Global Turmoil Is Not Stopping Crypto Inflows, Capital Hits $1.2B

The last Coinshares report shows that global disorders do not stop cryptographic capital. Despite increased geopolitical uncertainty, crypto entries reached a 10th consecutive week, reflecting investors’ resilience to volatility.

Meanwhile, increased volatility occurs in the midst of exacerbated tensions in the Middle East, with superpowers like the United States, Russia and China that are now taking sides.

Bitcoin and Ethereum continue to lead while crypto entries reached $ 1.2 billion

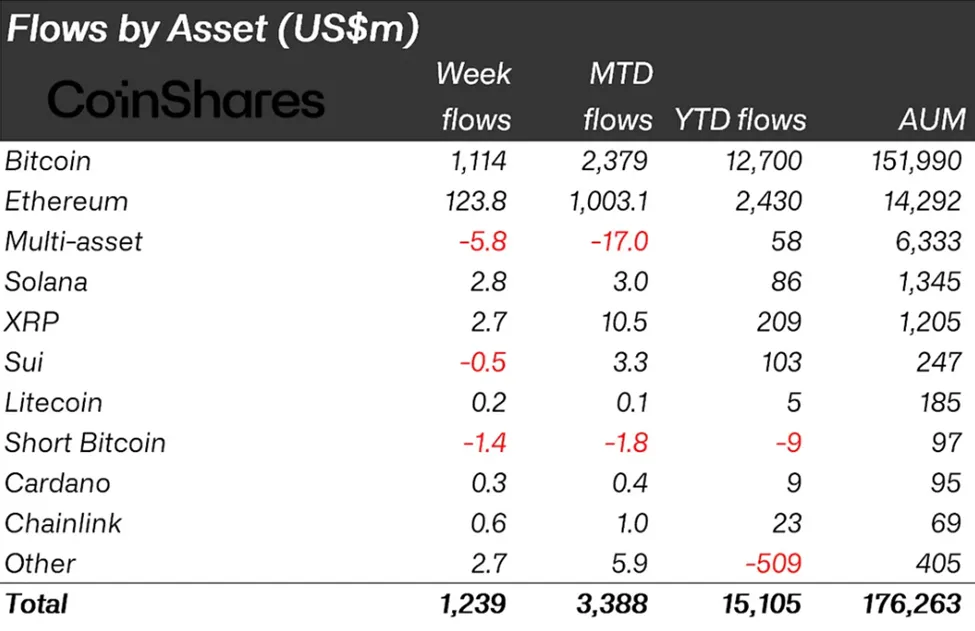

According to the latest weekly Coinshares report, crypto entrances totaled $ 1.24 billion in last week, pushing year -off at the start of the year (YTD) to a record of $ 15.1 billion.

Although this marks a decline compared to the $ 1.9 billion that the previous week always represents a strong continuation of the bullish feeling.

“Digital Asset Investment Products recorded its 10th consecutive week of entries, totaling $ 1.24 billion last week and pushing year -round year (YTD) at a new summit of $ 15.1 billion,” noted James Butterfill in Coinshares.

The report underlined a slowdown in entries during the last part of the week, awarded to the Junestent Lancers and emerging reports of the United States participation in the Iranian conflict.

Based on the report, Bitcoin continued to dominate cryptography entries, pulling $ 1.1 billion despite recent prices.

“Bitcoin had a second consecutive week of entries … indicating that investors bought weakness,” added Butterfill.

In particular, short -term products have recorded minor outings of $ 1.4 million, further strengthening the bullish positioning. Ethereum maintained its momentum with $ 124 million entries, marking its ninth week of winnings.

This brings Ethereum’s cumulative entries during this short period since mid-201.

Two weeks ago, Beincrypto reported that Ethereum had its strongest entry sequence since the American elections, contributing significantly in total of $ 224 million that week. The previous week, crypto entries reached $ 286 million, led once again by Ethereum.

Other altcoins showing modest entries include Solana with $ 2.78 million and XRP with $ 2.69 million. This result reflects a wider appetite for the main active ingredients in layer 1 beyond bitcoin and etherum.

Analysts say that uncertainty due to geopolitical tension has investors who pient cryptos with fundamental solids.

Regional flows reflect the divergent feeling

More closely, the report shows that the United States has led an overwhelming majority of regional entries with $ 1.25 billion. This suggests a strong interior demand, probably linked to the recent gathering in institutional interest.

While the total of this week was less than $ 1.9 billion from last week, continuous entries in the middle of macroeconomic and geopolitical factors mean that investors are still positioning themselves for long -term gains.

Bitcoin and Ethereum continue to attract institutional demand and stable detail, a breaded market for the wider market. With $ 15.1 billion already recorded YTD, 2025 could be underway to exceed previous recordings for crypto entries, market dynamics and macro-waonditions remain stable.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.