HBAR Price Prediction For October: What Should Traders Expect?

Historically,, The native token Hbar of Hedera Hashgraph delivered a mixed performance in October. Over the past six years, its history has also been divided between gains and losses.

The star was in 2021, when Hbar joined 20.3%, followed by smaller gains of 3.98% in 2022 and 5.40% in 2023. Decreasing, October also brought a lowered drop, including a drop of 19.4% in 2024 and a consecutive drop in Hbar in October 2019 and 2020?

Hbar struggles after the early September gains

Sponsored

Sponsored

September started on a positive note for Hbar, driven by the larger trend on the market which increased its price to a monthly peak of $ 0.2,551 on September 13.

However, as the feeling of the market was cooling, the token entered a consolidation phase between September 14 and 18 before Bears regained control.

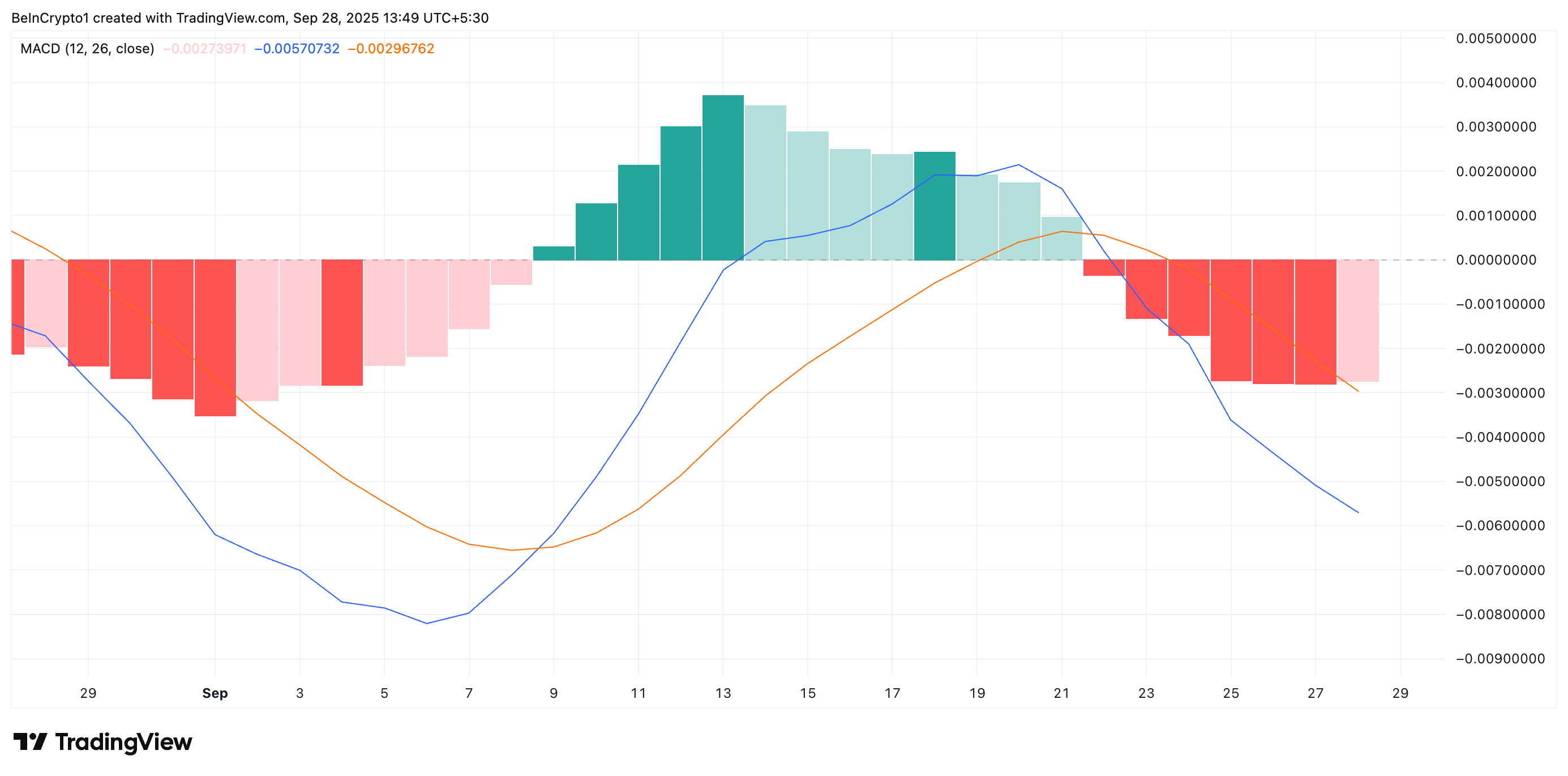

Since then, Hbar has slipped almost 16%, erasing most of its previous earnings. On the daily graphic, the readings of the Diver of Mobile Average Convergence (MacD) confirm that the token is firmly in the lower phase.

At the time of the press, the MacD (blue) line rests under the signal line (orange), showing that the bears have the upper hand.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The MacD indicator identifies trends and momentum in its price movement. It helps merchants to identify potential purchase or sale signals via crosses between the MACD and the signal lines.

Sponsored

Sponsored

When the MacD line crosses the signal line, it indicates an upward impulse and the possibility of an ascending price action. Conversely, when the MacD line rests under the signal line – as is the case for Hbar – this indicates that the bearish momentum is dominant.

This configuration suggests that without a bull catalyst, the sales pressure observed until September could extend well in October.

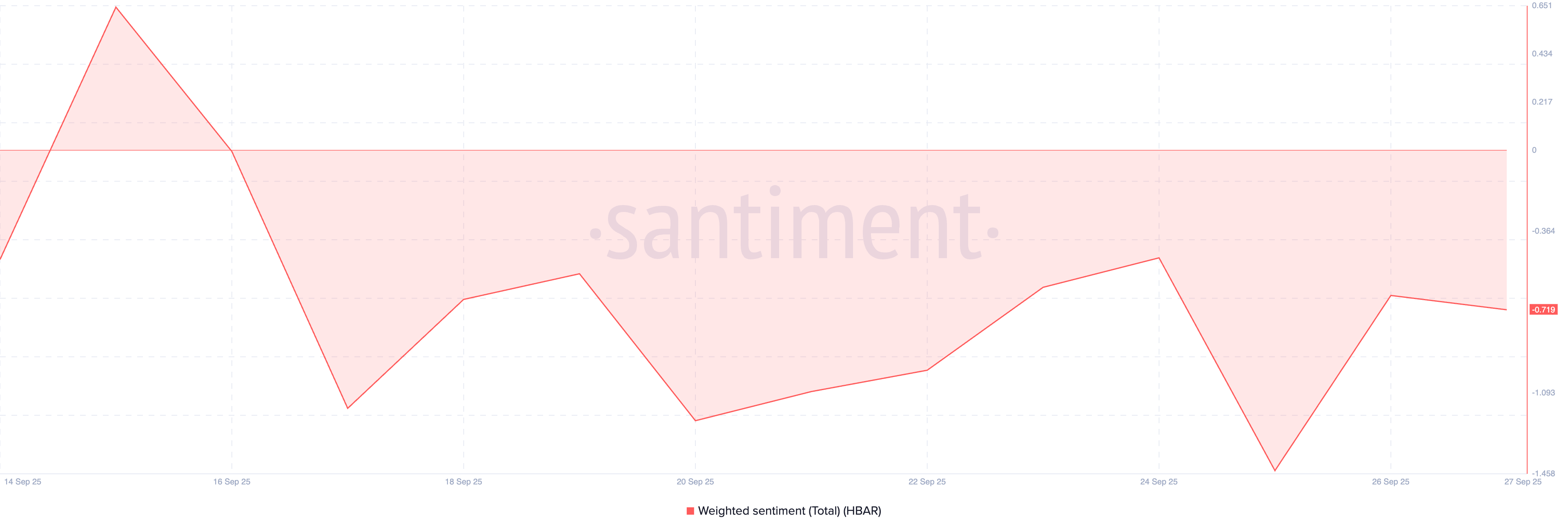

Adding to this pressure, the feeling of the market around Hbar remains decisively negatively. According to health data, it is currently at -0.719.

The weighted feeling follows discussions on a cryptocurrency on social networks and online platforms. It measures the volume of mentions and the balance of positive comments in relation to negative comments.

Sponsored

Sponsored

When weighted feeling is greater than zero, it indicates more positive comments and discussions on cryptocurrency than negatives, suggesting a favorable public perception.

On the other hand, a negative reading indicates more criticism than support, reflecting the lowering feeling. Consequently, the sustained negative weighted feeling of Hbar reflects the wider market bias against the token before October. This can make your price problems persist.

Hbar’s term merchants become lowered

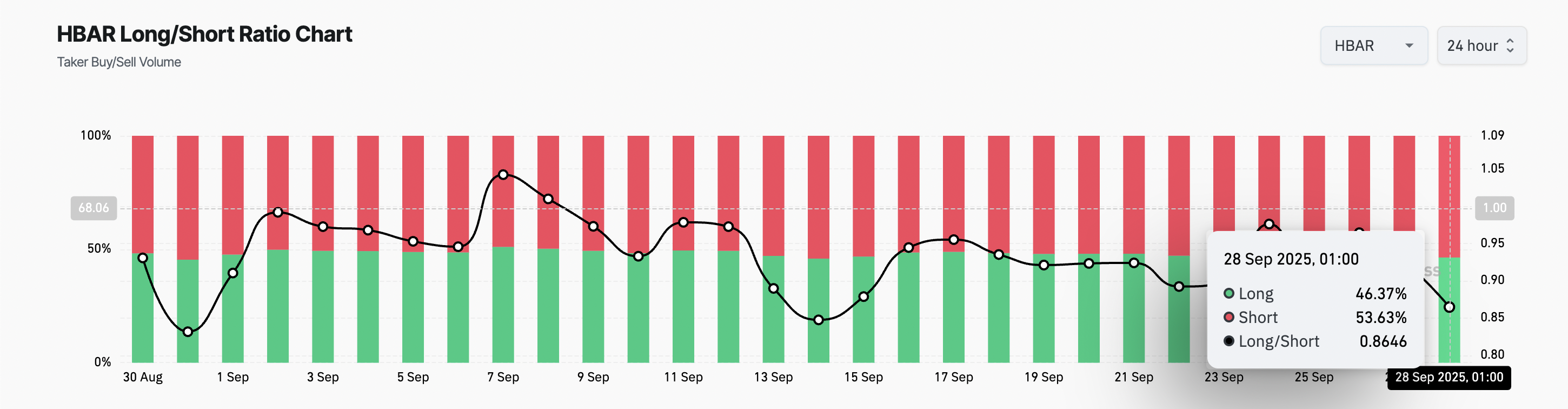

Among the merchants in the long term, the long / short ratio plunging token supports this downward perspective. At the time of the press, it is 0.84 and remains in a downward trend.

The long / short ratio measures the balance between upward and lowering positions on the long -term market of an asset. A value greater than 1 indicates that more traders are betting on the price gains (long) than the declines (shorts), reflecting positive feeling.

Sponsored

Sponsored

Conversely, a ratio less than 1 shows that lowering bets prevail over bullish bets, pointing that traders expect more drop. With the Hbar ratio much less than 1, its traders in the long term are largely positioned for losses rather than for recovery.

Hbar faces a October test

These trends add to the downstream pressure already weighing on the token, which makes October more likely to continue the Hbar defeats unless a significant change in feeling emerges.

Hbar could prolong its weekly drop and fall around $ 0.1654 if the lowering feeling increased.

On the other hand, a reversal of feeling and a renewed purchase activity could provide the necessary catalyst for a short -term recovery. In this scenario, the price of Hbar could push above 0.2266 and increase to $ 0.2453.