Strategy Scoops Up 15,355 Bitcoin as Max Keiser Declares Corporations Must ‘Saylorize’ To Survive | US Crypto News

Welcome to the US Morning Crypto News briefing – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee to see what analysts say about Bitcoin in the middle of the force test between the BTC giant strategy (formerly Microstrategy) and the investment company of Jack Mallers, 21 capital. With their Bitcoin models that come in question, is there a specific definition of what it means to gain in Bitcoin?

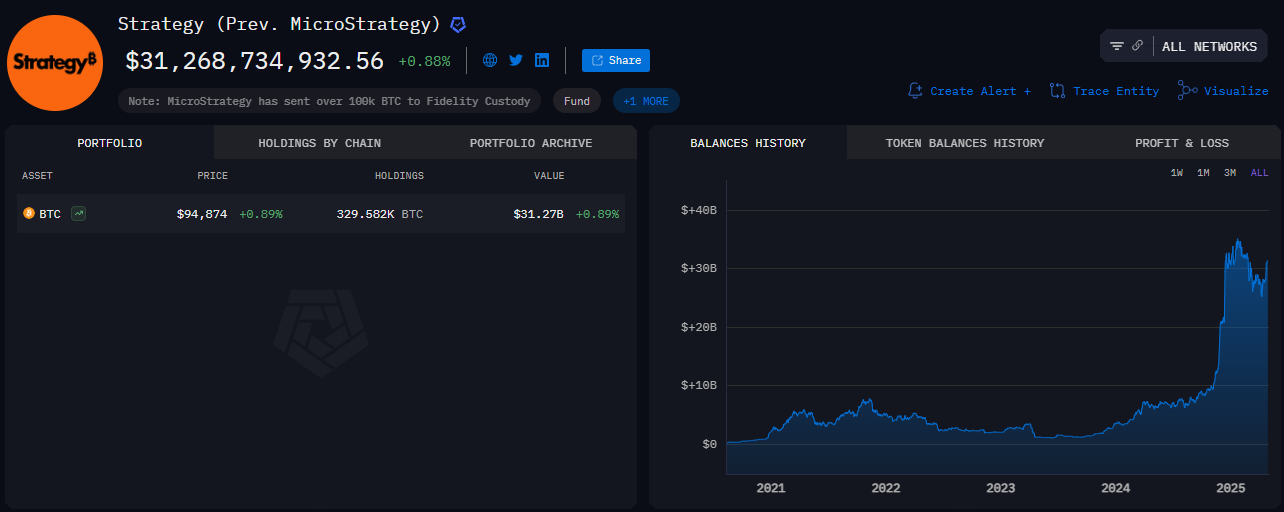

The strategy increases Bitcoin Stockpile, buys $ 1.42 billion in BTC

The strategy announced that it had recently bought an additional 15,355 BTC worth around $ 1.42 billion at an average price of $ 92,737 last week.

The company currently holds 553,555 BTC, valued at around 52.7 billion dollars. The average purchase price is $ 68,459 and the unpaid profit is $ 14.8 billion.

“By continuing to increase its Bitcoin holdings, the company maintains its status of force majeure on the cryptocurrency market, aroused interests of investors and industry analysts. The strategy is the largest Bitcoin cash company, an independent company and listed on the stock market and a Nasdaq 100 “actions of the NASDAQ 100,” reported Phoenix.

Meanwhile, as the strategy accelerates its Spree Bitcoin, 21 capital begins a “viral effect” where companies turn to BTC accumulation.

A recent American publication of Crypto News highlighted the advent of 21 capital. Investment company Bitcoin germinated after Cantor Fitzgerald, SoftBank, Tether and Bitfinex gathered by $ 3 billion in capital.

Based on the feeling, this new company could inadvertently contest the position of the strategy at the head of the property of business bitcoin in the model sense. According to 21 capital, the size of the strategy could make it difficult to increase its bitcoin per share, metric investors tend to consider.

In the midst of a chatter that 21 capital could threaten the firm led by Michael Saylor, Bitstrategy, a strategy shareholder, challenged the business model of the market potential.

The tension grows in the space of the Bitcoin treasure

In a detailed article on X (Twitter), Bitstrategy recognized the brewing tension in the Bitcoin Treasury Arena. However, he maintains that the strategy is ahead of the competition.

“Their business is in direct competition with ours, and they seek to exploit a perceived vulnerability in our structure, openly emphasizing their forces in relation to ours to gain investment,” challenged Bitstrategy in a recent article.

Beyond the BTC yield, also reported in a recent American publication of Crypto, the firm launched key performance indicators months ago – BTC Gain and BTC $ Gain.

- Bitcoin gain multiplies the BTC yield by the overall balance of the strategy, reflecting the extent of the company’s operations.

- The Bitcoin $ gain goes further, converting the BTC gain in terms of dollars, for additional transparency.

This strategy proactivity suggests a commitment to defend its position as a major Bitcoin restraint company in the midst of growing rivals.

“You can simulate an impressive BTC return. You cannot simulate an impressive BTC gain,” said Bitstrategy.

However, analyst Kenjikoshu argues that if the strategy can show substantial bitcoin gains, small businesses like 21 capital could reach a higher Bitcoin.

“As a person who has made an in-depth reflection on the reason why MSTR is undervalued, it might be true that BTC gain can always be substantial if not higher for MSTR. However, which would support action; it will be difficult to deny a smaller and similar reputation strategy will do more bitcoin by action when on the same strategy,” the analyst wrote.

These perspectives align with the feeling of 21 capital that the large size of the strategy prevents increasing its bitcoin per share.

However, Bitstrategy explained that the BTC and Gain BTC $ gain point indicates the importance of an entire performance vision compared to a sharing view.

According to the shareholder, there is no conventional evaluation methodology agreed for Bitcoin companies. This means that a metric is somewhat arbitrary.

In the middle of this confusion, Beincrypto contacted Max Keizer, the Bitcoin pioneer who helped the adoption by El Salvador de Bitcoin.

“”For companies to survive, they must imitate the strategy process, they must “say” or die, “Keizer told Beincrypto.

According to Keizer, the world goes to a Bitcoin standard, and any fiduciary currency, even with stablecoins supports them, is condemned.

Graphic of the day

Alpha the size of an byte

- Bitcoin approaches $ 95,700, driven by extreme greed and high optimism in the feeling of social media.

- Investors are increasingly turning to digital assets as a refuge, Bitcoin becoming coverage against the volatility of the US dollar while crypto entries reach $ 3.4 billion.

- Ethereum’s new proposal could propel TP to 2,000, suggesting a deterministic exponential growth plan to gradually increase the gas limit.

- Bitwise CEO says institutional investors lead the current Bitcoin rally, not Fomo. He says that explains why the Bitcoin search volume on Google Trends has dropped sharply.

- The approval of the optimism of the FUTUS FUTURE FNB proshares is expanding optimism, with predictions that an ETF Spot could follow, potentially attracting $ 100 billion to XRP.

- This week, three crypto air opportunities will offer investors an early entry into projects with high growth potential, inspired by significant financial support.

- The new Creation of XRP addresses reaches a level of two weeks to 3,677, indicating an increasing confidence of investors and a new market capitalization.

- The founders of World Liberty Financial and Changpeng Zhao met in Abu Dhabi to discuss the standardization of cryptographic industry and the strengthening of global adoption efforts.

Presentation of the actions of the crypto-actions

| Business | At the end of April 25 | Preview before the market |

| Strategy (MSTR) | $ 368.71 | $ 373.50 (+ 1.30%) |

| Coinbase Global (Coin) | $ 209.64 | $ 208.71 (-0.44%) |

| Galaxy Digital Holdings (Glxy.to) | $ 20.63 | $ 20.54 (-0.44%) |

| Mara Holdings (Mara) | $ 14.30 | $ 14.41 (+ 0.77%) |

| Riot platforms (riot) | $ 7.77 | $ 7.84 (+ 0.90%) |

| Core Scientific (Corz) | $ 8.31 | $ 8.37 (+ 0.72%) |

Non-liability clause

All the information contained on our website is published in good faith and for general purposes only. Any action that the reader undertakes on the information found on our website is strictly at their own risk.