HBAR Price Hits 5-Month High, Faces Drop as Profit-Taking Begins

Hbar briefly exceeded a five -month summit of $ 0.30 yesterday, motivated by the wider rally on the cryptography market.

However, the rally was short -lived. Despite the Haussier overall feeling on the market today, Hbar has reversed the course, decreasing by almost 5% in the last 24 hours while the for -profit activity is intensifying.

Hbar clogs under for lucrative pressure

Hbar has shaken up the larger market increase to record a price drop of 5% in the last 24 hours. The DIP suggests that traders who have traveled the rally at $ 0.30 now lock winnings, losing a drop in the price of the token.

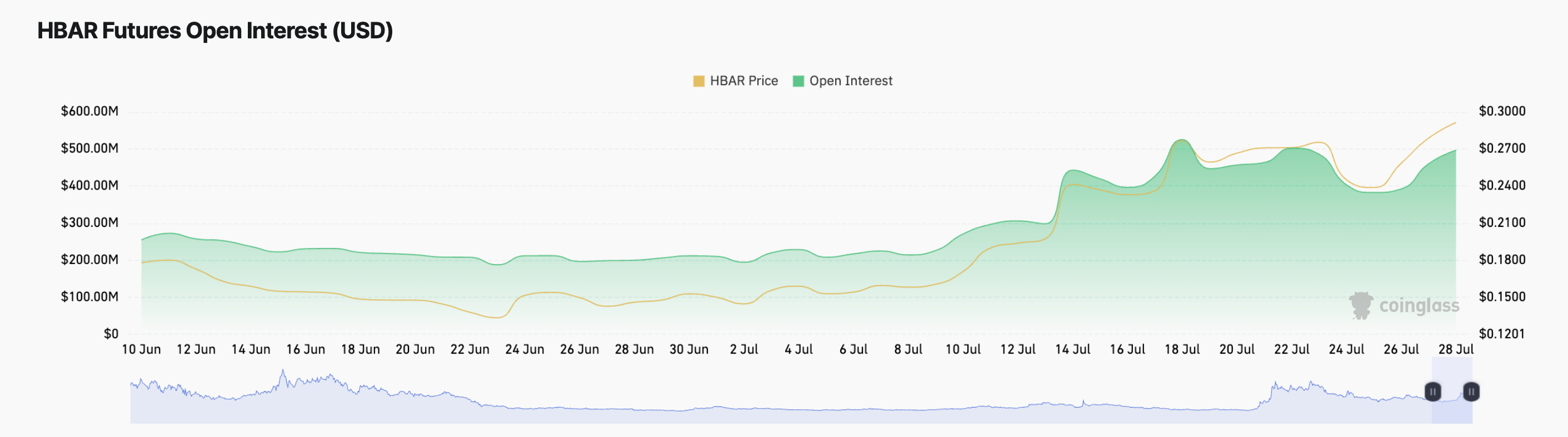

According to CorciLass, Hbar’s open interests have increased by 8% in the last 24 hours, reaching $ 497 million, even if downward token price trends. This is generally considered to be a red flag, as it indicates that more term positions are open, betting on additional drops.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The open interest refers to the total number of current contracts in progress which have not yet been set. When it increases and the price drops, this means that new funds enter the market to bet against assets, rather than supporting it.

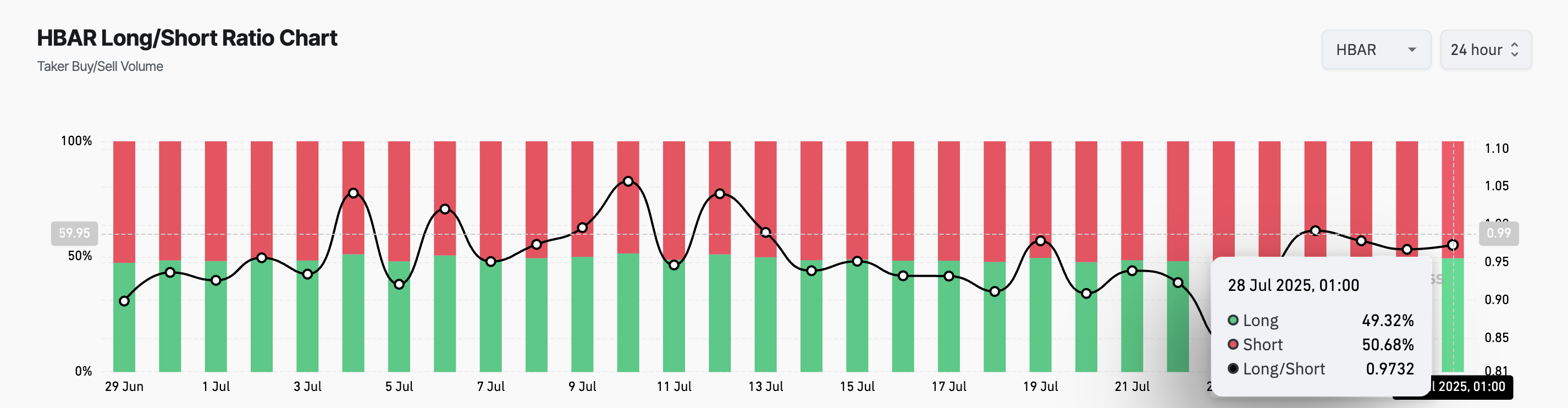

This scheme is generally interpreted as a lower signal, especially if a long / short fall ratio accompanies the increase in open interest. This is the case with Hbar, adding to the bearish pressure facing the Altcoin. To date, the ratio is 0.97.

The long metric / short measures the proportion of upward positions (long) to lower (short) positions on the long -term market of an asset. When the report is higher than one, there are more long positions than the shorts. This suggests a bullish feeling, most traders expecting the value of the asset to increase.

On the other hand, as is the case with Hbar, a ratio under one means that more traders are betting on a drop in prices than on an increase in prices. This reflects growing skepticism around the short -term prices of Altcoin, because more and more traders are trying to lock the gains.

Hbar at a crossroads: a ventilation of $ 0.26 or an escape of $ 0.30 then?

Unless the new request is on the market to provide support, the price of Hbar can continue to cope with the pressure, drawn both by the cash sale and the positioning of the lower derivatives. If this continues, Altcoin could fall to $ 0.26.

On the other hand, if the purchase of climbs, Hbar could violate the resistance at $ 0.29, recover the peak of the cycle of $ 0.30 and try to climb more.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.