GRASS Jumps 30% in a Week, More Gains Ahead?

Grass jumped almost 30% in last week, with its market capitalization of $ 415 million and its price exceeding $ 1.70 for the first time since March 10.

This high performance was supported by bullish technical signals, including a Bbtrend still positive and an ADX increasing. However, with Momentum indicators starting to cool slightly, the next few days will be essential to determine whether the grass continues its rally or enters a period of consolidation.

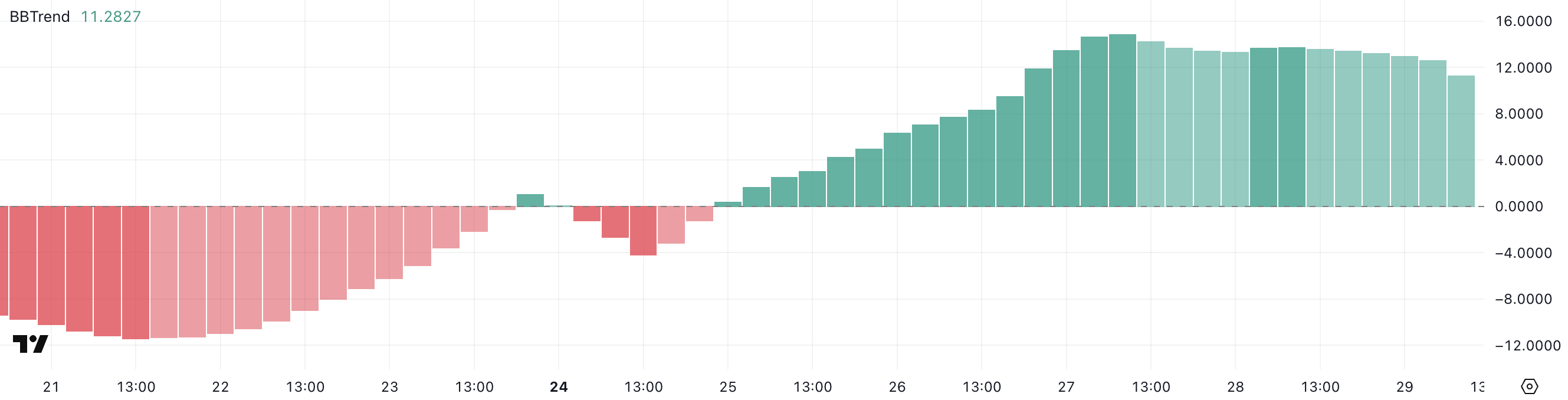

Grass Bbtrend remains strong, but is slightly down

Bbtrend de Grass is currently at 11:28 a.m., marking the fourth consecutive day in positive territory, after having culminated at 14.85 two days ago.

The Bbtrend (Bollinger Band Trend) indicator measures the strength of price trends by analyzing how far the price moves away from its mobile average in Bollinger strips.

Generally, the values higher than zero indicate an upward trend, while the values lower than zero suggest a downward trend. The higher the positive reading, the higher the bullish impulse, while deep negative values reflect strong sales pressure.

With the grass retaining a Bbtrend of 11.28, the token is always in an active rise trend, although slightly colder than its recent peak.

Supported positive bbtrend readings generally point out that buyers remain in control and that the upward dynamics could continue.

However, the slight withdrawal of 14.85 may suggest that the momentum begins to relax. If the BBTREND begins to decrease more, it could be an early sign of consolidation or a possible reversal.

For the moment, the grass seems to keep the bullish momentum, but traders should closely monitor any change in trend force.

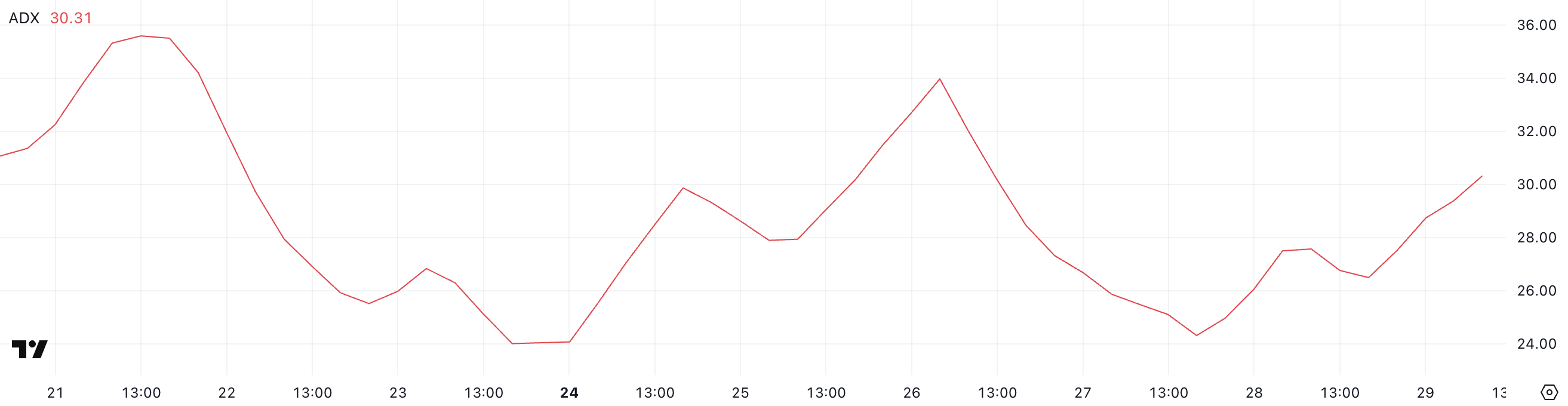

Grass Adx shows that the upward trend becomes stronger

The grass is currently on an upward trend, its average directional index (ADX) passing to 30.31 of 26.49 just one day, indicating a moment of strengthening trend.

ADX is a widely used technical indicator that measures the strength of a trend, whatever its direction, on a scale of 0 to 100.

The values less than 20 suggest a low or non -existent trend, while readings greater than 25 indicate that a trend is gaining ground.

When the ADX exceeds 30, it generally indicates that the trend becomes well established and can continue in the same direction.

With Adx de Grass now above threshold 30, the current upward trend seems to gain strength. This suggests that the bullish momentum approaches and that prices’ action can continue to promote short -term increase.

As long as the ADX remains high or continues to climb, the trend is likely to maintain, attracting more interest from Momentum traders.

However, if the ADX begins to complain or to reverse, this could report a slowdown or a potential consolidation phase to come.

The grass could soon form a new golden cross

The exponential mobile average lines of Grass (EMA) show signs of a potential golden cross, a bull-in-hand signal that occurs when a short-term EMA crosses an EMA above an EMA in the long term.

If this crossover confirms, it could mark the start of a sustained upward trend. The grass is likely to test immediate resistance at $ 1.85 because certain artificial intelligence parts are starting to recover a good time.

If the bullish momentum last week persists, the token can push even higher up to $ 2.26 and finally $ 2.56 or $ 2.79, possibly solidifying its position as one of the most efficient altcoins on the market.

However, if the trend does not hold and the feeling changes its bearish, the grass could withdraw to retest support at $ 1.63.

A break below this level could open the door to a deeper correction, which could reduce the price to $ 1.22.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.