HBAR Bulls Get Burned as Long Liquidations Dominate Futures Market

The Hedera Hashgraph Hbar noted a net slowdown this week, its sliding price of more than 17% since Sunday.

While feeling through the cryptography sector remains silent, Hbar has not been spared. Chain data show that bullish merchants are now the weight of its current prices.

Hbar faces long liquidations such as lower pressure climbing

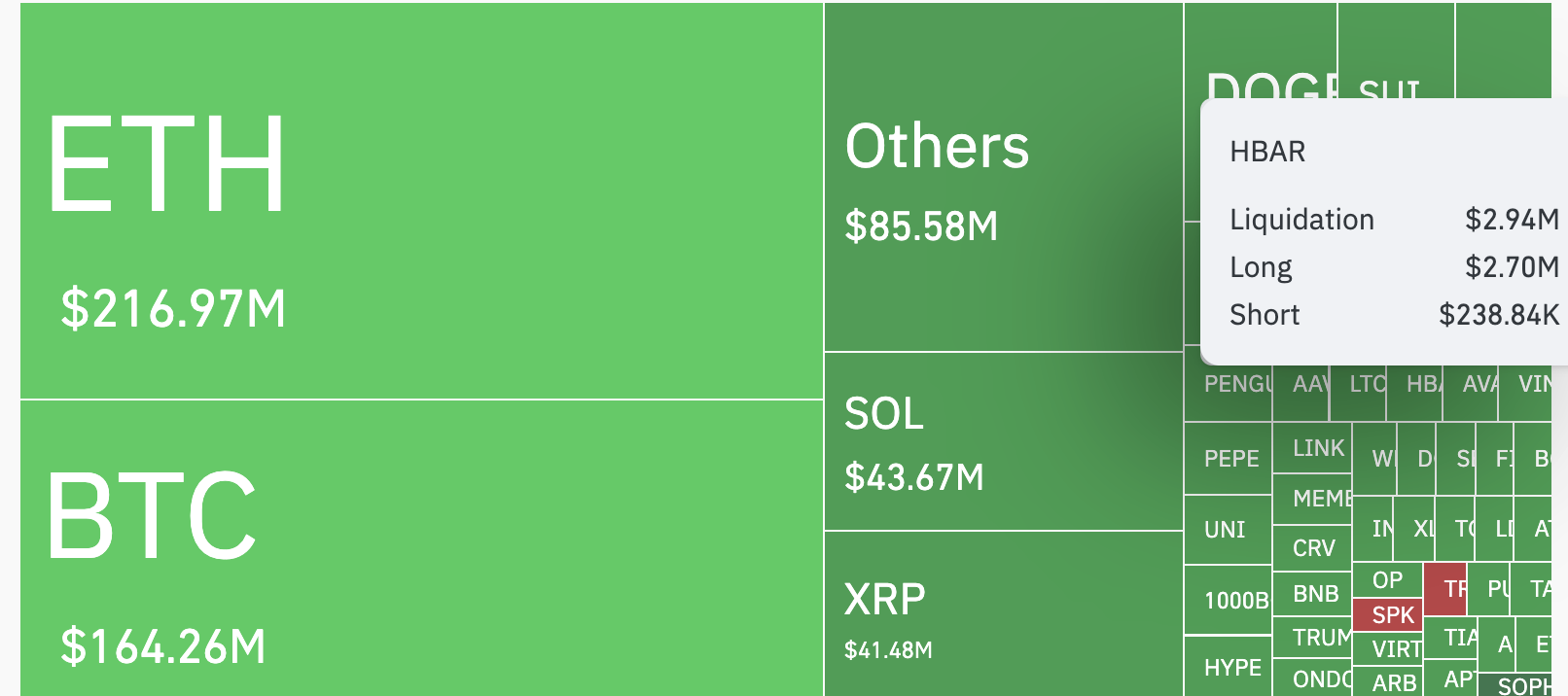

In the past 24 hours, Hbar’s price has plunged by 9%, increasing losses for bullish merchants. Coinglass data show that long liquidations alone represented $ 2.70 million in the total of $ 2.94 million from the HBAR UN Market during this period.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

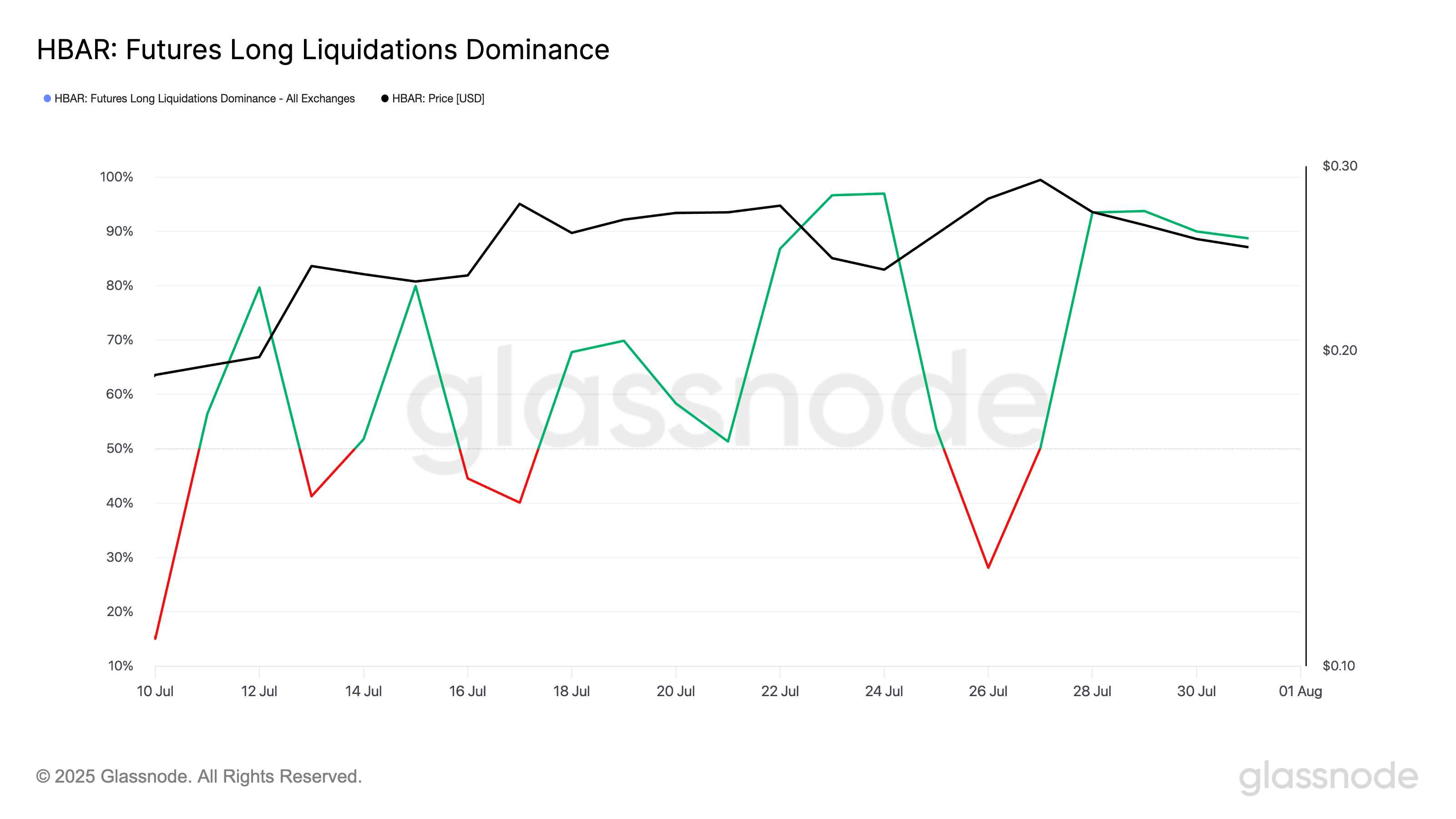

Long position holders were faced with a wave of liquidation while the Hbar price continues to drop. According to Glassnode, the dominance of the long -term liquidation length of the token exceeded 88% Thursday, marking another day of aggressive upheavals for bullish merchants this week.

This metric measures the proportion of total term liquidations which come from long positions. When it increases, this indicates that most liquidations come from traders who bet on the rise in prices due to a downward trend in prices.

In the case of Hbar, the metric confirms that the bearish momentum submerged a bullish feeling. This sparked a forced sales waterfall that could put pressure on the price of the token.

Hbar smart holders came out of the outing

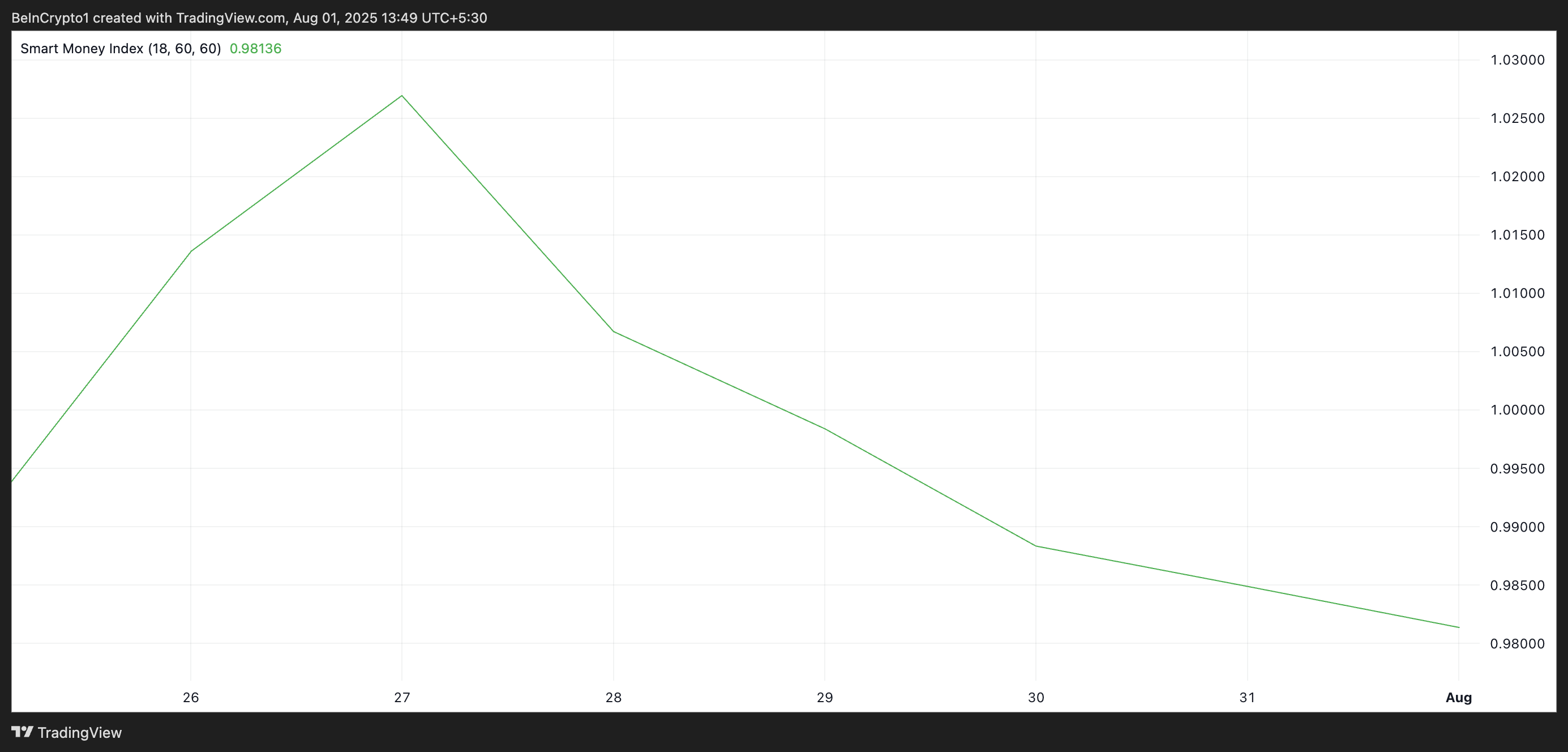

The sales activity has also exploded among Hbar’s “smart holders”. The readings of the Smart Money Index (SMI) indicator of the Token have revealed a constant drop in demand among these investors since Sunday. At the time of the press, it is 0.98.

Intelligent money refers to the capital controlled by institutional investors or experienced traders who include market trends and timing more deeply. The SMI follows the behavior of these investors by analyzing the movements of intradays prices.

It measures the sale in the morning (when retail merchants dominate) compared to the purchase in the afternoon (when the institutions are more active).

An increasing SMI indicates that intelligent money accumulates an asset, often before major price movements.

However, when this momentum indicator falls, experienced merchants retreat from the market. This trend indicates a weakening of confidence in the short -term price stability of Hbar while the market enters a new month of negotiation.

Hbar holds the line at $ 0.24-But will the soil of $ 0.22 collapse?

Hbar is negotiated at $ 0.24 at the time of the press, now just above a level of key support at $ 0.22. If the sale side pressure is intensifying, a drop below this floor could be imminent, which could reduce the price of the token to $ 0.18.

Conversely, an resurgence of the interest of the purchase could trigger a bullish reversal. Hbar can try to break above the resistance level of $ 0.26 in this scenario.

Post-Hbar bulls are burned when long liquidations dominate the term market first appear on Beincryptto.