Hodler’s Digest, March 2 – 8 – Cointelegraph Magazine

|

The best stories of the week

Donald Trump signs an executive decree for the strategic bitcoin reserve

US President Donald Trump has signed an executive decree that creates a “strategic bitcoin reserve” and “digital asset storage”, which will initially use confiscated cryptocurrency in government criminal cases.

“Barely a few minutes ago, President Trump signed an executive decree to establish a strategic bitcoin reserve,” said the White House AI and the Crypto-Tsar David Sacks in an article on March 7 on X.

“The reserve will be capitalized with bitcoin belonging to the federal government which was lost in the context of the confiscation of criminal or civil assets,” he added.

In addition, an information sheet of March 6 of the White House said that the prescription also establishes “storage of the American digital asset”, which, according to Sacks, would be made up of cryptocurrencies other than Bitcoin.

SBF sent to isolation of isolation on the maintenance of Tucker Carlson: Report

The former CEO of the FTX, Sam “SBF” Bankman, would have been sent to cell isolation after participating in an interview with the right -wing political commentator Tucker Carlson, who was not approved by the penitentiary authorities.

“This special interview was not approved,” a representative of the American prisons office in New York Times said on March 7.

According to a person informed of the situation, after the publication of the interview with Bankman Fried with Carlson, he was sent to the lonely assistance at the Brooklyn metropolitan detention center, where he has been detained since August 2023.

The prisons office would have strict rules on who can communicate with prisoners and how they can do it.

WOI presents the Crypto banks after Trump dressed in ending the ChokePoint 2.0 operation

The American Currency Controller Office (OCC) has released its position on how banks can engage with the crypto only a few hours after US President Donald Trump has promised to end prolonged repression restricting the access of cryptographic companies to banking services.

“Crypto-andst police custody, certain Stablecoin activities and participation in independent nodes verification networks such as the big book distributed are authorized to national banks and federal savings associations,” the WOI said in a press release on March 7.

The occurrence confirmed in a document entitled “Letter of interpretation 1183” The fact that financial institutions supervised by OUC no longer need “non-comprehensive supervision” to engage in activities related to crypto.

“Today’s action will reduce the burden of banks to engage in activities related to the crypto and guarantee that these banking activities are treated in a coherent manner by the WC,” said the acting controller of the currency Rodney E. Hood.

The FDIC is resistant to the transparency of Operation Chokepoint 2.0 – Coinbase Clo

Some US government agencies continue to deny transparency concerning their role in the ChokePoint 2.0 operation, a period of the Biden administration when the founders of Crypto and Tech have refused banking services, according to the chief legal director of Coinbase, Paul Grewal.

The collapse of Crypto friendly banks in early 2023 sparked the first Operation allegations Choke Point 2.0. Critics, whose venture capital Nic Carter described it as a government effort to put pressure on banks to reduce links with cryptocurrency companies.

Despite recent regulatory changes, agencies such as the Federal Deposit Insurance Corporation (FDIC) continue to “resist basic efforts of basic transparency”, said Grewal in a March 8 position on X.

“They did not receive the message,” he wrote.

The United States will use stablecoins to ensure the hegemony of the dollar – Scott Bessent

The United States Secretary of the Treasury, Scott Bessent, said the US government would use stablecoins to ensure that the US dollar remains the world’s reserve currency at the White House cryptography summit on March 7.

Bessent reiterated the Trump administration’s promise to end the war against the crypto and has committed to retreating the previous directives of the IRS and the punitive regulatory measures. Bessent then turned his attention to the Stablecoins and said:

“We are going to think a lot about the Stablecoin regime, and as President Trump has managed, we will keep the United States [dollar] The dominant reserve currency in the world, and we will use stablecoins to do so. »»

President Trump said at the top that he hoped that the legislators will obtain a complete stablecoin regulatory bill at his office before the August congress break.

“I think there are more than 50% chance that we will see heights of all time before the end of June this year.”

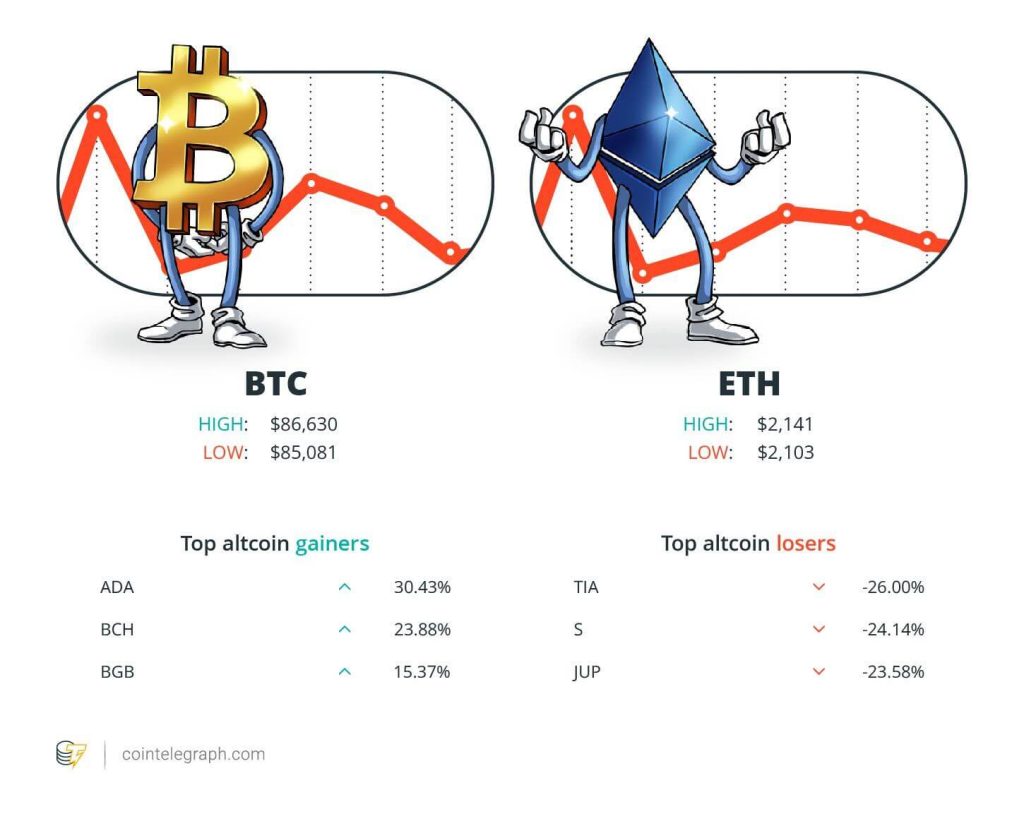

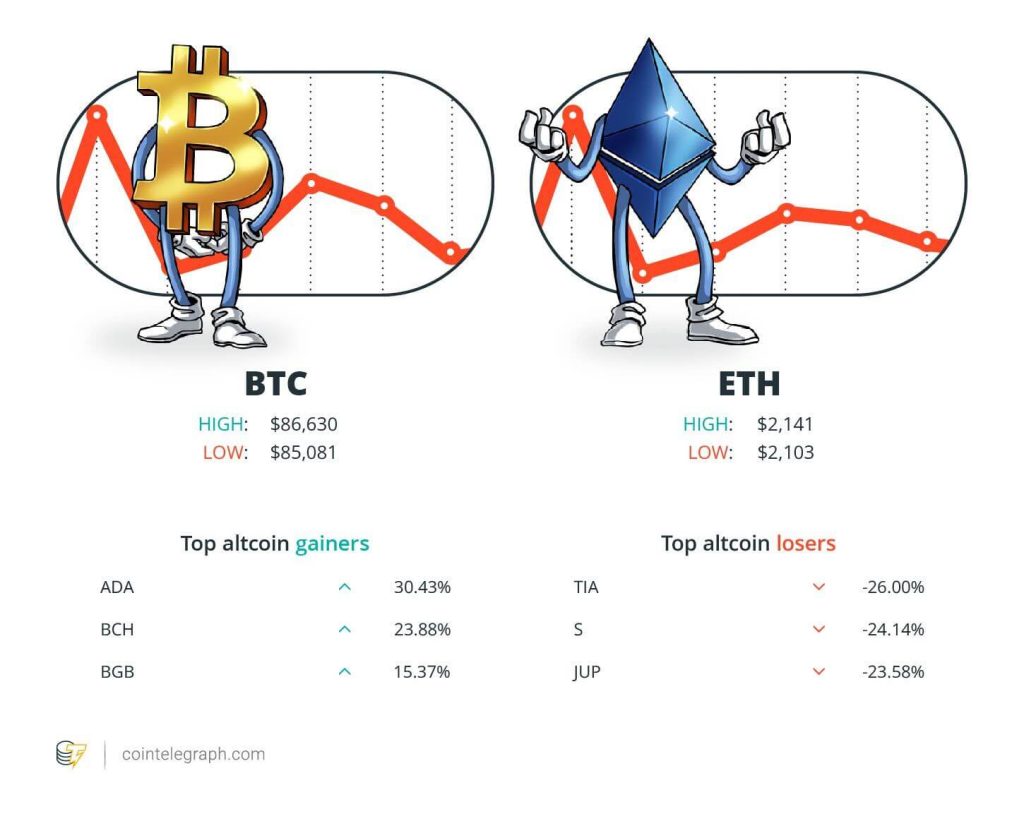

Winners and losers

At the end of the week, Bitcoin (BTC)) is $ 86,630 Ether (Ethn)) has $ 2,141 And Xrp has $ 2.39. Total market capitalization is at $ 2.85 Billion Billions, according to CoinmarketCap.

Among the 100 largest cryptocurrencies, the three main gains of the week are Cardano (ADA) At 30.43%, Bitcoin Cash (BCH) at 23.88% and Bitget token (BGB) at 15.37%.

The three main Altcoin losers of the week are Celestia (Tia) At 26.00%, Sonic (previous FTM) (S) at 24.14% and Jupiter (JUP) to 23.58%. For more information on cryptography prices, be sure to read Cointelegraph market analysis.

Most memorable quotes

“I think there are more than 50% chance that we will see heights of all time before the end of June this year.”

Cory KlippstenCEO of Swan Bitcoin

“The launch of Trump and Melania marked the summit for the same because he sucked the liquidity and the attention of all the other cryptocurrencies.”

Bobby NGOCoingecko co-founder

“I don’t think I was a criminal.”

Sam Bankman FritOld CEO of FTX

“Barely a few minutes ago, President Trump signed an executive decree to establish a Bitcoin strategic reserve.”

David SacksWhite House Ai and Czar Crypto

“We didn’t know that ADA was selected for the reserve. It was news for me. “

Charles HoskinsonFounder of Cardano

“If that did not stop when the world has ostraca and most of the” bitcoiners “have abandoned us, that will not stop now, and it will not stop in the future.”

Nayib BukelePresident of Salvador

Superior prediction of the week

Bitcoin has “more than 50% chances” High again by June: Cory Klippsten

The chances that Bitcoin exceeds its summit of $ 109,000 in June is favorable, but the market first needs time to absorb volatile macroeconomic conditions, explains the CEO of Swan Bitcoin, Cory Klippsten.

Read

Features

The Australian cryptography laws in Australia are at a crossroads: inner history

Features

You say you want a revolution: what blockchain can learn from a man’s attempt to save the world

“I think there are more than 50% chance that we will see heights of all time before the end of June this year,” Klippsteten told Cointelegraph.

However, he said market players should first adapt to the pricing threats from US President Donald Trump and uncertainty about inflation rates.

“The market must first digest the prices, fears of the trade war and the fears of growth. Bitcoin the merchant below $ 100,000 at the moment looks like a break, not at the end of the bull,” he said.

Top Fud of the week

Samecoins is probably dead at the moment, but they will be back: Coingecko

Enthusiasm for sames seems to have cooled after a series of bad launches and that the carpet is taking the death of investors, according to the founder of Coingecko, Bobby NGO.

The metrics of the pump in Token Launchpad.

Read

Features

Cristo Cristo: Can Fud ever be useful?

Features

How to protect your crypto in a volatile market: OG and Bitcoin experts weigh

“The launch of Trump and Melania marked the summit for the same because it sucked the liquidity and attention of all the other cryptocurrencies,” NGO said.

Us Crypto Sanctions related to Nemeis Darknet Marketplace

The American authorities have sanctioned the operator of an online closed Darknet market, including its crypto addresses, which recently took advantage of the price of the Bitcoin price.

Behrouz Parsarad, based in Iran, created the Nemesis on the Darknet market in 2021 and used it to facilitate the sale of drugs, false identification documents, professional hacking resources and a variety of other illegal services for cybercriminals, said the US Foreign active control office in a March 4 press release.

Under sanctions, American citizens are now prevented from dealing with Parsarad and all companies where it holds more than 50%.

Solana sees $ 485 million released in February while Crypto Capital fled to “security”

Solana saw almost half a billion dollars out of outings last month when investors moved to what was perceived as safer digital assets, reflecting growing uncertainty in the cryptocurrency market.

Solana has been affected by more than $ 485 million outings in the past 30 days, with investor capital which mainly extend to Ethereum, Arbitrum and the BNB chain.

The exodus of the capital occurred in the middle of a wider flight to “security” among the cryptography market players, according to a research report in binance shared with Cointelegraph.

“Overall, there is a wider flight to the safety in cryptographic markets, the domination of the bitcoin increasing by 1% during the month to 59.6%,” said the report.

Top Magazine Histories of the week

The U-turn of the dry on the crypto leaves key questions unanswered

Crypto wins the main legal battles in the United States and develops in importance on the world scene – but the fight for regulatory clarity continues.

Meet the lawyer Max Burwick – “The ambulance hunter of the crypto”

The lawyer based in New York following Pump.fun and the creators of the Hawk Tuah Memecoin says that when you are in the eyes of the public, “you are forced to have heat.”

Mystery Celeb same scam factory, HK Firm Dumps Bitcoin: Asia Express

Shenzhen Memecoin Factory according to celebrity scams, the Hong Kong company sells most of its bitcoin, the repression of telegram crooks, and more.

Get down

The most engaging can be read in the blockchain. Delivered once a week.

Editorial

The editors and journalists of Cintelelelegraph magazine contributed to this article.

![Blucera Access with Tekedia Mini-MBA Annual Registration [video] Blucera Access with Tekedia Mini-MBA Annual Registration [video]](https://i3.wp.com/tkcdn.tekedia.com/wp-content/uploads/2025/03/16135221/blucera.jpg?w=390&resize=390,220&ssl=1)