Ethereum Long-Term Holders are Selling – Is ETH About to Drop?

On June 20, a key metric on the chain according to the behavior of long -term holders of the ETH (LTHS) closed at its record level, signaling the sales pressure of this cohort.

This happens at a time when the larger market momentum has cooled considerably. With the demand for weakening ETH and the investors largely sidelined in the middle of a persistent market lull, the lowering feeling increases.

Ethereum Vivacity strikes a high record

According to Glassnode, the vivacity of ETH increased at a summit of 0.69 during the negotiation session on Friday. This metric follows the movement of the long -term / dormant tokens. He does this by measuring the report of the days of currency of an assets destroyed with the total accumulated currency.

When this metric falls, the LTHs of an asset deploy their assets of the exchanges, a movement considered as an accumulation signal. On the other hand, as for ETH, when he goes up, the LTH move their pieces to exchanges to sell them.

This increase in the liveliness of ETH to 0.69 suggests that its liquid LTHS increasingly their positions as uncertainty increases. It reflects the growing lack of confidence in the resumption of short -term prices of the medal.

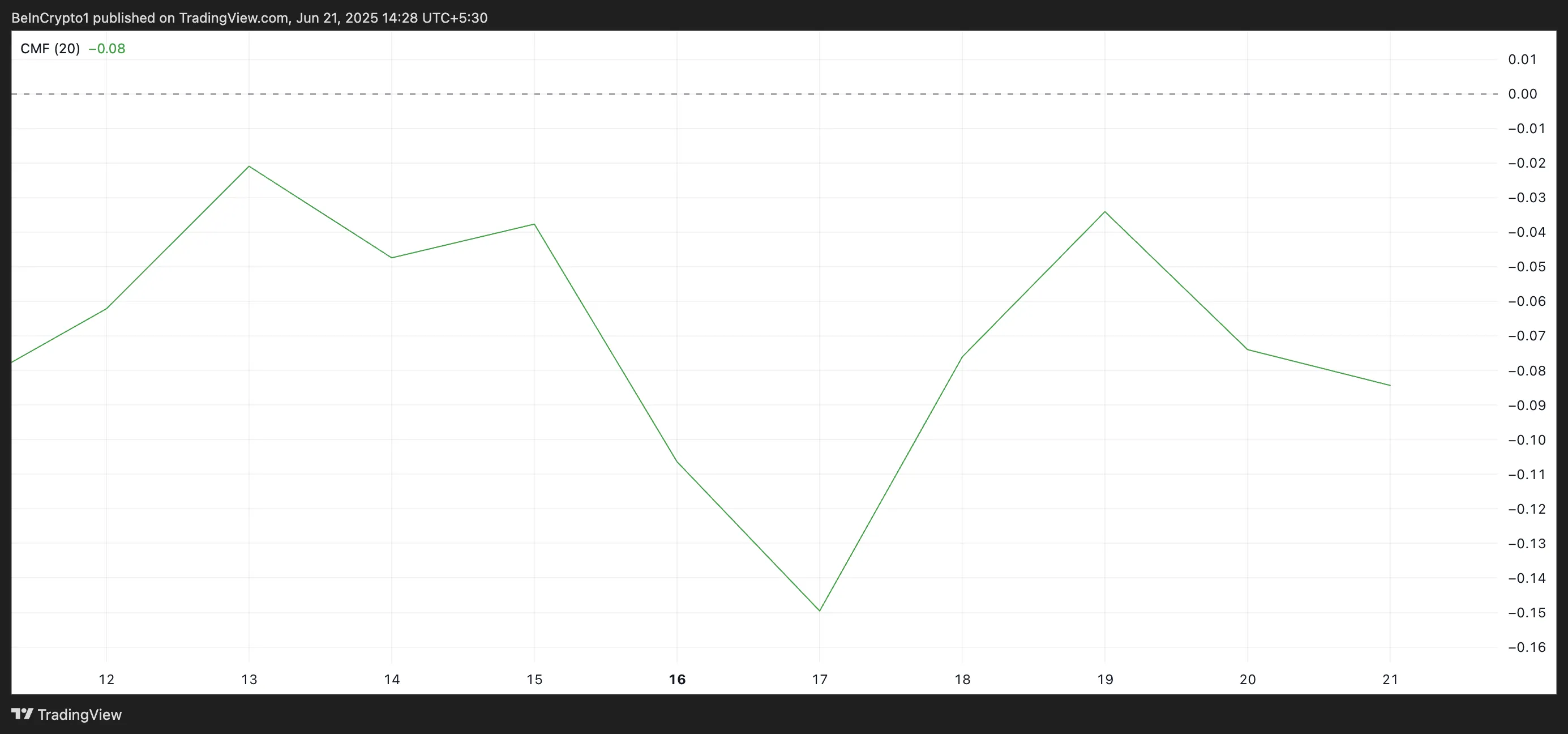

Additional confirmation of this downward trend can be found on the daily graphic of ETH, where the flow of chaikin silver of the room (CMF) is negative and tends the decline. To date, the CMF of ETH is at -0.08, indicating a drop in capital entries.

The CMF indicator measures the silver flow in and outside an asset. When its value is negative, it signals a low purchase interest and validates the transition to distribution rather than accumulation.

Eth eyes fall off in May

The persistent unloading of long -term ETH holders, combined with the drop in demand on the market scale, could make it see a deeper correction in the short term.

At the time of the press, the Altcoin leader is negotiated at $ 2,429. If the sellers persist among ETH holders, the room could drop to $ 2,185. If this floor price does not hold, the part could drop more to $ 2,027, a weak that he reached in May for the last time.

Conversely, an resurgence of the new request for Altcoin will invalidate this downward perspective. In this scenario, its price could reverse its downward trend and climb to $ 2,745.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.