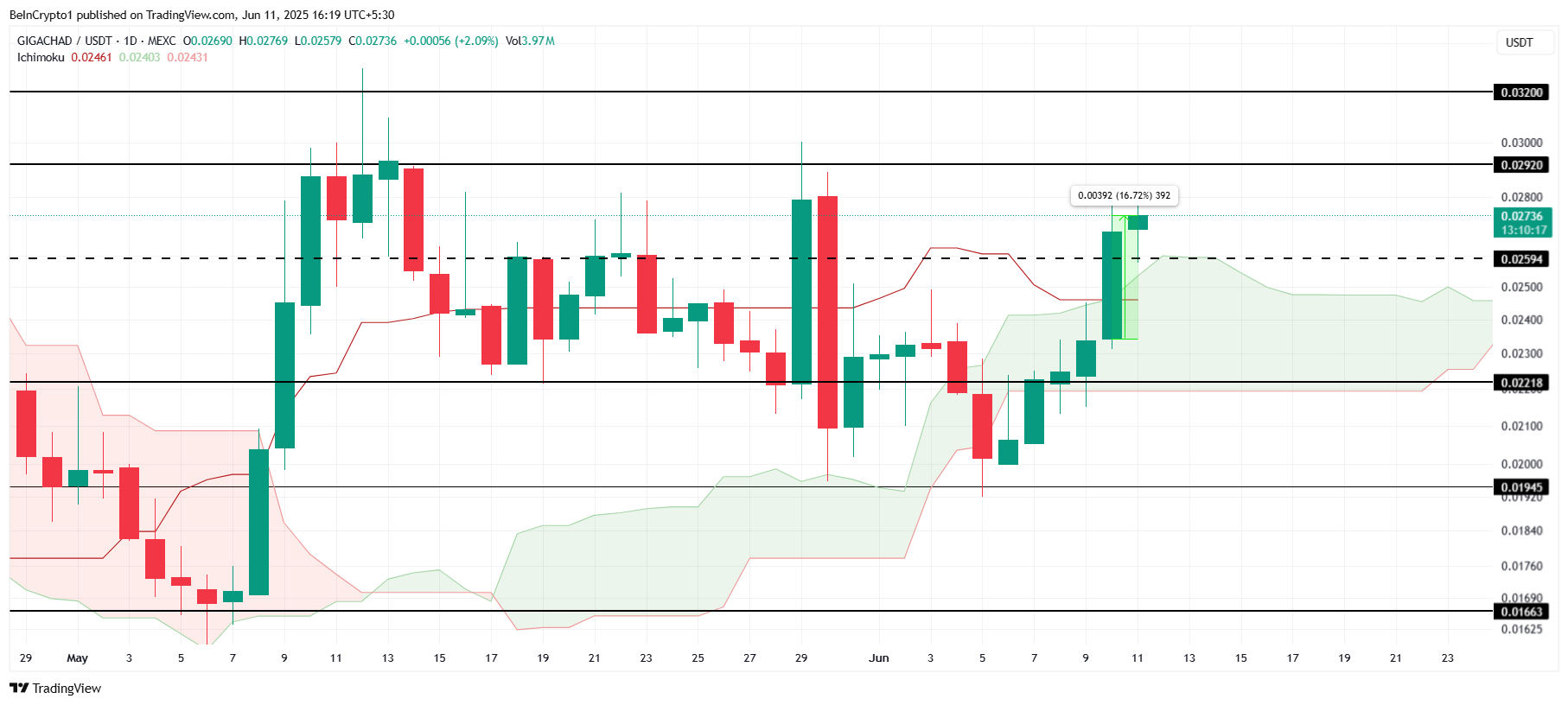

GIGA posted an increase of 16% in the last 24 hours, currently negotiating at $ 0.0273. Despite the strong ascending movement, the same piece is faced with resistance at $ 0.0292, a level that persisted in the last month. The main challenge for Giga will be to violate this barrier to continue its growth.

The Ichimoku cloud, positioned under the candlesticks, indicates that the bullish impulse is likely to continue. If Giga can secure the local resistance level of $ 0.0259 as a support, it could exceed the resistance of $ 0.0292. This would open the way to Giga to reach $ 0.0320, continuing its ascending trajectory.

However, if Giga does not hold $ 0.0259 as a support and faces the sales pressure, the Altcoin could drop to $ 0.0221. Such a drop would invalidate upward perspectives and signal a potential reversal, undergoing positive impetus and causing new losses for investors.

Launch Coin on Believe (Launchcoin)

- Launch date – January 2025

- Power supply in total circulation – 999.87 million launch

- Maximum power supply – 1 billion launch

- Fully diluted evaluation (FDV) – 232.62 million dollars

- Contract address – EY59PH7Z4BFU4HJYKNYMDWT5GGN76KAZTAWQIHOUXRK

Launchcoin has increased by 19% in the last 24 hours, currently negotiating at $ 0.233. The room even tries to secure $ 0.219 as a support level. If this support is valid, it could open the way to an additional upward movement, the next target being the resistance of $ 0.300.

The parabolic SAR is positioned under the candlesticks, indicating that the upward trend should continue. This Haussier signal could help the launch push towards the resistance of $ 0.300. If the momentum is strengthened, Altcoin could unravel this resistance and evolve towards higher price levels, benefiting from increased confidence of investors.

However, if the sale of pressure is strengthened and investors liquidate their assets, the Launchcoin price could drop from the support of $ 0.219. A decrease to $ 0.149 would invalidate upward perspectives, signaling a reversal of potential trend. This would cause significant losses for those who hold the meme piece.

Corner of Petit Cap – Harrypotterobasonic10inu (Bitcoin)

- Launch date – July 2023

- Power supply in total circulation – 999.79 million bitcoin

- Maximum power supply – 1 billion bitcoin

- Fully diluted evaluation (FDV) – $ 79.75 million

- Contract address – 0x72e4f9f808c49a2a61de9c5896298920dc4eea9

Bitcoin jumped 21.6% in the last 24 hours, currently negotiating at $ 0.095. The room even reaches a monthly summit and works to secure $ 0.094 as a support floor. If this level has remained, the part could continue its rise upwards and target higher price levels.

The 50 -day EMA is positioned well below the candlesticks, indicating a strong bullish momentum. This suggests that the upward trend should continue. With the support of 25,000 investors, Bitcoin could push towards the psychological barrier of $ 0.100. If market conditions remain favorable, this objective could soon be achieved.

However, if the bullish momentum does not materialize, a drop to $ 0.090 is likely. The loss of this support would further weaken the price, which potentially sent a bitcoin to $ 0.081. Such a decision would invalidate current upward perspectives and arouse concerns about additional cooling.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.